Question: please help Question 1 (1 point) Shams Inc. offers a zero-coupon bond that has 17 years to maturity and the yield-to- maturity of similar bonds

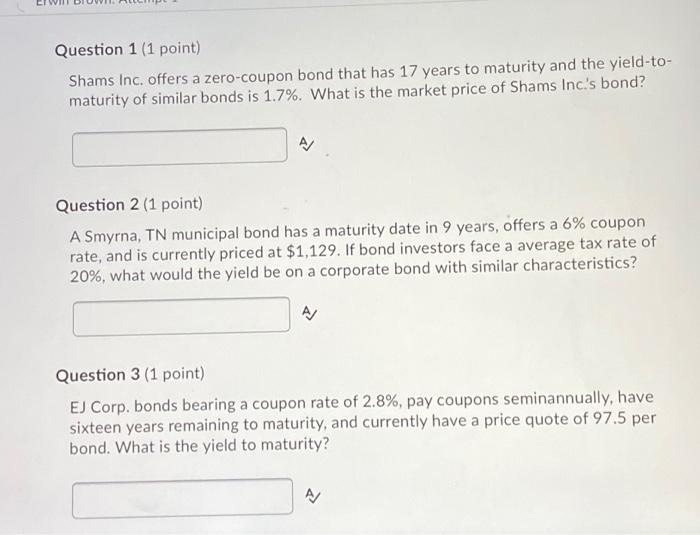

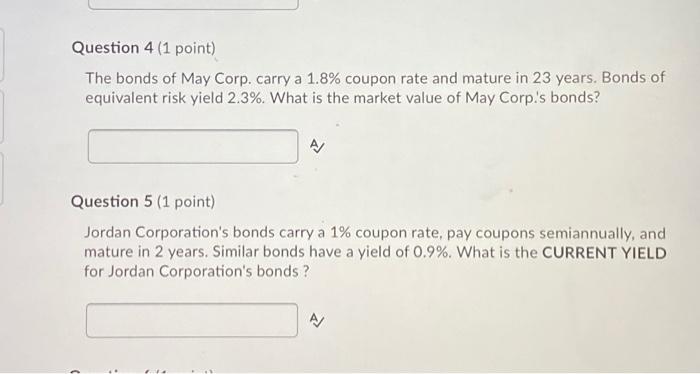

Question 1 (1 point) Shams Inc. offers a zero-coupon bond that has 17 years to maturity and the yield-to- maturity of similar bonds is 1.7%. What is the market price of Shams Inc.'s bond? A/ Question 2 (1 point) A Smyrna, TN municipal bond has a maturity date in 9 years, offers a 6% coupon rate, and is currently priced at $1,129. If bond investors face a average tax rate of 20%, what would the yield be on a corporate bond with similar characteristics? Question 3 (1 point) EJ Corp. bonds bearing a coupon rate of 2.8%, pay coupons seminannually, have sixteen years remaining to maturity, and currently have a price quote of 97.5 per bond. What is the yield to maturity? Question 4 (1 point) The bonds of May Corp. carry a 1.8% coupon rate and mature in 23 years. Bonds of equivalent risk yield 2.3%. What is the market value of May Corp's bonds? A/ Question 5 (1 point) Jordan Corporation's bonds carry a 1% coupon rate, pay coupons semiannually, and mature in 2 years. Similar bonds have a yield of 0.9%. What is the CURRENT YIELD for Jordan Corporation's bonds ? A/ 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts