Question: please help solve using excel and show formulas thank you! Lesson 5 Exercise 3: Managing Equity Portfolio Risk with Targeted Beta An investment management firm

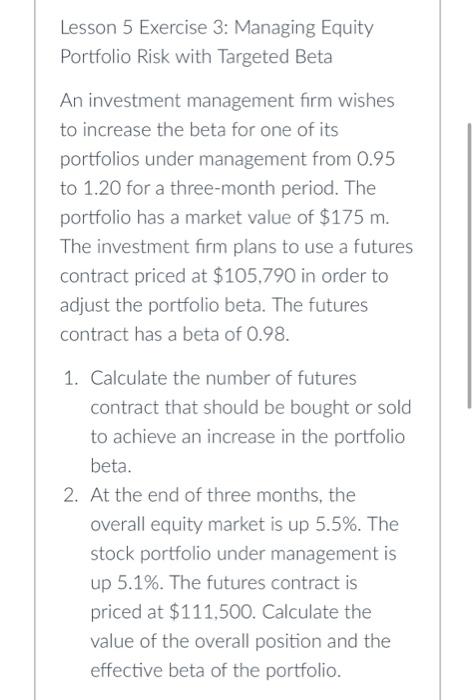

Lesson 5 Exercise 3: Managing Equity Portfolio Risk with Targeted Beta An investment management firm wishes to increase the beta for one of its portfolios under management from 0.95 to 1.20 for a three-month period. The portfolio has a market value of $175m. The investment firm plans to use a futures contract priced at $105,790 in order to adjust the portfolio beta. The futures contract has a beta of 0.98 . 1. Calculate the number of futures contract that should be bought or sold to achieve an increase in the portfolio beta. 2. At the end of three months, the overall equity market is up 5.5%. The stock portfolio under management is up 5.1%. The futures contract is priced at $111,500. Calculate the value of the overall position and the effective beta of the portfolio. Lesson 5 Exercise 3: Managing Equity Portfolio Risk with Targeted Beta An investment management firm wishes to increase the beta for one of its portfolios under management from 0.95 to 1.20 for a three-month period. The portfolio has a market value of $175m. The investment firm plans to use a futures contract priced at $105,790 in order to adjust the portfolio beta. The futures contract has a beta of 0.98 . 1. Calculate the number of futures contract that should be bought or sold to achieve an increase in the portfolio beta. 2. At the end of three months, the overall equity market is up 5.5%. The stock portfolio under management is up 5.1%. The futures contract is priced at $111,500. Calculate the value of the overall position and the effective beta of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts