Question: PLEASE HELP! prepare a Statement of Cash Flows for Laughlin, Inc. for the year ended December 31, 2019. Remember, you must use formulas for all

PLEASE HELP!

prepare a Statement of Cash Flows for Laughlin, Inc. for the year ended December 31, 2019. Remember, you must use formulas for all calculations or points will be deducted.

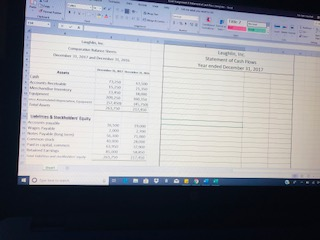

The comparative balance sheet for Laughlin, Inc. is shown below:

|

| December 31, 2019 | December 31, 2018 |

| Assets |

|

|

| Cash | 73,250 | 63,500 |

| Accounts Receivable | 15,250 | 21,350 |

| Merchandise inventory | 23,450 | 18,000 |

| Equipment | 209,250 | 160,350 |

| Less: Accumulated depreciation, Equipment | -57,450 | -45,750 |

| Total assets | 263,750 | 217,450 |

|

|

|

|

| Liabilities & Stockholders Equity |

|

|

| Accounts payable | 16,500 | 19,000 |

| Wages payable | 2,000 | 2,700 |

| Notes payable (long term) | 56,300 | 71,000 |

| Common Stock | 40,000 | 28,000 |

| Paid in Capital, common | 63,950 | 37,900 |

| Retained Earnings | 85,000 | 58,850 |

| Total liabilities & stockholders equity | 263,750 | 217,450 |

Additional data:

a. Bought equipment for cash.

b. Paid $14,700 on the long term note payable

c. Issued new shares of stock for $38,050 cash.

d. Dividends of $650 were paid.

e. Income statement amounts: Net income = 26,800; Depreciation expense = 11,700

Instruction:

Prepare a statement of cash flows for the year ended December 31, 2019.

Use formulas with cell references to calculate increase and decreases to current assets and current liabilities, net cash flows provided by operating activities, net cash flows provided by investing activities, net cash flows provided by financing activities, increase in cash and ending balance in cash.

*CHECK FIGURE: Net cash flows provided by operating activities = $35,950.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts