Question: Please help solve using excel and show formulas! Thank you! A firm has a debt-to-equity ratio of 50%. The firm's quity beta is 1.5 and

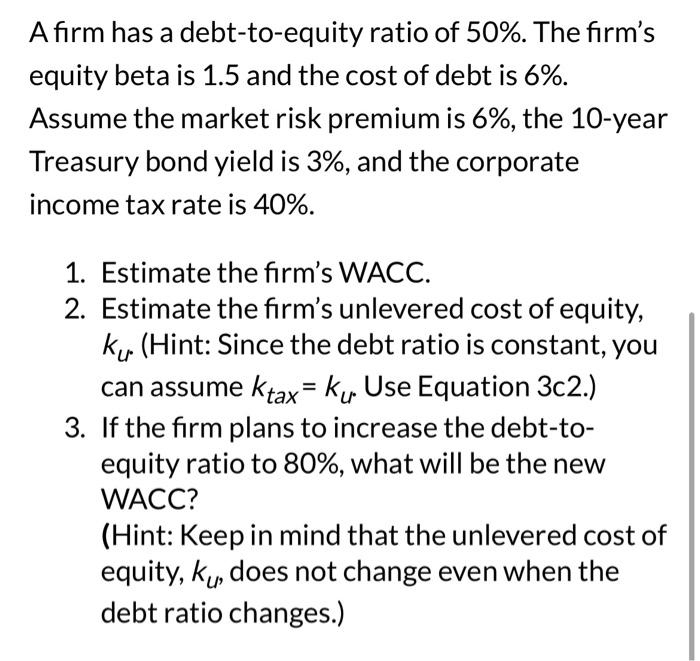

A firm has a debt-to-equity ratio of 50%. The firm's quity beta is 1.5 and the cost of debt is 6%. Assume the market risk premium is 6%, the 10 -year reasury bond yield is 3%, and the corporate ncome tax rate is 40%. 1. Estimate the firm's WACC. 2. Estimate the firm's unlevered cost of equity, ku (Hint: Since the debt ratio is constant, you can assume ktax=ku. Use Equation 3c2.) 3. If the firm plans to increase the debt-toequity ratio to 80%, what will be the new WACC? (Hint: Keep in mind that the unlevered cost of equity, ku, does not change even when the debt ratio changes.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts