Question: PLEASE HELP! Read this information carefully. The whole part (b) for Payroll Tax Entries. Payroll Tax Entries According to a summary of the payroll of

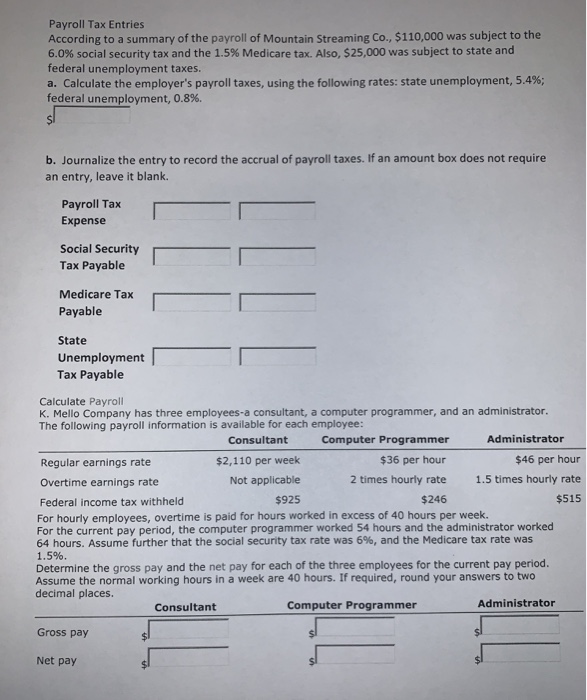

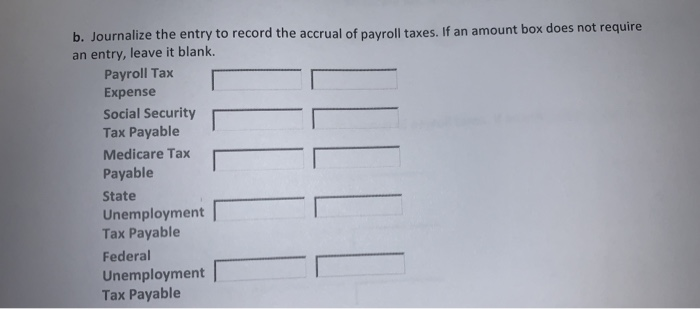

Payroll Tax Entries According to a summary of the payroll of Mountain Streaming Co., $110,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $25,000 was subject to state and federal unemployment taxes. a. Calculate the employer's payroll taxes, using the following rates: state unemployment, 5.4%; federal unemployment, 0.8%. b. Journalize the entry to record the accrual of payroll taxes. If an amount box does not require an entry, leave it blank. Payroll Tax Expense Social Security Tax Payable Medicare Tax Payable State Unemployment Tax Payable Calculate Payroll K. Mello Company has three employees a consultant, a computer programmer, and an administrator The following payroll information is available for each employee: Consultant Computer Programmer Regular earnings rate $2,110 per week $2.110 $36 per hour $46 per hour Overtime earnings rate Not applicable 2 times hourly rate 1.5 times hourly rate Federal income tax withheld $925 $246 $515 For hourly employees, overtime is paid for hours worked in excess of 40 hours per week. For the current pay period, the computer programmer worked 54 hours and the administrator worked 64 hours. Assume further that the social security tax rate was 6%, and the Medicare tax rate was 1.5%. Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. If required, round your answers to two decimal places. Consultant Computer Programmer Administrator Gross pay Net pay b. Journalize the entry to record the accrual of payroll taxes. If an amount box does not require an entry, leave it blank. Payroll Tax Expense Social Security Tax Payable Medicare Tax Payable State Unemployment Tax Payable Federal Unemployment Tax Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts