Question: Please help; unable to get the correct answer. Will upvote!! Thank you much! Noncoristant srowth Stock Valuation Simplins Cocporation does not pay any dividends because

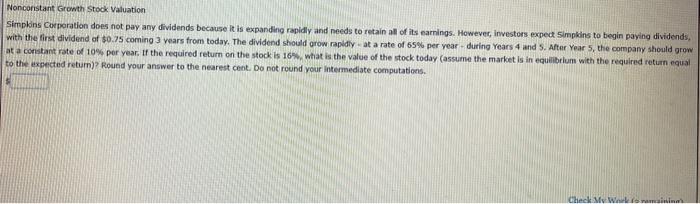

Noncoristant srowth Stock Valuation Simplins Cocporation does not pay any dividends because lt is expanding ropidly and needs to retain all of its earnings. Howevec, investors expect 5 impkins to begin paying dividends, with the first dividend of $0.75 coming 3 vears from today. The dividend should grow rapidly - at a rate of 65% per year-during Years 4 and 5 . After Year 5 , the company should grow at a constant rate of 10% por year. If the required return on the stock is 16%, what is the value of the stock today (assume the market is in equilibrium with the required return equal to the uxpected return)? Round your answer to the nearest cent. Do not round your intermediate computations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts