Question: please help will give a thumbs up if correct Consider how Preston Valley Brook Park Lodge could une capital budgetrng to decide whether the $11,500,000

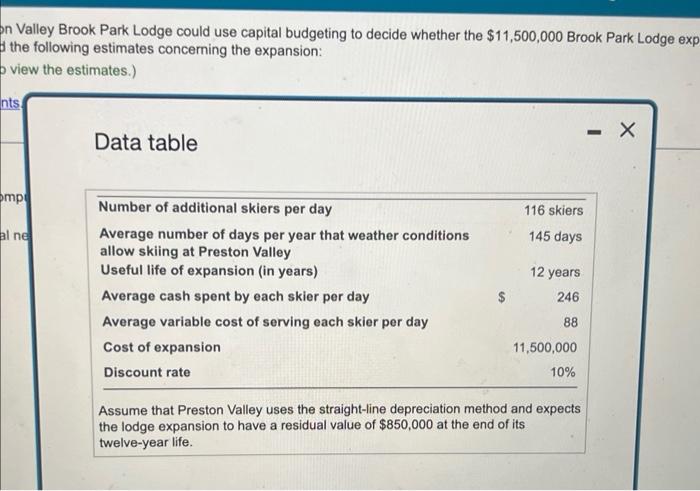

Consider how Preston Valley Brook Park Lodge could une capital budgetrng to decide whether the $11,500,000 Brook Pank Lodpe expansion would be a good investment, Ausume Prestion Valey managers developed the following nstimates tonceming the expansion (Click the loon to view the entinates) Read the teavirements Requiremem 1. Compute the average annual net cash infow from the exparision The everage annual net cavh infow from the exparsion is ook Park Lodge could use capital budgeting to decide whether the $11,500,000 ing estimates concerning the expansion: astimates.) average annual net cash inflow from the expansion. Requirements 1. Compute the average annual net cash inflow from the expansion. 2. Compute the average annual operating income from the expansion. n Valley Brook Park Lodge could use capital budgeting to decide whether the $11,500,000 Brook Park Lodge exp the following estimates concerning the expansion: view the estimates.) Data table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts