Question: please help me with this questions as i do not know how 1. A Truck is purchased for $200,000 and is planned to have an

please help me with this questions as i do not know how

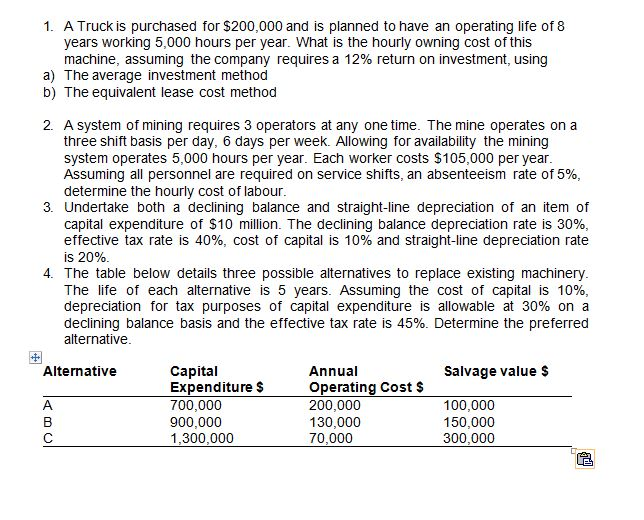

1. A Truck is purchased for $200,000 and is planned to have an operating life of 8 years working 5,000 hours per year. What is the hourly owning cost of this machine, assuming the company requires a 12% return on investment, using a) The average investment method b) The equivalent lease cost method 2. A system of mining requires 3 operators at any one time. The mine operates on a three shift basis per day, 6 days per week. Allowing for availability the mining system operates 5,000 hours per year. Each worker costs $105,000 per year. Assuming all personnel are required on service shifts, an absenteeism rate of 5%, determine the hourly cost of labour. 3. Undertake both a declining balance and straight-line depreciation of an item of capital expenditure of $10 million. The declining balance depreciation rate is 30%, effective tax rate is 40%, cost of capital is 10% and straight-line depreciation rate is 20% 4. The table below details three possible alternatives to replace existing machinery. The life of each alternative is 5 years. Assuming the cost of capital is 10%, depreciation for tax purposes of capital expenditure is allowable at 30% on a declining balance basis and the effective tax rate is 45%. Determine the preferred alternative + Alternative Salvage values A B Capital Expenditure $ 700,000 900,000 1,300,000 Annual Operating cost $ 200,000 130,000 70,000 100,000 150,000 300,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts