Question: please help Use the NPV method to determine whether McKnight Products should invest in the following projects: - Project A: Costs $270,000 and offers eight

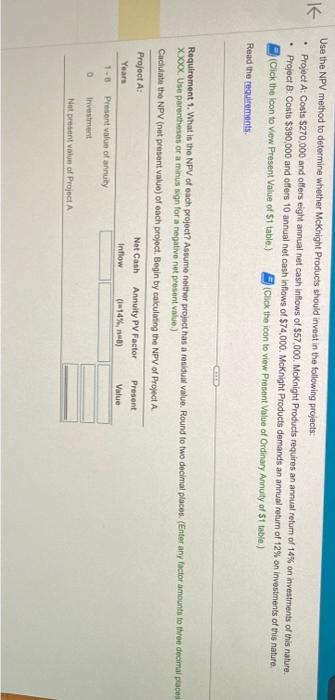

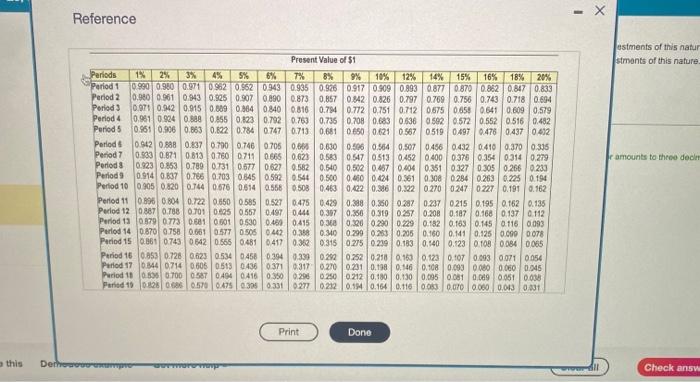

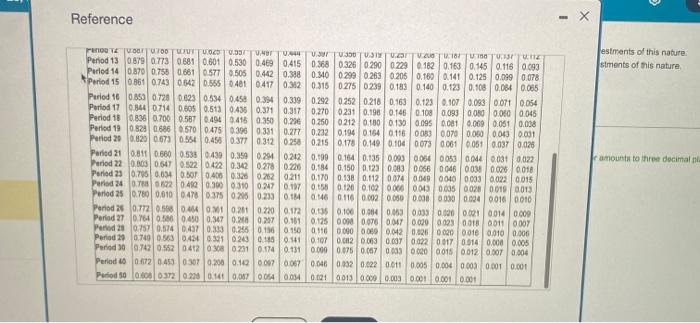

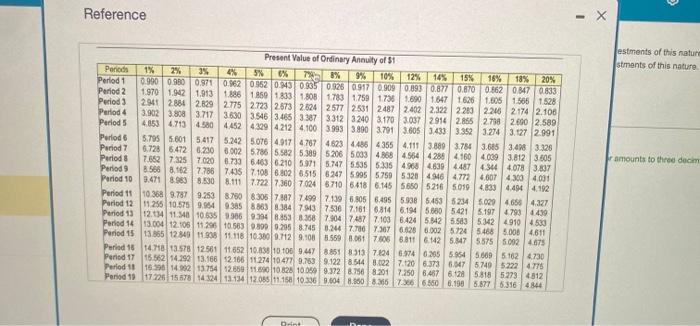

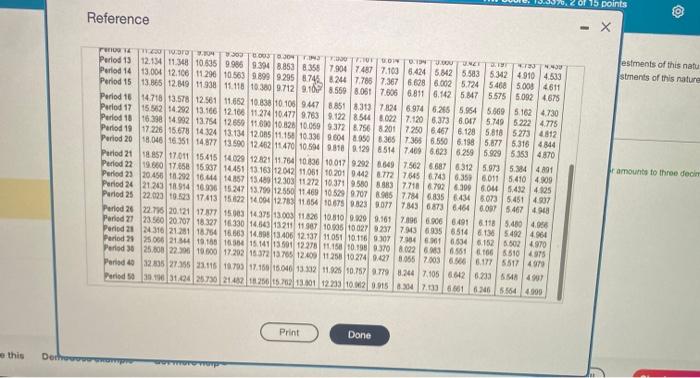

Use the NPV method to determine whether McKnight Products should invest in the following projects: - Project A: Costs $270,000 and offers eight annual net cash infiows of $57,000. McKnight Products requires an annual refurn of 14% on investrnents of this nature. - Projoct B: Costs $390,000 and offers 10 annual net cash inflows of $74,000. McKnight Products demands an annual retum of 12% on investments of this nature. E. (Cick the icon to Vew Present Value of $1 table.) Read the requirements. E (Click the icon to view Present Value of Ordinary Annuily of \$t table.) XOOCX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present valuo) of each projoct. Begin by calculating the NPV of Project A. Reference x Present Value of $1 estments of this natur Reference Reference x estrents of this nature. stments of nis nature. Reference Present Value of Oreinary Annuily of \$1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts