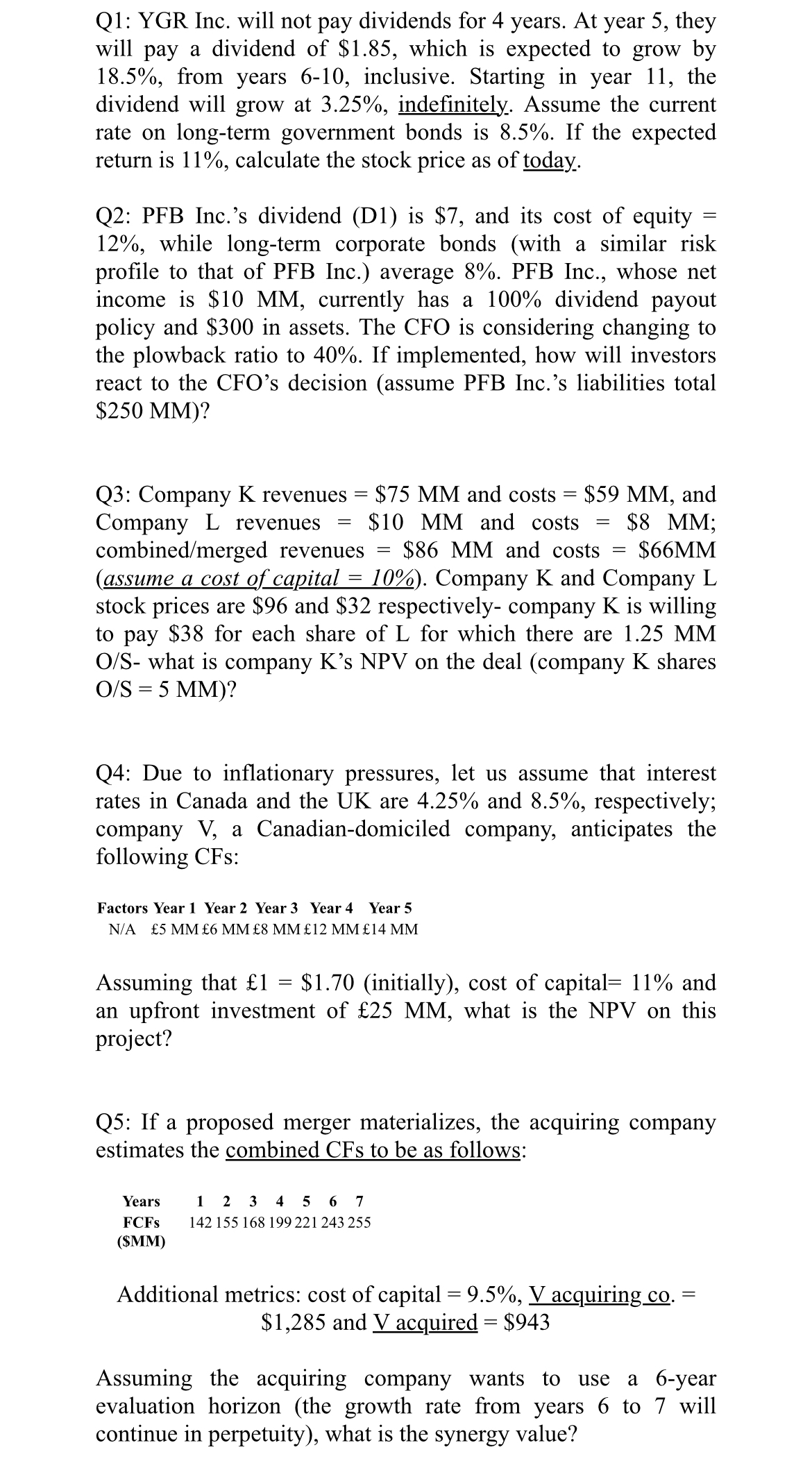

Question: Q 1 : YGR Inc. will not pay dividends for 4 years. At year 5 , they will pay a dividend of $ 1 .

Q: YGR Inc. will not pay dividends for years. At year they will pay a dividend of $ which is expected to grow by from years inclusive. Starting in year the dividend will grow at indefinitely. Assume the current rate on longterm government bonds is If the expected return is calculate the stock price as of today.

Q: PFB Inc.s dividend D is $ and its cost of equity while longterm corporate bonds with a similar risk profile to that of PFB Inc. average PFB Inc., whose net income is $ currently has a dividend payout policy and $ in assets. The CFO is considering changing to the plowback ratio to If implemented, how will investors react to the CFO's decision assume PFB Inc.s liabilities total $ MM

Q: Company K revenues $ and costs $ and Company L revenues $ and costs $; combined merged revenues $ and costs $assume a cost of capital Company K and Company L stock prices are $ and $ respectively company K is willing to pay $ for each share of L for which there are MM OS what is company Ks NPV on the deal company K shares

Q: Due to inflationary pressures, let us assume that interest rates in Canada and the UK are and respectively; company V a Canadiandomiciled company, anticipates the following CFs:

Factors Year Year Year Year Year

NA MM MM MM MM MM

Assuming that $initially cost of capital and an upfront investment of what is the NPV on this project?

Q: If a proposed merger materializes, the acquiring company estimates the combined CFs to be as follows:

tableYears

Answer all questions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock