Question: please help me write this. All data values are given. explain everything well between 1500 words. write your own word and If you write something

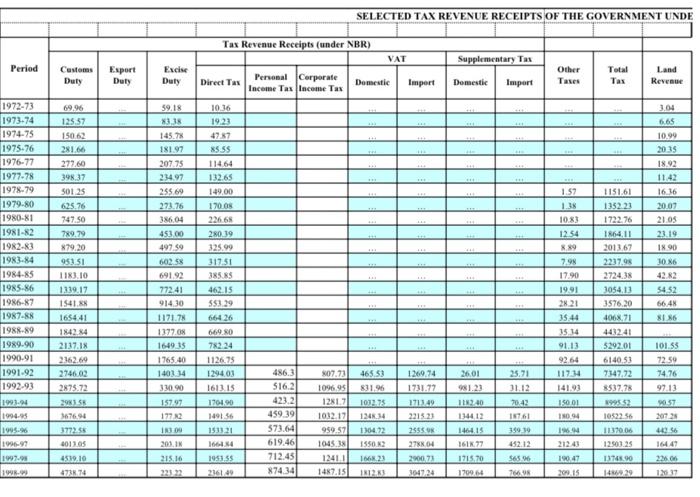

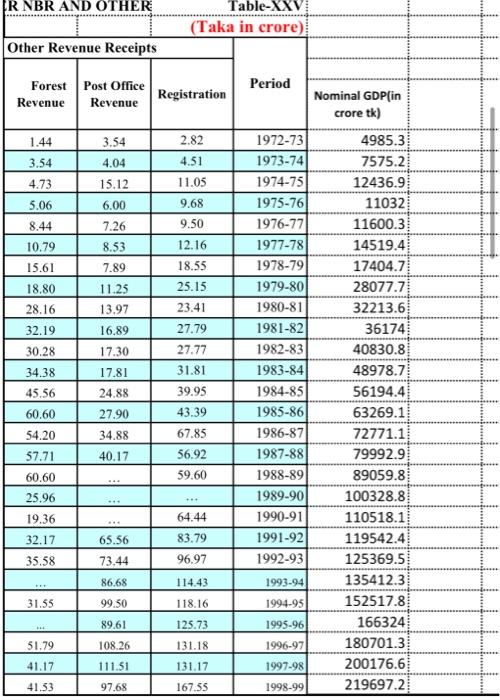

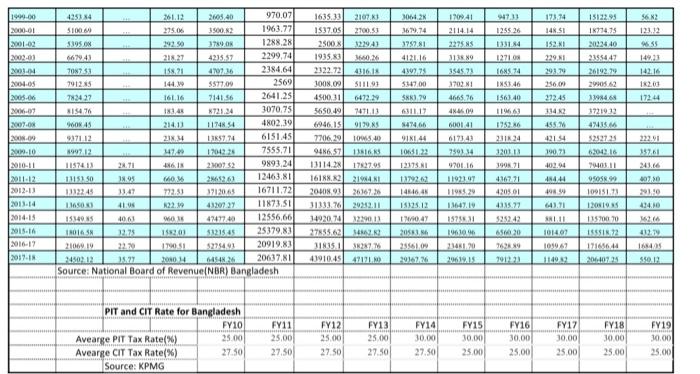

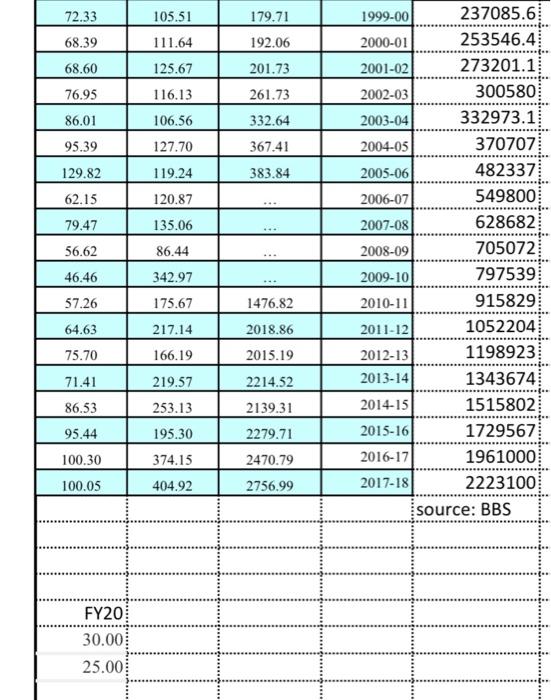

SELECTED TAX REVENUE RECEIPTS OF THE GOVERNMENT UNDE Tax Revenue Receipts (under NBR) VAT Supplementary Tas Period Customs Duty Export Duty Excise Duty Other Taxes Personal Corporate Income Tax Income Tax Total Tax Land Revenue Direct Tax Domestic Import Domestic Import 1.04 6.65 10.36 19,23 47.87 *555 10.99 2015 18.92 11.43 16.36 20.07 21 Os 1972-73 1973-74 1974-75 1975.76 1976-77 1977.78 1978-79 1979.80 1980-81 1981-82 1982-83 1983-84 1984-85 1985-86 1986-87 1987-88 1988-89 1989-90 1990-91 1991.92 1992-93 1993.04 1994.95 1995 1996-92 1997 19. 69.95 12557 15062 281.66 277.60 39837 50125 625.76 747.50 789.79 879,20 95051 1183.10 1339.17 1541.8 165441 184234 2137.1% 2362.69 2746.00 2875.72 59.18 X338 145.78 181 97 207.75 234.97 255.69 278.76 386.04 453.00 497.59 602.58 691.92 772.41 914.30 1171.7 1377.08 1649.35 1765.40 1403-14 330.90 157,97 17712 11464 132.65 149.00 170.05 22668 280.19 325.99 31751 385.8$ 462.15 563.29 664 26 1.57 1.38 10.83 12.54 8.89 7.98 17.90 1151.61 1352.23 1722.76 1864.11 2013.67 2237.98 2724.38 3054.13 3576.20 4068,71 23.19 1890 10.26 4282 54.52 66.4 8186 19.91 669.80 LE 2821 35.44 15.14 91.13 92.64 11714 141.93 15001 110.94 782.24 1126.73 1294.03 1613.15 1701.00 149156 153321 5292.00 6140.53 7347.72 8537,78 101.55 72.59 74.76 97.13 25.71 31.12 70.42 2676.94 377255 40115 4519.10 473.74 10522:56 486.3 $16.2 423.2 459.39 573.64 619.46 712.45 874.34 307.73 1096.95 12812 1012.17 959.57 1045.18 12411 1487.151 465.53 831.96 100175 124.34 1364.72 15502 166 23 1269.74 1731.72 171.3.49 2215 23 255505 27804 2000.73 3644 26.01 91.23 112.40 1346.12 1464.13 1616.77 1715.70 1200 64 35939 452.12 $656 21243 190.47 11370.05 1250125 13768.90 14 40 16447 2260 12 17 205.16 22322 1951.35 216149 181 7665.98 R NBR AND OTHER Table-XXVI (Taka in crore) Other Revenue Receipts Period Forest Revenue Post Office Revenue Registration Nominal GDP in crore tk) 1.44 3.54 3.54 4.04 15.12 2.82 4.51 11.05 4.73 5.06 8.44 10.79 6.00 7.26 8.53 9.68 9.50 12.16 18.55 15.61 7.89 18,80 25.15 28.16 32.19 30.28 11.25 13.97 16.89 23.41 27.79 17.30 1972-731 1973-74 1974-75 1975-76 1976-77 1977-78 1978-79 1979-80 1980-81 1981-82 1982-83 1983-84 1984-851 1985-86 1986-87 1987-88 1988-89 1989-90 1990-91 1991-92 1992-93 17.81 34.38 45.56 60.60 54.20 57.71 27.77 31.81 39.95 43.39 67.85 56.92 24.88 27.90 34.88 40.17 4985.3 7575.2 12436.9 11032 11600.3 14519.4 17404.7 28077.7 32213.6 36174 40830.8 48978.7 56194.4 63269.1 72771.1 79992.9 89059.8 100328.8 110518.1 119542.4 125369.5 135412.3 152517.8 166324 180701.3 200176.6 219697.2 59.60 60.60 25.96 19.36 64.44 83.79 65.56 32.17 35.58 73.44 96.97 86.68 114.43 1993-94 31.55 99.50 118.16 1994-95 89.61 125.73 51.79 108.26 131.18 1995-96 1996-97 1997-98 41.17 111.51 131.17 41.53 97.68 167.55 1998-99 97.33 56 NZ 199.00 2000-01 30612 3679.74 170941 2014.14 173.74 14.51 1232 SS 20:01 31389 354523 2291 299.79 2001. 15122.95 16774.75 2024.40 2355447 26192.79 2920562 3984.68 3721932 4121.16 4392,73 5147.00 38179 31117 1255 26 131184 12210 168574 INS3.46 1563.40 11463 17526 2001.08 2005.06 2702N 4665.76 404 LCHER 142.16 12.01 17244 256.00 272.45 1342 2006-07 1635.33 1537.05 2700.53 2500 122941 1935.3 166026 2322.72 4316.11 2008.00 511191 490031 6472.29 565049 7471 01 912085 7706,20 HOWS 40 946 51 1356 13114.22 17827.95 1618. 21941 2040803 31131020202.11 14920 74 1229011 27855.62 149466 00141 WSST EP1219 PETIT 222.01 425184 261.12 2005.40 970.07 S100M 275.00 3500.NZ 1963.77 33950 3789.0 1288,28 66949 218.27 2299,74 4235.57 703753 158.21 4706 2384.64 791245 5577.09 2569 161.16 7141 56 2641.25 8154.76 183.48 8721.24 3070.75 Wox 45 21411 4802.39 937112 213.94 IKS 14 6151.45 1997.12 47. 1704224 7555.71 1057413 21.71 486. 9893.24 1115150 2.5261 12463.81 1312245 772.31 3712065 16711.72 41.05 4320727 11873.51 1514035 4061 01 44740 12556,66 TON 12.73 10 5121545 25379,83 2106919 2220 170051 3279492 20919.83 2430212 327 645426 20637.80 Source: National Board of Revenue(NBR) Bangladesh SIKI44 106522 12373.1 42154 19071 402.94 525273 62042.16 120311 390.71 35724 09 SOME LEE 444 200.0 0.10 2010-11 2011.12 2012-13 2013-14 2014-15 2015 2016-17 2017-18 290114 9701.16 1197101 1198529 11647.19 95.00 1091511 416771 420301 431577 1484643 15125.12 047 400 2010 434.0 ORI PESES 1150070 WW 157511 1961096 650 20 101407 UNISSE 412 10194 SOFW 24561.00 2016 171616.40 20.40726 FONOK 41910.45 4112 T 296115 291223 VOOR I OSS PIT and CIT Rate for Bangladesh FY10 Avearge PIT Tax Rate(%) 25.00 Avearge CIT Tax Rate(%) 27.50 Source: KPMG FY11 25.00 FY12 25.00 27.50 FY13 25.00 27.50 FY14 30.00 27.50 FY15 30.00 25.00 FY16 30,00 25,00 FY17 30.00 25.00 FY18 30.00 25.00 FY19 10.00 25.00 27.50 72.33 179.71 192.06 68.39 68.60 105.51 111.64 125.67 116.13 106.56 201.73 76.95 261.73 86.01 332.64 367.41 95.39 127.70 129.82 119.24 383.84 62.15 120.87 79.47 135.06 86.44 56.62 1999-00 237085.6 2000-01 253546.4 2001-02 273201.11 2002-03 300580 2003-04 332973.1 2004-05 370707 2005-06 482337 2006-07 549800 2007-08 628682 2008-09 705072 2009-10 797539 2010-11 915829 2011-12 1052204 2012-13 1198923 2013-14 1343674 2014-15 1515802 2015-16 1729567 2016-17 1961000 2017-18 2223100 source: BBS 342.97 46.46 57.26 175.67 1476.82 64.63 217.14 2018.86 75.70 166.19 2015.19 71.41 219.57 2214.52 86.53 253.13 2139.31 95.44 100.30 195.30 374.15 404.92 2279.71 2470.79 2756.99 100.05 FY20 30.00 25.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts