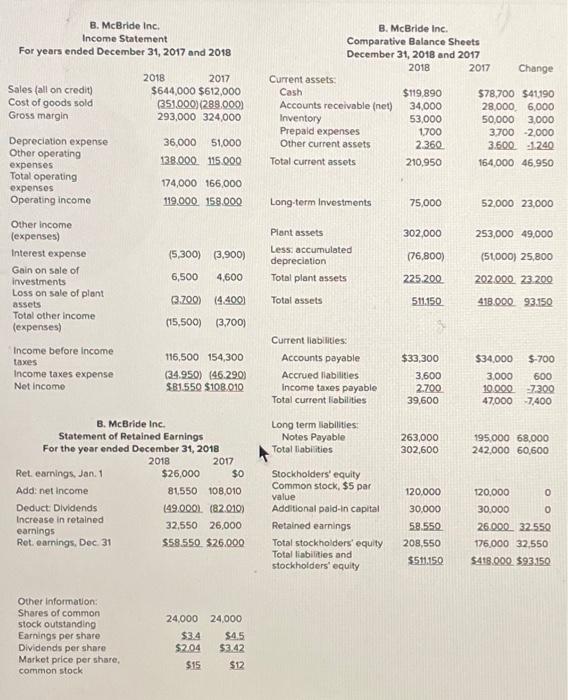

Question: please help! vertical income statement and ratios section B. McBride Inc. Income Statement For years ended December 31, 2017 and 2018 Sales (all on credit)

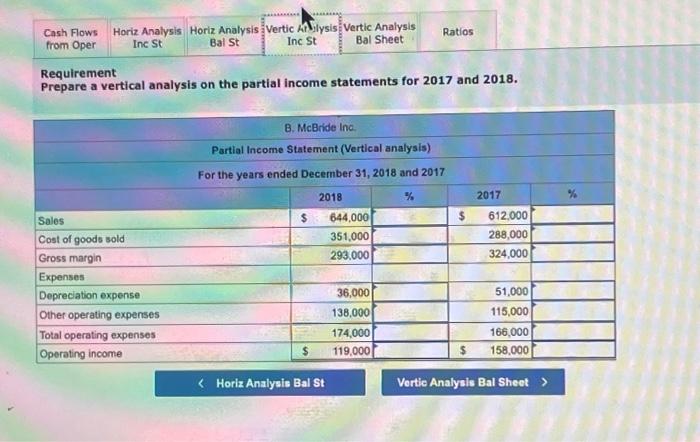

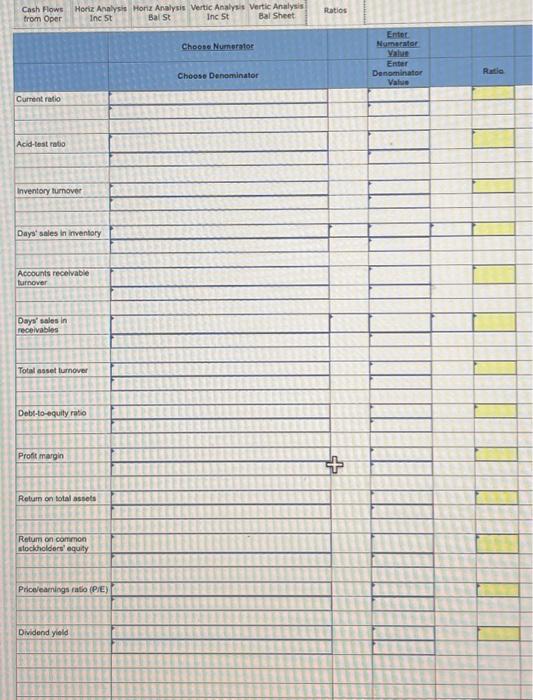

B. McBride Inc. Income Statement For years ended December 31, 2017 and 2018 Sales (all on credit) 2018$644,000(351,000)293,0002017$612,000(288,000)324,000 Gross margin Depreciation expense Other operating expenses Total operating expenses Operating income Other income (expenses) Interest expense Gain on sale of investments Loss on sale of plant assets Total other income (expenses) Income before income taxes Income taxes expense Net income B. McBride inc. Comparative Balance Sheets December 31, 2018 and 2017 2018 Current assets: 2017 Change Cash $119,89034,00053,0001,7002,360210,950$78,70028,00050,0003,7003,500164,000$41,1906,0003,0002,0001.24046,950 174,000166,000 119.000 .158 .000 Long-term Invostments 75,000 52,00023,000 Piant assets 302,000 253,00049,000 Less: accurnulated depreciation (76,800) (51,000) 25,800 Total plant assets 225.200 202.00023.200 Total assets 511.150 418.00093.150 Current liabilities: 116,500154,300 Accounts payable (34.950) (46.290) Accrued liablities $81.550$108.010 B. McBride Inc. Statement of Retained Earnings For the year ended December 31, 2018 2018 2017 Income taxes payable Total current libbilties Long term liabilities: Notes Payable Total liabilities 263,000 302,600 Stockholders' equity Common stock, $5 par value Additional paid-in capital Retained earnings Total stocknoiders' equity Total liabilities and stockholders' equity $33,300 3,600 2700 39,600 $34.000$700 3.000600 47,00010.000=7.400 Deduct: Dividends Increase in retained earnings Ret. earnings, Dec 31 $58.550$26.000 Other information: Shares of common stock outstanding 24.00024,000 Earnings per share Dividends per share Market price per share, common stock $3.4$204$15$4.5$3.42$12 Requirement Prepare a vertical analysis on the partial income statements for 2017 and 2018. Cash Hows trom Oper Her Ine 5t Inc 5t Bal Sheet. Balst Choose Numeralor Cheose Denominator Enter. Enter Humperator Yalue Enter Denominator Ratio Current ratio Acid-test rotio Inventory turnover Days' sales in imventory Acoounts recelvable turnower Days' sales in receivables Total asset lumover Debs-to-equity ratio Profit margin Retum on common atocknolders' equity Pricelearnings falo (PIC) Dividend yiold Return on total assets Prodearnings falto (PIE) ( 4 4 4 5 \begin{tabular}{|l|l|} \hline 12+ \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts