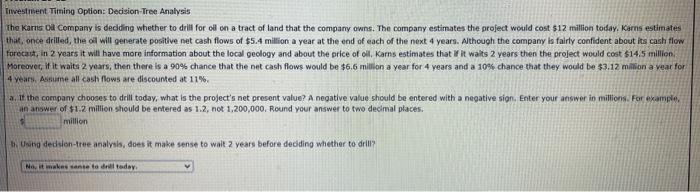

Question: Please help! Unable to get the correct answer. Will upvote!! :-) Thank you!!!! Tivestrent Tining Option: Decision-Iree Analysis The Karns ca Company is dediling whether

Tivestrent Tining Option: Decision-Iree Analysis The Karns ca Company is dediling whether to drill for oll on a thact of land that the company owns. The company estimates the grofect would cost s12 million today. Karns estimates that, once drilled, the oil will generate positive net cash flows of $5.4 million a year at the end of each of the next 4 years. Athough the compamy is fairly confident about its cash flow forecamt, in 2 vears it will have more information about the local geclogy and about the price of oll, Karns estimates that if it waits 2 years then the project would cost 514,5 million, Moreovec, if it waits 2 years, then there is a 90% chance that the net cash flows would be $6.6 million a year for 4 years and a 10% chance that they would be $3.12 mililon a year for 4 years. Assiame all cash flows are discounted at 11%. a. It the company chooses to drill today; what is the project's net present value? A negative value should be entered with a negative sign. Enter your answer in millions. For examile. an answer of \$1.2 millien should be entered as 1.2 , not 1,200,000. Round your answer to two decimal places. milisich Wh Uwihd dedzuch-irtec analysis, does it make sense to wait 2 years before deoding whether to drill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts