Question: Please help for the tax section and part b. EX 11-12 Payroll tax entries OBJ. 3 According to a summary of the payroll of Guthrie

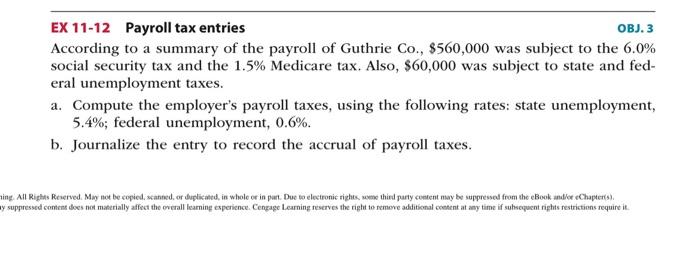

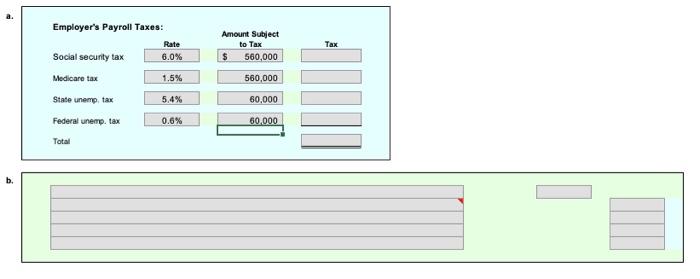

EX 11-12 Payroll tax entries OBJ. 3 According to a summary of the payroll of Guthrie Co., $560,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $60,000 was subject to state and federal unemployment taxes. a. Compute the employer's payroll taxes, using the following rates: state unemployment, 5.4%; federal unemployment, 0.6%. b. Journalize the entry to record the accrual of payroll taxes. a. b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts