Question: please help me understand with some short written explanations, questions 20 AND 24 ONLY, thank you 20. In the ideal estate plan, what amount would

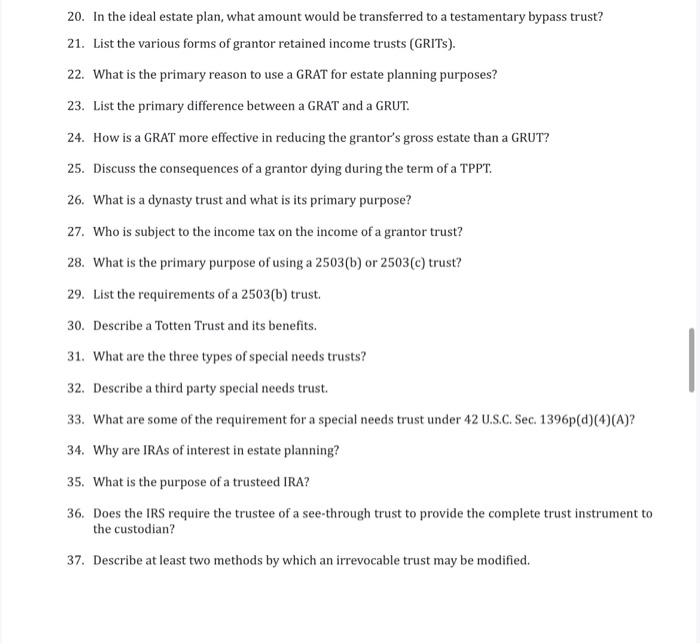

20. In the ideal estate plan, what amount would be transferred to a testamentary bypass trust? 21. List the various forms of grantor retained income trusts (GRITs). 22. What is the primary reason to use a GRAT for estate planning purposes? 23. List the primary difference between a GRAT and a GRUT. 24. How is a GRAT more effective in reducing the grantor's gross estate than a GRUT? 25. Discuss the consequences of a grantor dying during the term of a TPPT. 26. What is a dynasty trust and what is its primary purpose? 27. Who is subject to the income tax on the income of a grantor trust? 28. What is the primary purpose of using a 2503(b) or 2503(c) trust? 29. List the requirements of a 2503(b) trust. 30. Describe a Totten Trust and its benefits. 31. What are the three types of special needs trusts? 32. Describe a third party special needs trust. 33. What are some of the requirement for a special needs trust under 42 U.S.C. Sec. 1396p(d)(4)(A) ? 34. Why are IRAs of interest in estate planning? 35. What is the purpose of a trusteed IRA? 36. Does the IRS require the trustee of a see-through trust to provide the complete trust instrument to the custodian? 37. Describe at least two methods by which an irrevocable trust may be modified

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts