Question: Please help me to answer this question with step by step explanation, thank you in advance. 2 E ELE 3 4 L 35 Following are

Please help me to answer this question with step by step explanation, thank you in advance.

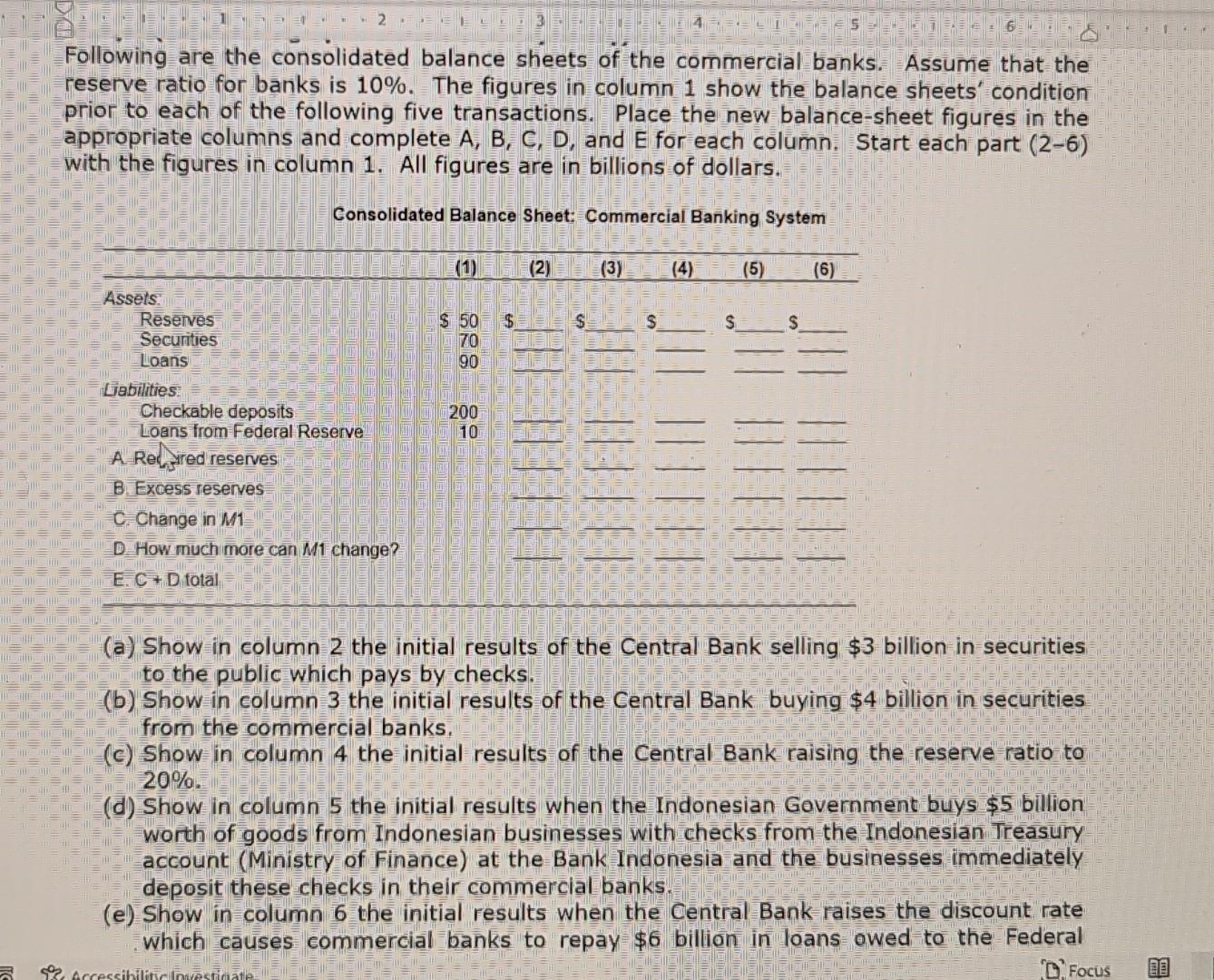

2 E ELE 3 4 L 35 Following are the consolidated balance sheets of the commercial banks. Assume that the reserve ratio for banks is 10%. The figures in column 1 show the balance sheets' condition prior to each of the following five transactions. Place the new balance-sheet figures in the appropriate columns and complete A, B, C, D, and E for each column. Start each part (2-6) with the figures in column 1. All figures are in billions of dollars. Consolidated Balance Sheet: Commercial Banking System (1) (2) (3) (4) (5) (6) $ Assets Reserves Secunties Loans S $ S $ 50 70 90 200 10 Liabilities Checkable deposits Loans from Federal Reserve A Rec red reserves B. Excess reserves c Change in M1 D. How much more can M1 change? E. C + D total II/ || | (a) Show in column 2 the initial results of the Central Bank selling $3 billion in securities to the public which pays by checks. (b) Show in column 3 the initial results of the Central Bank buying $4 billion in securities from the commercial banks. (c) Show in column 4 the initial results of the Central Bank raising the reserve ratio to 20%. (d) Show in column 5 the initial results when the Indonesian Government buys $5 billion worth of goods from Indonesian businesses with checks from the Indonesian Treasury account (Ministry of Finance) at the Bank Indonesia and the businesses immediately deposit these checks in their commercial banks. (e) Show in column 6 the initial results when the Central Bank raises the discount rate which causes commercial banks to repay $6 billion in loans owed to the Federal Focus e accessibility mate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts