Question: Please help me with this practice question parts a-c asap. Thank you! Imagine you're a contractor trying to build new apartments and you are debating

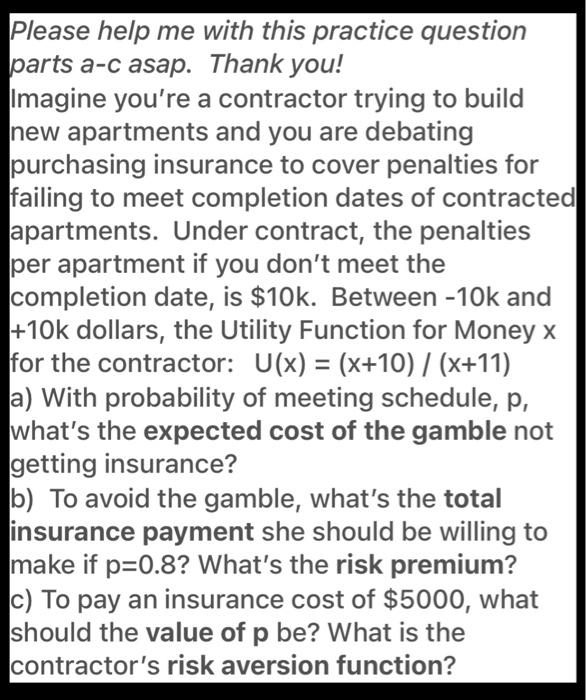

Please help me with this practice question parts a-c asap. Thank you! Imagine you're a contractor trying to build new apartments and you are debating purchasing insurance to cover penalties for failing to meet completion dates of contracted apartments. Under contract, the penalties per apartment if you don't meet the completion date, is $10k. Between -10k and +10k dollars, the Utility Function for Money x for the contractor: U(x) = (x+10) / (x+11) a) With probability of meeting schedule, p, what's the expected cost of the gamble not getting insurance? b) To avoid the gamble, what's the total insurance payment she should be willing to make if p=0.8? What's the risk premium? c) To pay an insurance cost of $5000, what should the value of p be? What is the contractor's risk aversion function? Please help me with this practice question parts a-c asap. Thank you! Imagine you're a contractor trying to build new apartments and you are debating purchasing insurance to cover penalties for failing to meet completion dates of contracted apartments. Under contract, the penalties per apartment if you don't meet the completion date, is $10k. Between -10k and +10k dollars, the Utility Function for Money x for the contractor: U(x) = (x+10) / (x+11) a) With probability of meeting schedule, p, what's the expected cost of the gamble not getting insurance? b) To avoid the gamble, what's the total insurance payment she should be willing to make if p=0.8? What's the risk premium? c) To pay an insurance cost of $5000, what should the value of p be? What is the contractor's risk aversion function

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts