Question: Please help me solve the following problem Here is an EXAMPLE problem using the formula approach Last year Janet purchased a $1,000 face value corporate

Please help me solve the following problem

Here is an EXAMPLE problem using the formula approach

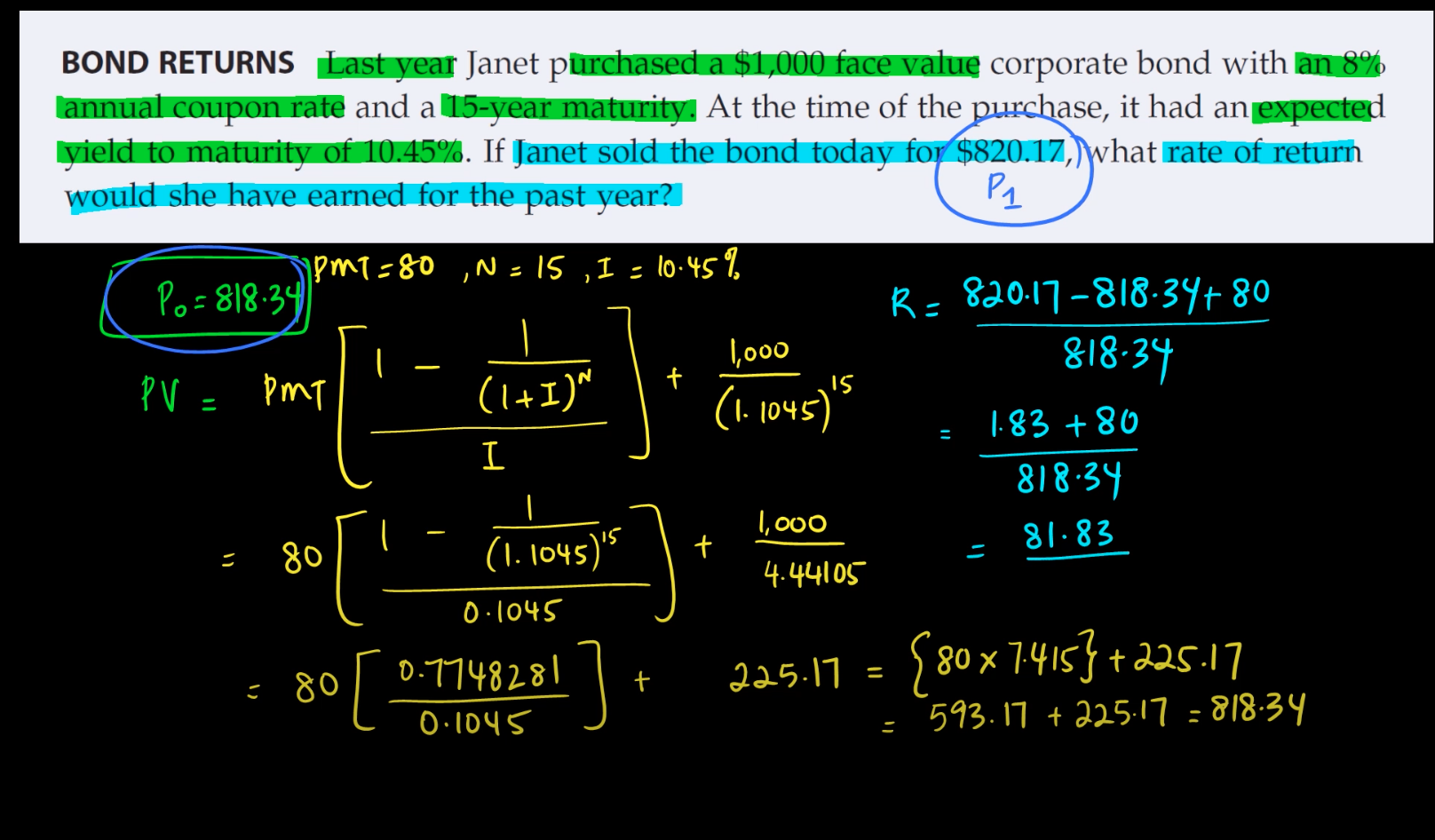

Last year Janet purchased a $1,000 face value corporate bond with an 11% annual coupon rate and a 10 -year maturity. At the time of the purchase, it had an expected yield to maturity of 12.77%. If Janet sold the bond today for $1,040.41, what rate of return would she have earned for the past year? Do not round intermediate calculations. Round your answer to two decimal places. % BOND RETURNS Last year Janet purchased a $1,000 face value corporate bond with an 8% Iannual coupon rate and a 15-year maturity. At the time of the purchase, it had an expected yield to maturity of 10.45%. If Janet sold the bond today for $820.17, ) what rate of return would she have earned for the past year? P1 P0=818.34,PMT=80,N=15,I=10.45%PV=PMT[I1(1+I)N1]+(1.1045)151,000R=818.34820.17818.34+80=818.341.83+80=80[0.10451(1.1045)151]+4.441051,000=81.83=80[0.10450.7748281]+225.17={807.415}+225.17=593.17+225.17=818.34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts