Question: Please help solve return on common stockholder equity and debt to asset ratio Oriole Company has $1,170,000 in assets and $1,170,000 in stockholders' equity, with

Please help solve return on common stockholder equity and debt to asset ratio

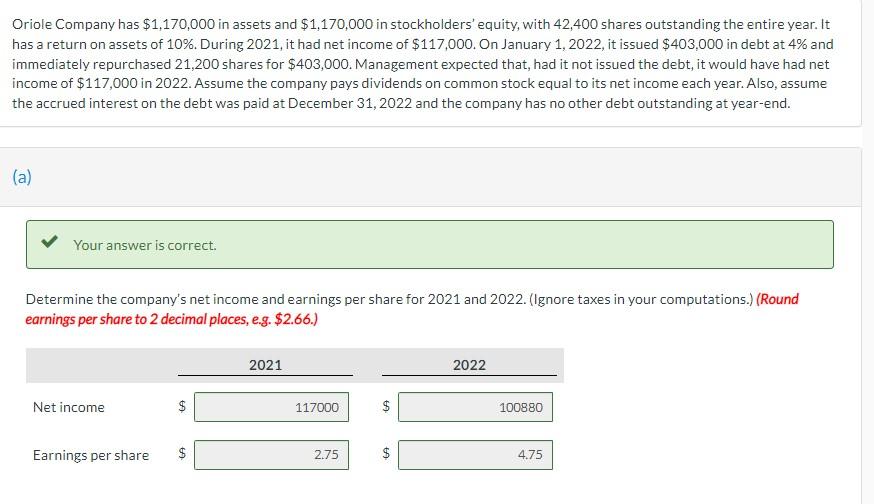

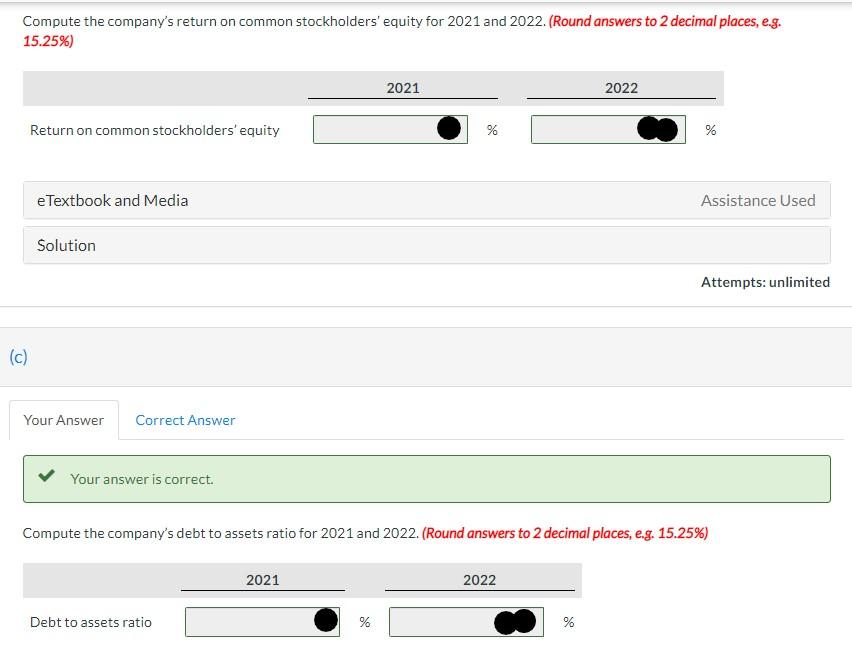

Oriole Company has $1,170,000 in assets and $1,170,000 in stockholders' equity, with 42,400 shares outstanding the entire year. It has a return on assets of 10%. During 2021, it had net income of $117,000. On January 1, 2022, it issued $403,000 in debt at 4% and immediately repurchased 21,200 shares for $403,000. Management expected that, had it not issued the debt, it would have had net income of $117,000 in 2022. Assume the company pays dividends on common stock equal to its net income each year. Also, assume the accrued interest on the debt was paid at December 31, 2022 and the company has no other debt outstanding at year-end. (a) Your answer is correct. Determine the company's net income and earnings per share for 2021 and 2022. (Ignore taxes in your computations.) (Round earnings per share to 2 decimal places, e.g. $2.66.) 2021 2022 Net income $ $ 117000 $ 100880 Earnings per share $ GA 2.75 GA 4.75 Compute the company's return on common stockholders' equity for 2021 and 2022. (Round answers to 2 decimal places, eg. 15.25%) 2021 2022 Return on common stockholders' equity % % e Textbook and Media Assistance Used Solution Attempts: unlimited (c) Your Answer Correct Answer Your answer is correct. Compute the company's debt to assets ratio for 2021 and 2022. (Round answers to 2 decimal places, e.g. 15.25%) 2021 2022 Debt to assets ratio % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts