Question: Please help solve both parts and help me understand the process, thank you Sammie's Club wants to buy a 320,000 -square-feet distribution facility on the

Please help solve both parts and help me understand the process, thank you

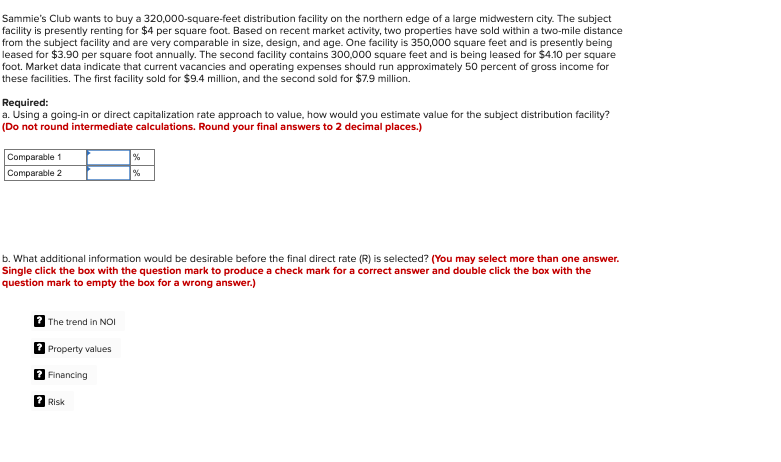

Sammie's Club wants to buy a 320,000 -square-feet distribution facility on the northern edge of a large midwestern city. The subject facility is presently renting for $4 per square foot. Based on recent market activity, two properties have sold within a two-mile distance from the subject facility and are very comparable in size, design, and age. One facility is 350,000 square feet and is presently being leased for $3.90 per square foot annually. The second facility contains 300,000 square feet and is being leased for $4.10 per square foot. Market data indicate that current vacancies and operating expenses should run approximately 50 percent of gross income for these facilities. The first facility sold for $9.4 million, and the second sold for $7.9 million. Required: a. Using a going-in or direct capitalization rate approach to value, how would you estimate value for the subject distribution facility? (Do not round intermediate calculations. Round your final answers to 2 decimal places.) b. What additional information would be desirable before the final direct rate (R ) is selected? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts