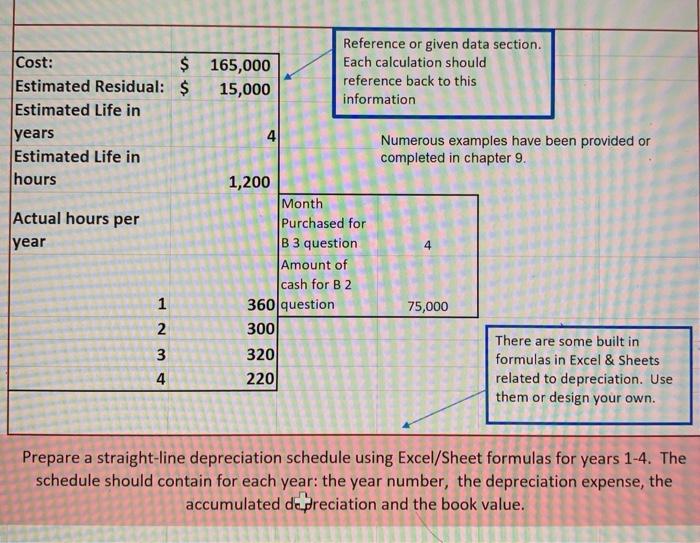

Question: Reference or given data section. Cost: $ 165,000 Each calculation should Estimated Residual: $ reference back to this 15,000 information Estimated Life in years Numerous

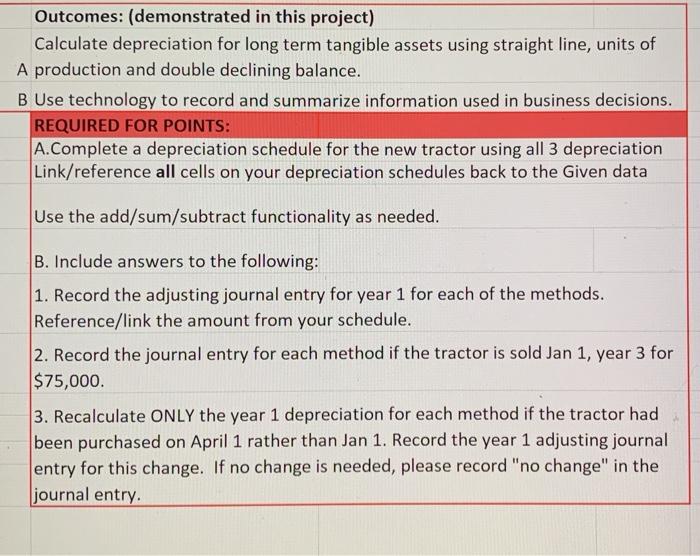

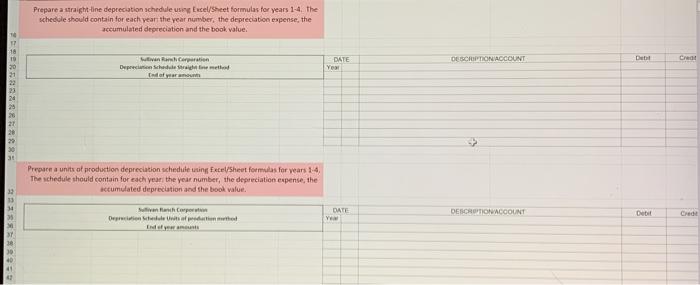

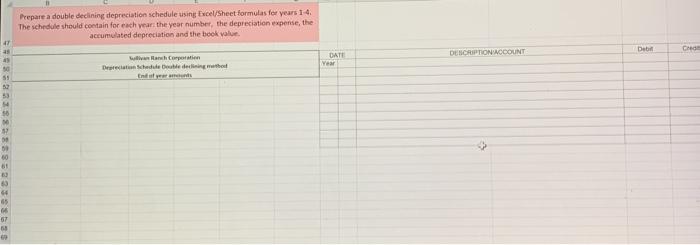

Reference or given data section. Cost: $ 165,000 Each calculation should Estimated Residual: $ reference back to this 15,000 information Estimated Life in years Numerous examples have been provided or Estimated Life in completed in chapter 9. hours 1,200 Month Actual hours per Purchased for year B 3 question Amount of cash for B2 1 360 question 75,000 2 300 There are some built in 3 320 formulas in Excel & Sheets 4 220 related to depreciation. Use them or design your own. 4 3 4 Prepare a straight-line depreciation schedule using Excel/Sheet formulas for years 1-4. The schedule should contain for each year: the year number, the depreciation expense, the accumulated depreciation and the book value. Outcomes: (demonstrated in this project) Calculate depreciation for long term tangible assets using straight line, units of A production and double declining balance. B Use technology to record and summarize information used in business decisions. REQUIRED FOR POINTS: A. Complete a depreciation schedule for the new tractor using all 3 depreciation Link/reference all cells on your depreciation schedules back to the Given data Use the add/sum/subtract functionality as needed. B. Include answers to the following: 1. Record the adjusting journal entry for year 1 for each of the methods. Reference/link the amount from your schedule. 2. Record the journal entry for each method if the tractor is sold Jan 1, year 3 for $75,000. 3. Recalculate ONLY the year 1 depreciation for each method if the tractor had been purchased on April 1 rather than Jan 1. Record the year 1 adjusting journal entry for this change. If no change is needed, please record "no change" in the journal entry. Prepare a straight-line depreciation schedide using Excel/Sheet formulas for years 1-4. The schedole should contain for each year the year number, the depreciation expense, the accumulated depreciation and the book value. DESCRIPTION ACCOUNT Det Win Carpation Depreciation Schedule white met teda yaramount DATE YM FARNAR Prepare a units of production depreciation schedule ting Exce/Sheet formulas for years 1-4 The schedule should contain for each year the year number, the depreciation expense, the accumulated depreciation and the book value. 33 DATE DESCRIPTION ACCOUNT Det Crede Y Der Stelle in the Erdem Prepare a double declining depreciation schedule using Excel/Sheet formulas for years 1-4 The schedule should contain for each year the year number, the depreciation expense, the accumulated depreciation and the book value 47 DESCRIPTION WOCOUNT De CO warh Corporation Deprecated the declining the Enter DATE Wear 88308EUSE 3 64 65 57

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts