Question: please help me solve this! Q1: YGR Inc. will not pay dividends for 4 years. At year 5 , they will pay a dividend of

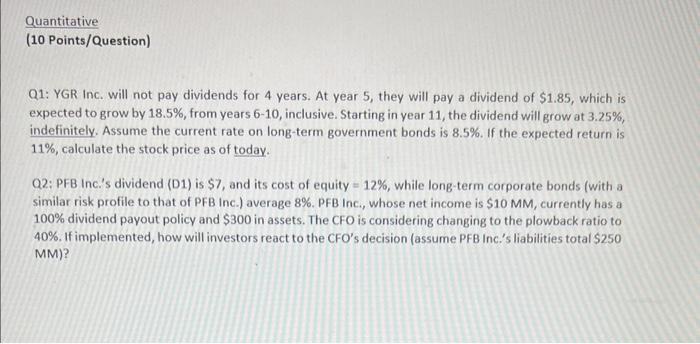

Q1: YGR Inc. will not pay dividends for 4 years. At year 5 , they will pay a dividend of $1.85, which is expected to grow by 18.5%, from years 610, inclusive. Starting in year 11 , the dividend will grow at 3.25%, indefinitely. Assume the current rate on long-term government bonds is 8.5%. If the expected return is 11%, calculate the stock price as of today. Q2: PFB Inc.'s dividend (D1) is $7, and its cost of equity =12%, while long-term corporate bonds (with a similar risk profile to that of PFB Inc.) average 8%. PFB Inc., whose net income is $10MM, currently has a 100% dividend payout policy and $300 in assets. The CFO is considering changing to the plowback ratio to 40%. If implemented, how will investors react to the CFO's decision (assume PFB Inc.'s liabilities total $250 MM) ? Q1: YGR Inc. will not pay dividends for 4 years. At year 5 , they will pay a dividend of $1.85, which is expected to grow by 18.5%, from years 610, inclusive. Starting in year 11 , the dividend will grow at 3.25%, indefinitely. Assume the current rate on long-term government bonds is 8.5%. If the expected return is 11%, calculate the stock price as of today. Q2: PFB Inc.'s dividend (D1) is $7, and its cost of equity =12%, while long-term corporate bonds (with a similar risk profile to that of PFB Inc.) average 8%. PFB Inc., whose net income is $10MM, currently has a 100% dividend payout policy and $300 in assets. The CFO is considering changing to the plowback ratio to 40%. If implemented, how will investors react to the CFO's decision (assume PFB Inc.'s liabilities total $250 MM)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts