Question: Please help solve correctly with explanations. Questions 29-32 are based on the following information. Annuity and Annuity Due. You would like to make an investment

Please help solve correctly with explanations.

Please help solve correctly with explanations.

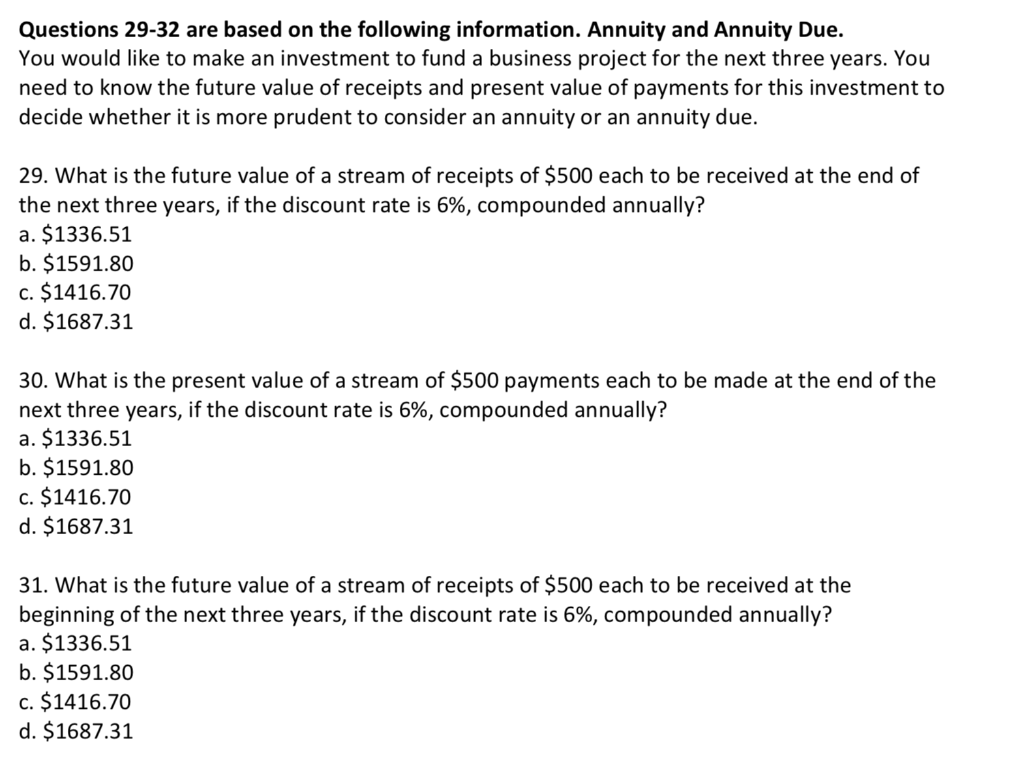

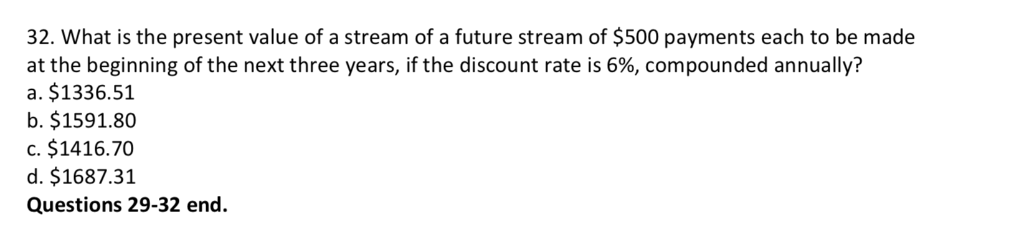

Questions 29-32 are based on the following information. Annuity and Annuity Due. You would like to make an investment to fund a business project for the next three years. You need to know the future value of receipts and present value of payments for this investment to decide whether it is more prudent to consider an annuity or an annuity due. 29. What is the future value of a stream of receipts of $500 each to be received at the end of the next three years, if the discount rate is 6%, compounded annually? a. $1336.51 b. $1591.80 c. $1416.70 d. $1687.31 30. What is the present value of a stream of $500 payments each to be made at the end of the next three years, if the discount rate is 6%, compounded annually? a. $1336.51 b. $1591.80 c. $1416.70 d. $1687.31 31. What is the future value of a stream of receipts of $500 each to be received at the beginning of the next three years, if the discount rate is 6%, compounded annually? a. $1336.51 b. $1591.80 c. $1416.70 d. $1687.31 32. What is the present value of a stream of a future stream of $500 payments each to be made at the beginning of the next three years, if the discount rate is 6%, compounded annually? a. $1336.51 b. $1591.80 c. $1416.70 d. $1687.31 Questions 29-32 end. Questions 33-34 are based on the following information. Effective annual rate and present value. Suppose Bank of America quotes a 10% annual interest rate to you. 33. If your deposit in the bank is compounded monthly what is the effective annual interest rate that your money earns? a. 11.04% b. 10.47% C. 10.12% d. 10.00% 34. Suppose your money is compounded once a year in Bank of America. Your uncle promises you today that he will give you the following cash flows at the end each year for the next 5 years: $1,000; $4,000; $9,000; $5,000; and $2,000 respectively. You decide to save your uncle's annual gift in Bank of America. What is the present value of your uncle's promise? a. 11,220.16 b. 14,249.34 c. 16,607.77 d. 15,633.62 End of Questions 33-34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts