Question: Please help solve this with an explanation for calculations. Thank you P8-55B Special order decision and considerations (Learning Objective 3) Summer Fun manufactures flotation vests

Please help solve this with an explanation for calculations. Thank you

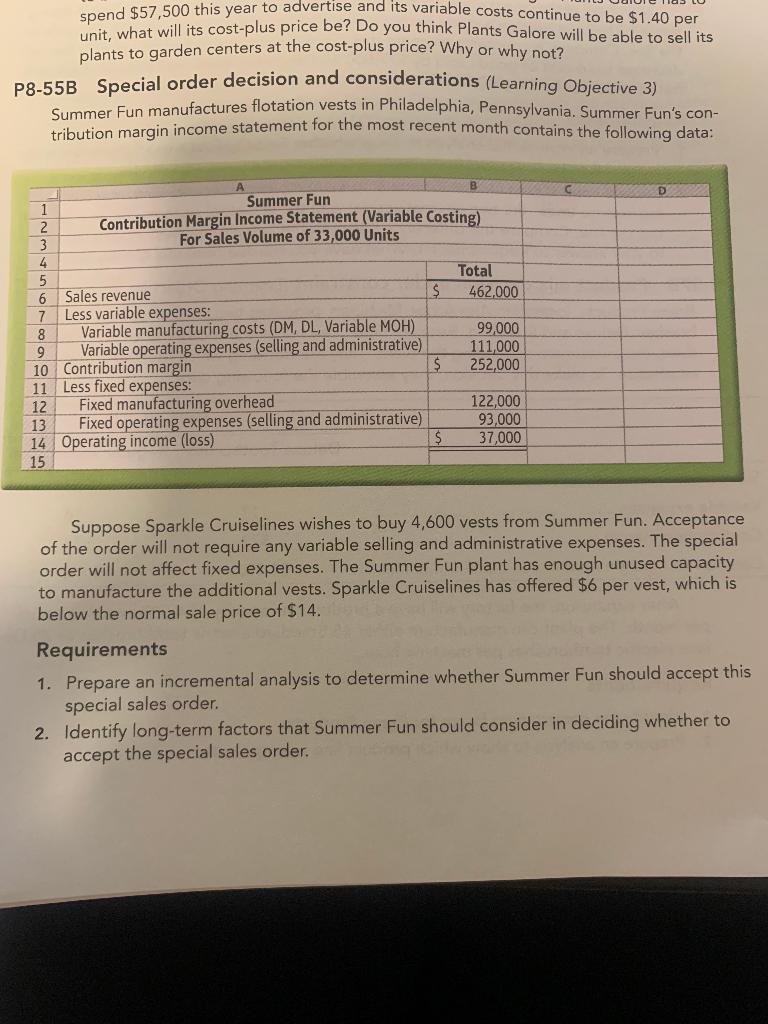

P8-55B Special order decision and considerations (Learning Objective 3) Summer Fun manufactures flotation vests in Philadelphia, Pennsylvania. Summer Fun's con- tribution margin income statement for the most recent month contains the following data: 1 2 3 4 5 6 7 8 9 10 11 12 spend $57,500 this year to advertise and its variable costs continue to be $1.40 per unit, what will its cost-plus price be? Do you think Plants Galore will be able to sell its plants to garden centers at the cost-plus price? Why or why not? 13 14 15 Summer Fun Contribution Margin Income Statement (Variable Costing) For Sales Volume of 33,000 Units Sales revenue Less variable expenses: Variable manufacturing costs (DM, DL, Variable MOH) Variable operating expenses (selling and administrative) Contribution margin Less fixed expenses: Fixed manufacturing overhead Fixed operating expenses (selling and administrative) Operating income (loss) $ $ $ Total 462,000 99,000 111,000 252,000 122,000 93,000 37,000 C D Suppose Sparkle Cruiselines wishes to buy 4,600 vests from Summer Fun. Acceptance of the order will not require any variable selling and administrative expenses. The special order will not affect fixed expenses. The Summer Fun plant has enough unused capacity to manufacture the additional vests. Sparkle Cruiselines has offered $6 per vest, which is below the normal sale price of $14. Requirements 1. Prepare an incremental analysis to determine whether Summer Fun should accept this special sales order. 2. Identify long-term factors that Summer Fun should consider in deciding whether to accept the special sales order

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts