Question: Please help US Corp has bid on a large contract to sell a product to a German customer. The German customer notified US Corp that

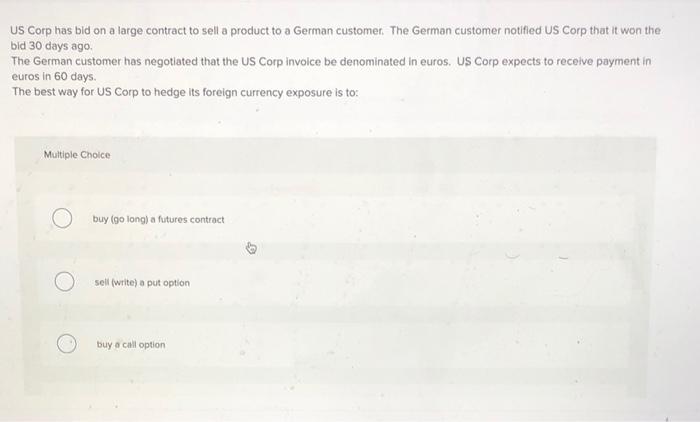

US Corp has bid on a large contract to sell a product to a German customer. The German customer notified US Corp that it won the bid 30 days ago The German customer has negotiated that the US Corp involce be denominated in euros. US Corp expects to receive payment in euros in 60 days. The best way for US Corp to hedge its foreign currency exposure is to Multiple Choice buy (golong) a futures contract sell (write) o put option buy a call option US Corp has bid on a large contract to sell a product to a German customer. The German customer notified US Corp that it won the bid 30 days ago The German customer has negotiated that the US Corp involce be denominated in euros. US Corp expects to receive payment in euros in 60 days. The best way for US Corp to hedge its foreign currency exposure is to Multiple Choice buy (golong) a futures contract sell (write) o put option buy a call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts