Question: please help solve using excel and show formulas thank you Lesson 5 Exercise 1: Hedge When Yield Beta is Not 1 Consider a bond portfolio

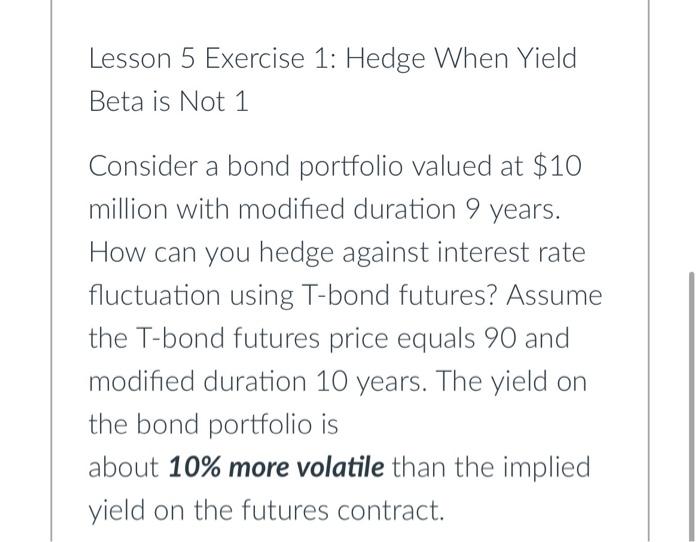

Lesson 5 Exercise 1: Hedge When Yield Beta is Not 1 Consider a bond portfolio valued at $10 million with modified duration 9 years. How can you hedge against interest rate fluctuation using T-bond futures? Assume the T-bond futures price equals 90 and modified duration 10 years. The yield on the bond portfolio is about 10% more volatile than the implied yield on the futures contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts