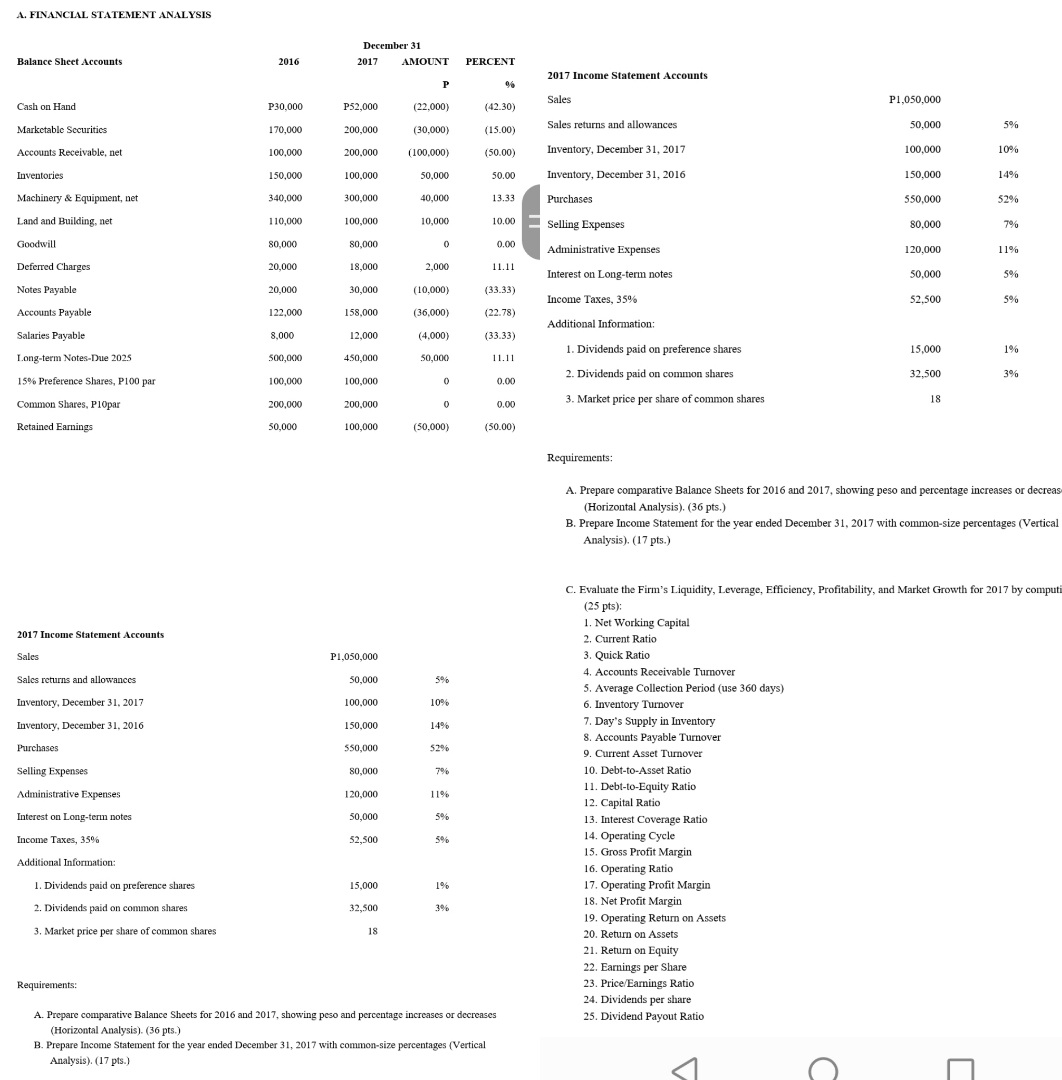

Question: PLEASE HELP ME TO ANSWER REQUIREMENT C ONLY. WITH SOLUTIONS. A. FINANCIAL STATEMENT ANALYSIS December 31 Balance Sheet Accounts 2016 2017 AMOUNT PERCENT 2017 Income

PLEASE HELP ME TO ANSWER REQUIREMENT C ONLY. WITH SOLUTIONS.

A. FINANCIAL STATEMENT ANALYSIS December 31 Balance Sheet Accounts 2016 2017 AMOUNT PERCENT 2017 Income Statement Accounts Cash on Hand P30.000 P52,000 22,000) Sales 42.30 P1,050,000 Marketable Securities 170,000 200,000 (30,000) (15.00) Sales returns and allowances 50,000 5% Accounts Receivable, net 100,000 200,000 100,000) 50.0 Inventory, December 31, 2017 100,000 10% Inventories 150,000 100,000 50,000 50.00 nventory, December 31, 2016 150,000 14% Machinery & Equipment, net 340,000 300,000 40,000 13.33 Purchases $50,000 $2% Land and Building, net 1 10,000 100,000 10,000 0,00 Selling Expenses 80,000 79% Goodwill 80,000 80,000 0.00 Administrative Expenses 120,000 11% Deferred Charges 20,000 18,000 2,000 11.11 nterest on Long-term notes 50,000 Notes Payable 20,000 30,000 (10,000) (33.33) ncome Taxes, 35% 52,500 Accounts Payable 122,000 158,000 (36,000) 22.78) Additional Information: Salaries Payable 8,000 12,000 (4,000) (33.33) Long-term Notes-Due 2025 1. Dividends paid on preference shares 15,000 1% 500,000 450,000 50,000 11.11 2. Dividends paid on common shares 32,500 15% Preference Shares, P100 par 100,00 100,000 0.00 Common Shares, PIOpar 200,000 200.000 0.00 3. Market price per share of common shares 18 Retained Earnings 50,000 100,000 (50,000) (50.00) Requirements: A. Prepare comparative Balance Sheets for 2016 and 2017, showing peso and percentage increases or decreas (Horizontal Analysis), (36 pts.) B. Prepare Income Statement for the year ended December 31, 2017 with common-size percentages (Vertical Analysis). (17 pts.) C. Evaluate the Firm's Liquidity, Leverage, Efficiency, Profitability, and Market Growth for 2017 by comput (25 pts): . Net Working Capital 2017 Income Statement Accounts 2. Current Ratio Sales P1,050,000 3. Quick Ratio Sales returns and allowances 50,000 4. Accounts Receivable Turnover 5. Average Collection Period (use 360 days) Inventory, December 31. 2017 100.000 10% 6. Inventory Turnover Inventory, December 31. 2016 150,000 14% 7. Day's Supply in Inventory Purchases $50,000 B. Accounts Payable Turnover $29% 9. Current Asset Turnover Selling Expenses 80,000 10. Debt-to-Asset Ratio Administrative Expenses 120,000 1 1% 1 1. Debt-to-Equity Ratio 12. Capital Ratio Interest on Long-term notes 50,000 5% 13. Interest Coverage Ratio Income Taxes, 35% 52,500 14. Operating Cycle 15. Gross Profit Margin Additional Information: 16. Operating Ratio 1. Dividends paid on preference shares 15,000 1% 17. Operating Profit Margin 2. Dividends paid on common shares 32,500 18. Net Profit Margin 19. Operating Return on Assets 3. Market price per share of common shares 20. Return on Assets 21. Return on Equity 22. Earnings per Share Requirements: 23. Price/Earnings Ratio 24. Dividends per share A. Prepare comparative Balance Sheets for 2016 and 2017, showing peso and percentage increases or decreases 25. Dividend Payout Ratio (Horizontal Analysis). (36 pts.) B. Prepare Income Statement for the year ended December 31, 2017 with common-size percentages (Vertical Analysis). (17 pts.)