Question: please help , thank you You are considering a project with conventional cash flows, an IRR of 13.28 percent, a PI of 1.16, an NPV

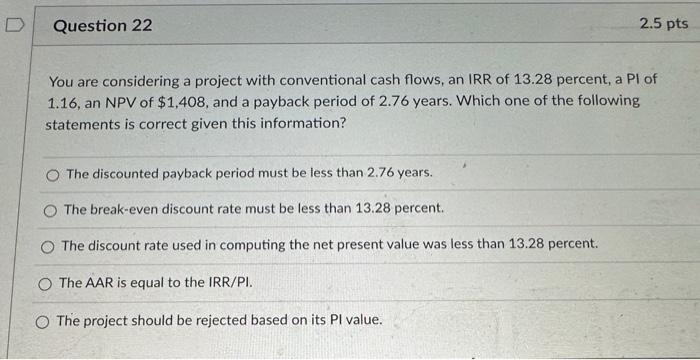

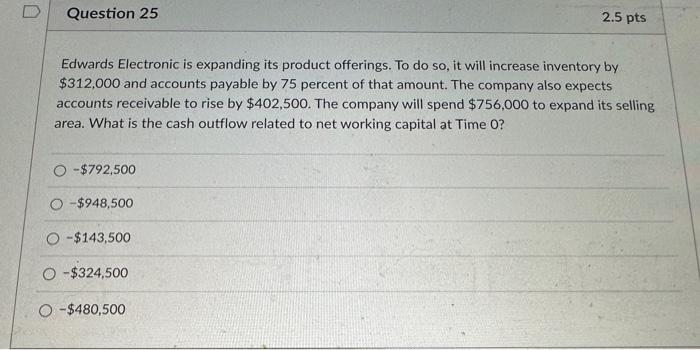

You are considering a project with conventional cash flows, an IRR of 13.28 percent, a PI of 1.16, an NPV of $1,408, and a payback period of 2.76 years. Which one of the following statements is correct given this information? The discounted payback period must be less than 2.76 years. The break-even discount rate must be less than 13.28 percent. The discount rate used in computing the net present value was less than 13.28 percent. The AAR is equal to the IRR/PI. The project should be rejected based on its PI value. Edwards Electronic is expanding its product offerings. To do so, it will increase inventory by $312,000 and accounts payable by 75 percent of that amount. The company also expects accounts receivable to rise by $402,500. The company will spend $756,000 to expand its selling area. What is the cash outflow related to net working capital at Time 0 ? $792,500 $948,500 $143,500 $324,500 $480,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts