Question: Please Help Thank you Surved Help Save & Exit Submit (The following information applies to the questions displayed below.) Lisa Company had outstanding 100,000 shares

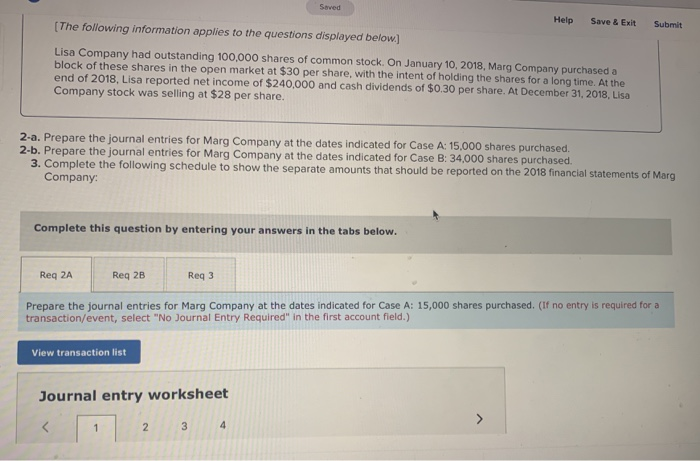

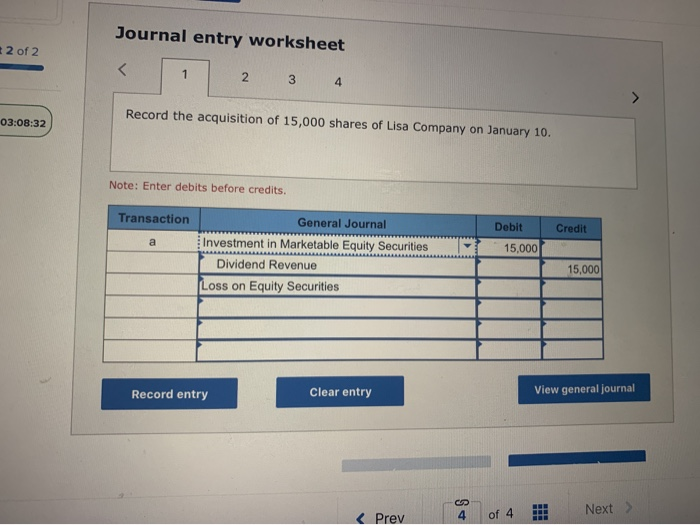

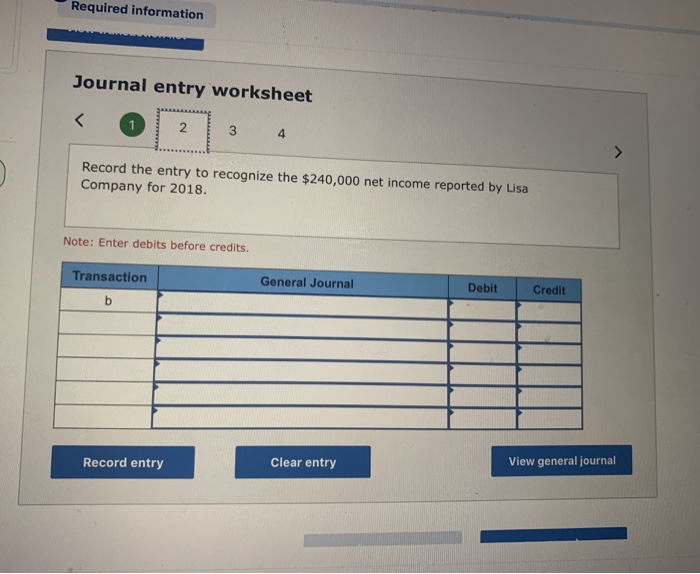

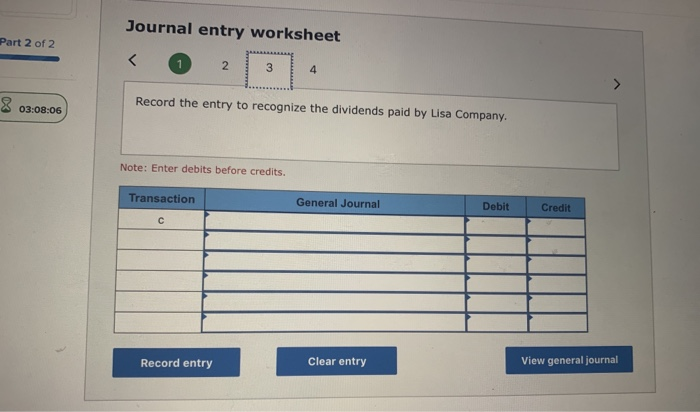

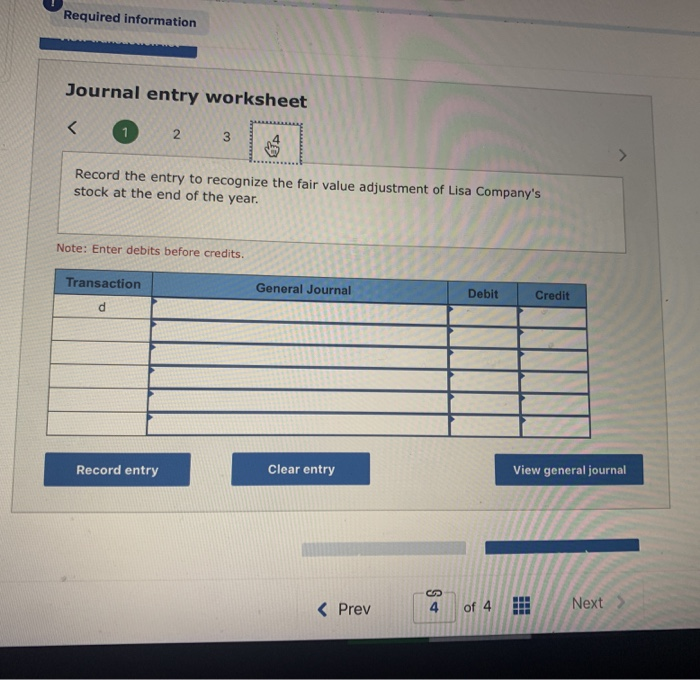

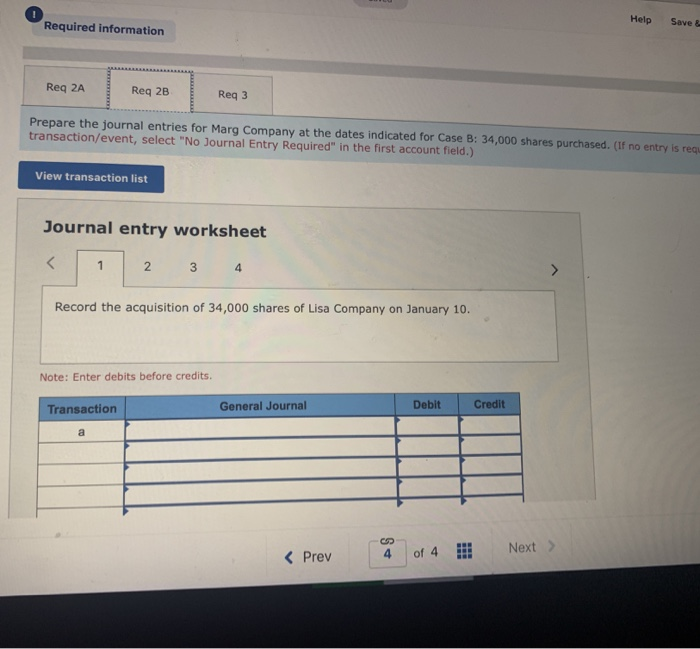

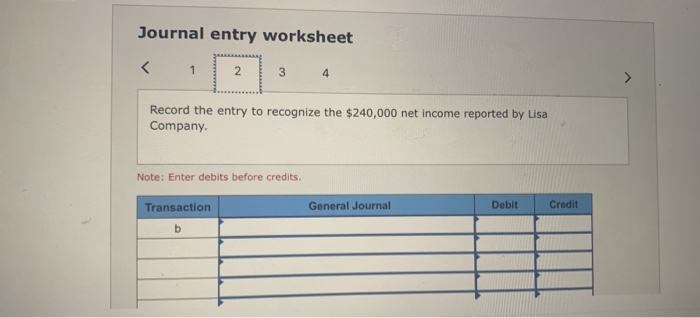

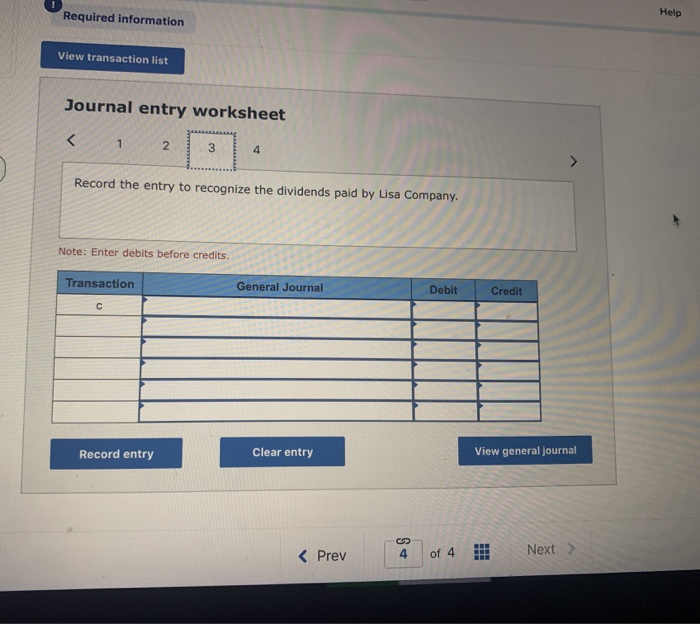

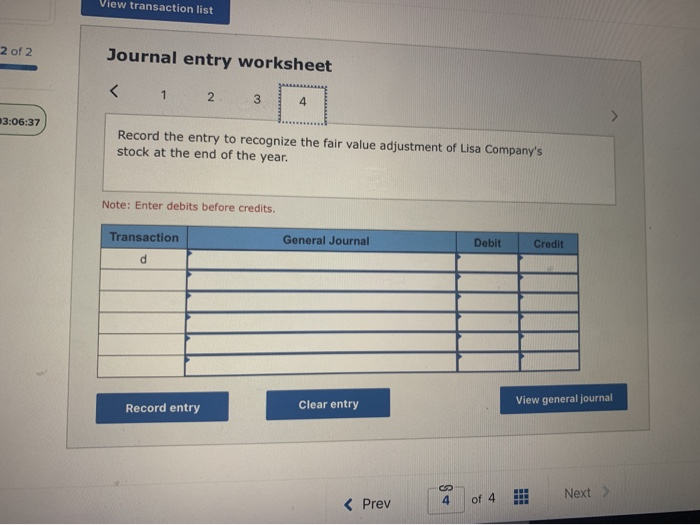

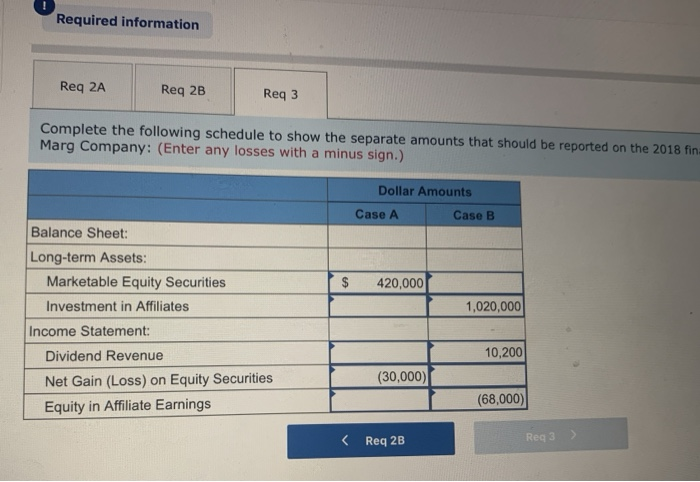

Surved Help Save & Exit Submit (The following information applies to the questions displayed below.) Lisa Company had outstanding 100,000 shares of common stock. On January 10, 2018, Marg Company purchased a block of these shares in the open market at $30 per share, with the intent of holding the shares for a long time. At the end of 2018, Lisa reported net income of $240,000 and cash dividends of $0.30 per share. At December 31, 2018, Lisa Company stock was selling at $28 per share. 2-a. Prepare the journal entries for Marg Company at the dates indicated for Case A: 15,000 shares purchased. 2-b. Prepare the journal entries for Marg Company at the dates indicated for Case B: 34,000 shares purchased. 3. Complete the following schedule to show the separate amounts that should be reported on the 2018 financial statements of Marg Company: Complete this question by entering your answ rs in the tabs below. Req 2A Reg 2B Req3 Prepare the journal entries for Marg Company at the dates indicated for Case A: 15,000 shares purchased. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Help Required information Save Reg 2A Req 2B Reg 3 Prepare the journal entries for Marg Company at the dates indicated for Case B: 34,000 shares purchased. (If no entry is requ transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 Record the acquisition of 34,000 shares of Lisa Company on January 10. Note: Enter debits before credits. Transaction General Journal Debit Credit GP 4 of 4 Journal entry worksheet View transaction list 2 of 2 Journal entry worksheet 1 2 3 4 03:06:37 Record the entry to recognize the fair value adjustment of Lisa Company's stock at the end of the year. Note: Enter debits before credits. Transaction General Journal Debit Credit d Record entry Clear entry View general journal 4 of 4 ! Required information Req 2A Req 2B Req3 Complete the following schedule to show the separate amounts that should be reported on the 2018 fin Marg Company: (Enter any losses with a minus sign.) Dollar Amounts Case A Case B 420,000 1,020,000 Balance Sheet: Long-term Assets: Marketable Equity Securities Investment in Affiliates Income Statement: Dividend Revenue Net Gain (Loss) on Equity Securities Equity in Affiliate Earnings 10,200 (30,000) (68,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts