Question: please help me with this E8-9 (Algo) Computing Depreciation under Alternative Methods LO8-3 Plain lce Cream Co. bought a new ice cream machine at the

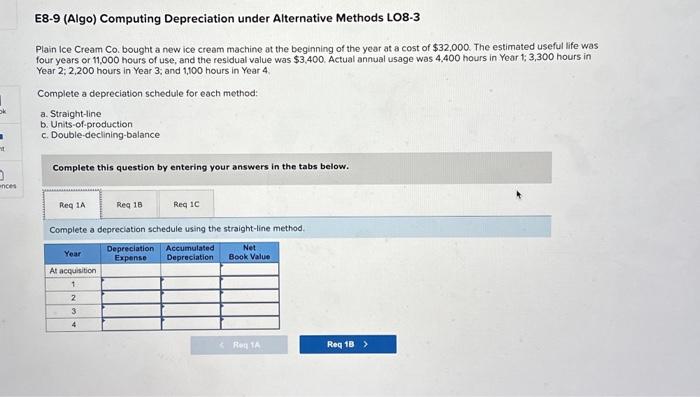

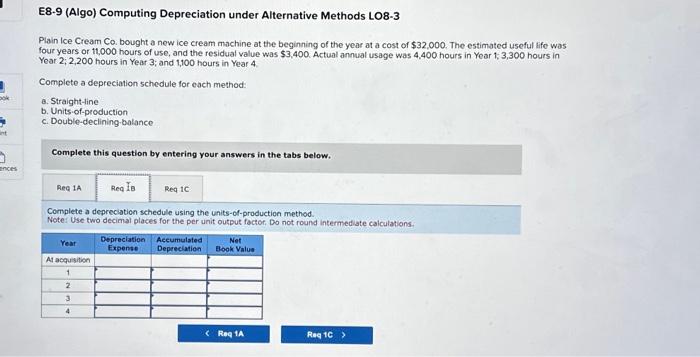

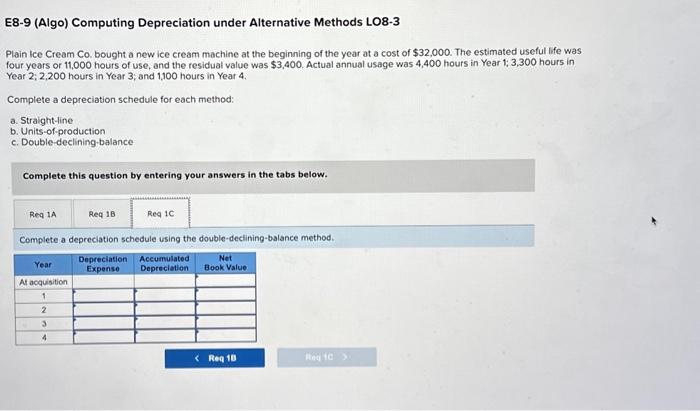

E8-9 (Algo) Computing Depreciation under Alternative Methods LO8-3 Plain lce Cream Co. bought a new ice cream machine at the beginning of the year at a cost of $32,000. The estimated useful life was four years or 11,000 hours of use, and the residual value was $3,400. Actual annual usage was 4,400 hours in Year 1;3,300 hours in Year 2; 2,200 hours in Year 3; and 1,100 hours in Year 4. Complete a depreciation schedule for each method: a. Straight-line b. Units-of-production c. Double-declining-balance Complete this question by entering your answers in the tabs below. Complete a depreciation schedule using the straight-line method. E8-9 (Algo) Computing Depreciation under Alternative Methods LO8-3 Plain lce Cream Ca. bought a new ice cream machine at the beginning of the year at a cost of $32,000. The estimated useful lifo was four years or 11,000 hours of use, and the residual value was $3,400. Actual annual usage was 4,400 hours in Year 1,3,300 hours in Year 2;2,200 hours in Year 3; and 1,100 hours in Year 4. Complete a depreciation schedule for each method: a. Straight-line b. Units-of-production c. Double-declining-balance Complete this question by entering your answers in the tabs below. Complete a depreciation schedule using the units-of-production method. Note: Use two decimal places for the per unit output factor, Do not round intermediate calculations. E8-9 (Algo) Computing Depreciation under Alternative Methods LO8-3 Plain Ice Cream Co, bought a new ice cream machine at the beginning of the year at a cost of $32,000. The estimated useful life was four years or 11,000 hours of use, and the residual value was $3,400. Actual annual usage was 4,400 hours in Year 1;3,300 hours in Year 2;2,200 hours in Year 3 ; and 1,100 hours in Year 4. Complete a depreciation schedule for each method: a. Straight-line b. Units-of-production c. Double-declining-balance Complete this question by entering your answers in the tabs below. Complete a depreciation schedule using the double-dectining-balance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts