Question: Please help me solve this question and explain Barron's carried the following information on three corporate bonds with identical ratings: (i) Ford Motor company 10

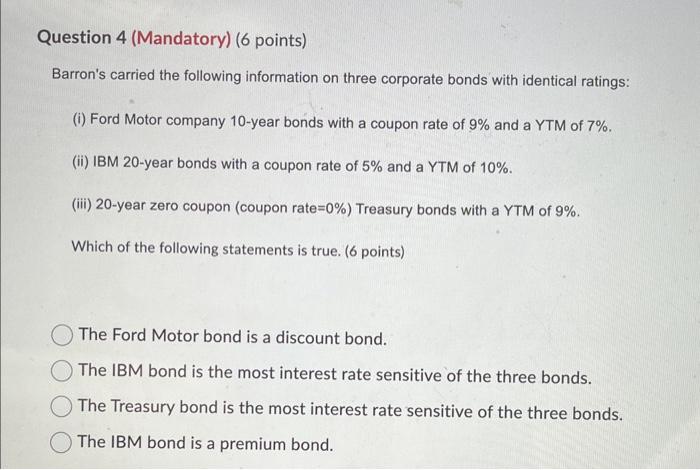

Barron's carried the following information on three corporate bonds with identical ratings: (i) Ford Motor company 10 -year bonds with a coupon rate of 9% and a YTM of 7%. (ii) IBM 20-year bonds with a coupon rate of 5% and a YTM of 10%. (iii) 20-year zero coupon (coupon rate=0\%) Treasury bonds with a YTM of 9%. Which of the following statements is true. (6 points) The Ford Motor bond is a discount bond. The IBM bond is the most interest rate sensitive of the three bonds. The Treasury bond is the most interest rate sensitive of the three bonds. The IBM bond is a premium bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts