Question: please help on these two parts if you know how to do them Cray Research (a U.S firm) sold a super computer to the Max

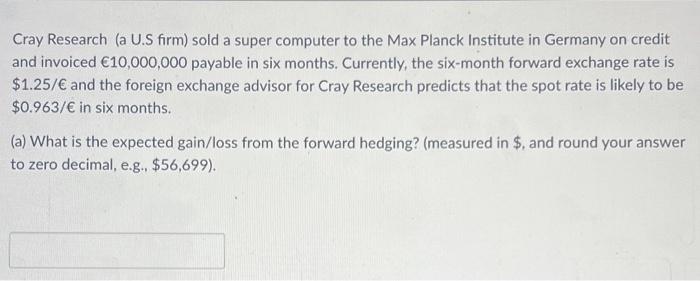

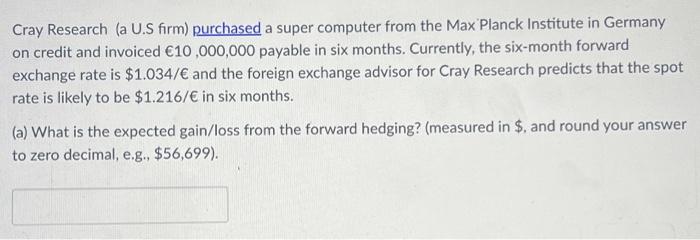

Cray Research (a U.S firm) sold a super computer to the Max Planck Institute in Germany on credit and invoiced 10,000,000 payable in six months. Currently, the six-month forward exchange rate is $1.25/ and the foreign exchange advisor for Cray Research predicts that the spot rate is likely to be $0.963/ in six months. (a) What is the expected gain/loss from the forward hedging? (measured in $, and round your answer to zero decimal, e.g. $56,699). Cray Research (a U.S firm) purchased a super computer from the Max Planck Institute in Germany on credit and invoiced 10,000,000 payable in six months. Currently, the six-month forward exchange rate is $1.034/ and the foreign exchange advisor for Cray Research predicts that the spot rate is likely to be $1.216/ in six months. (a) What is the expected gain/loss from the forward hedging? (measured in $, and round your answer to zero decimal, e.g., $56,699)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts