Question: Please help me solve these questions and explain A bond will sell at a premium when (5 points) its coupon rate is greater than its

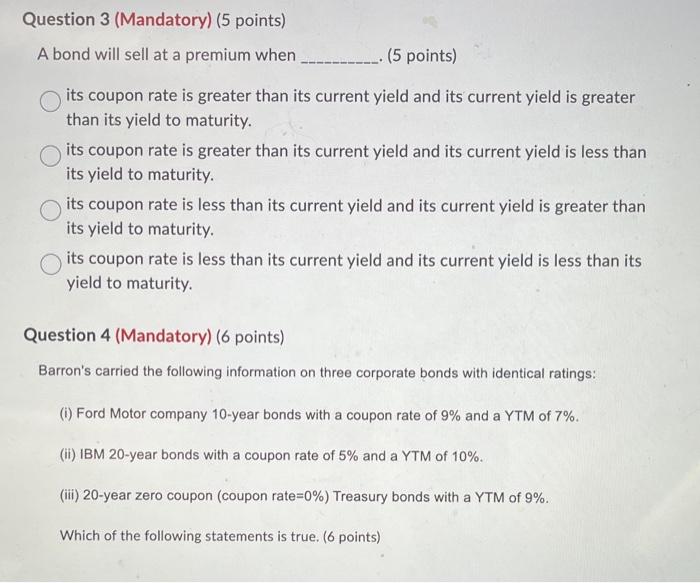

A bond will sell at a premium when (5 points) its coupon rate is greater than its current yield and its current yield is greater than its yield to maturity. its coupon rate is greater than its current yield and its current yield is less than its yield to maturity. its coupon rate is less than its current yield and its current yield is greater than its yield to maturity. its coupon rate is less than its current yield and its current yield is less than its yield to maturity. Question 4 (Mandatory) (6 points) Barron's carried the following information on three corporate bonds with identical ratings: (i) Ford Motor company 10-year bonds with a coupon rate of 9% and a YTM of 7%. (ii) IBM 20-year bonds with a coupon rate of 5% and a YTM of 10%. (iii) 20-year zero coupon (coupon rate=0\%) Treasury bonds with a YTM of 9%. Which of the following statements is true. (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts