Question: PLEASE HELP WITH LAB 2! YOU DO NOT NEED TO DO LAB 1 BUT WILL NEED THE INFO FROM LAB 1 TO DO LAB 2!

PLEASE HELP WITH LAB 2! YOU DO NOT NEED TO DO LAB 1 BUT WILL NEED THE INFO FROM LAB 1 TO DO LAB 2!

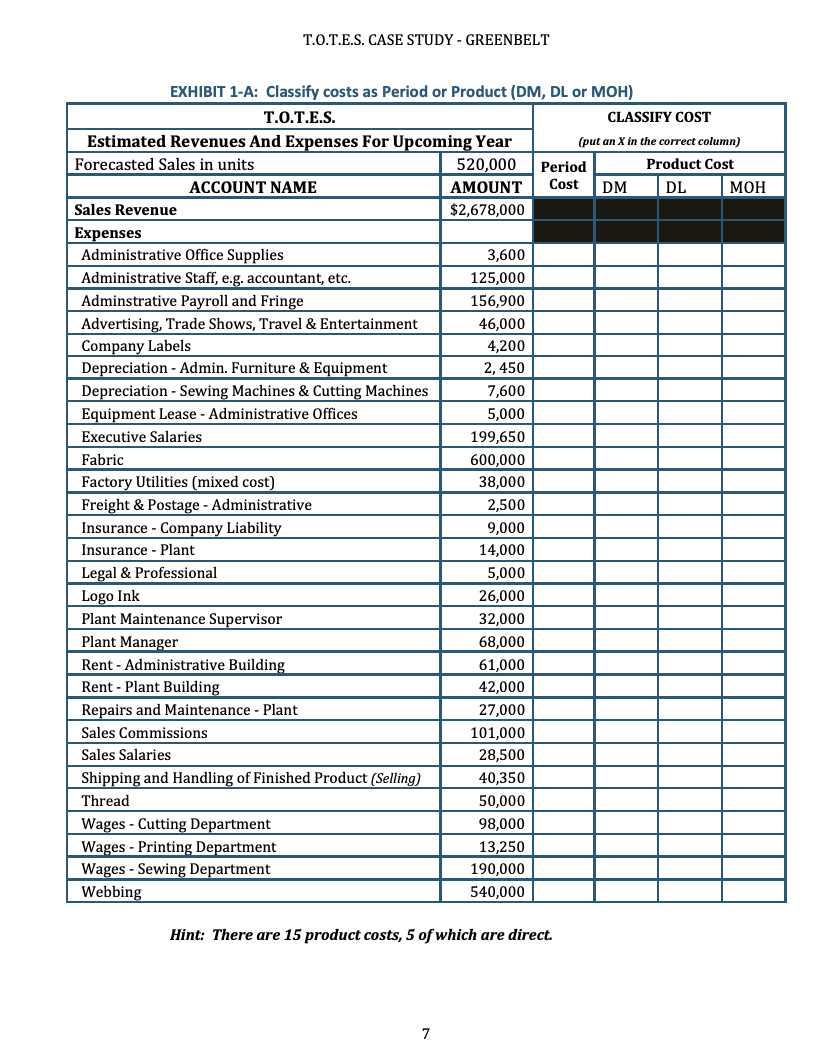

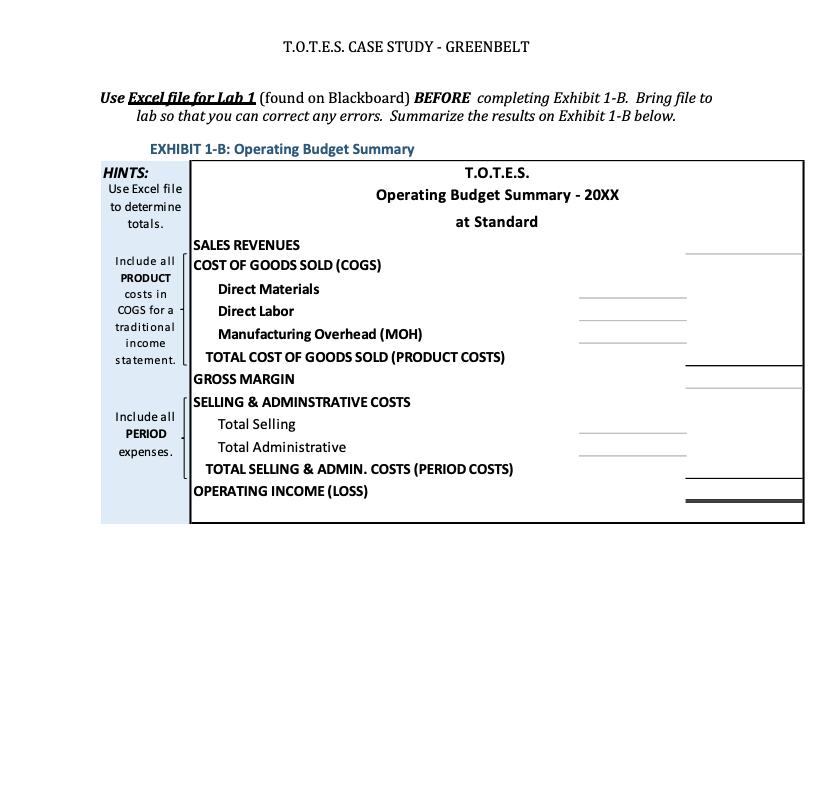

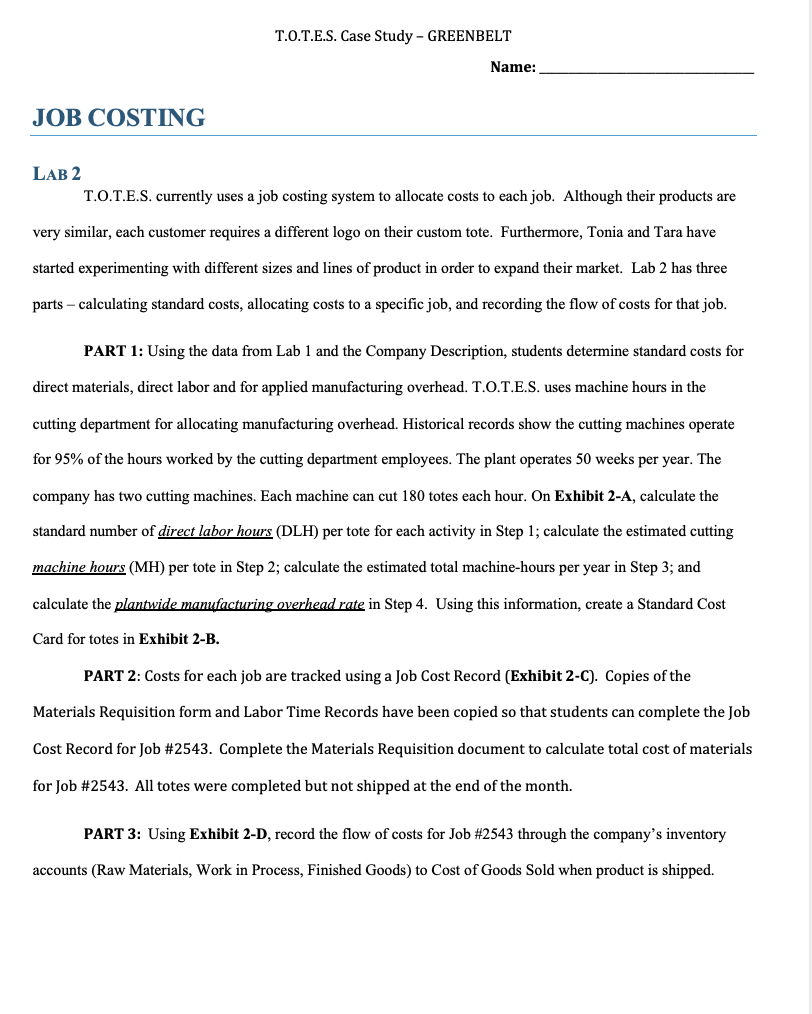

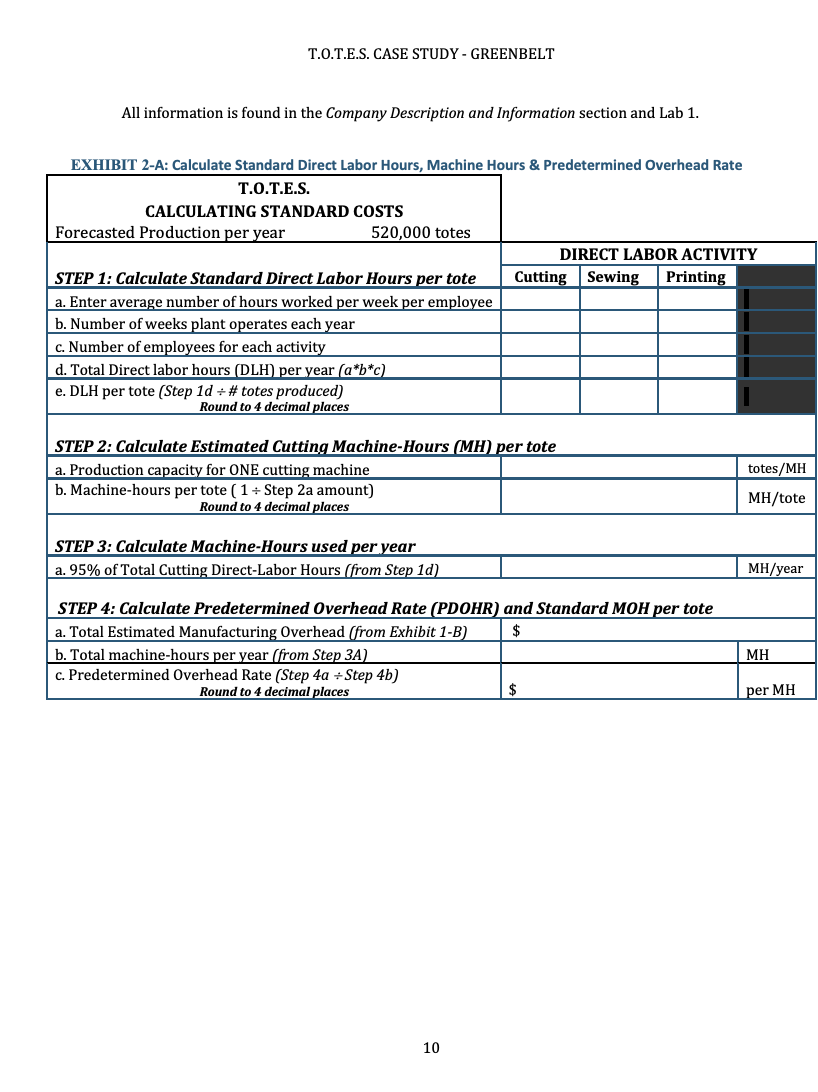

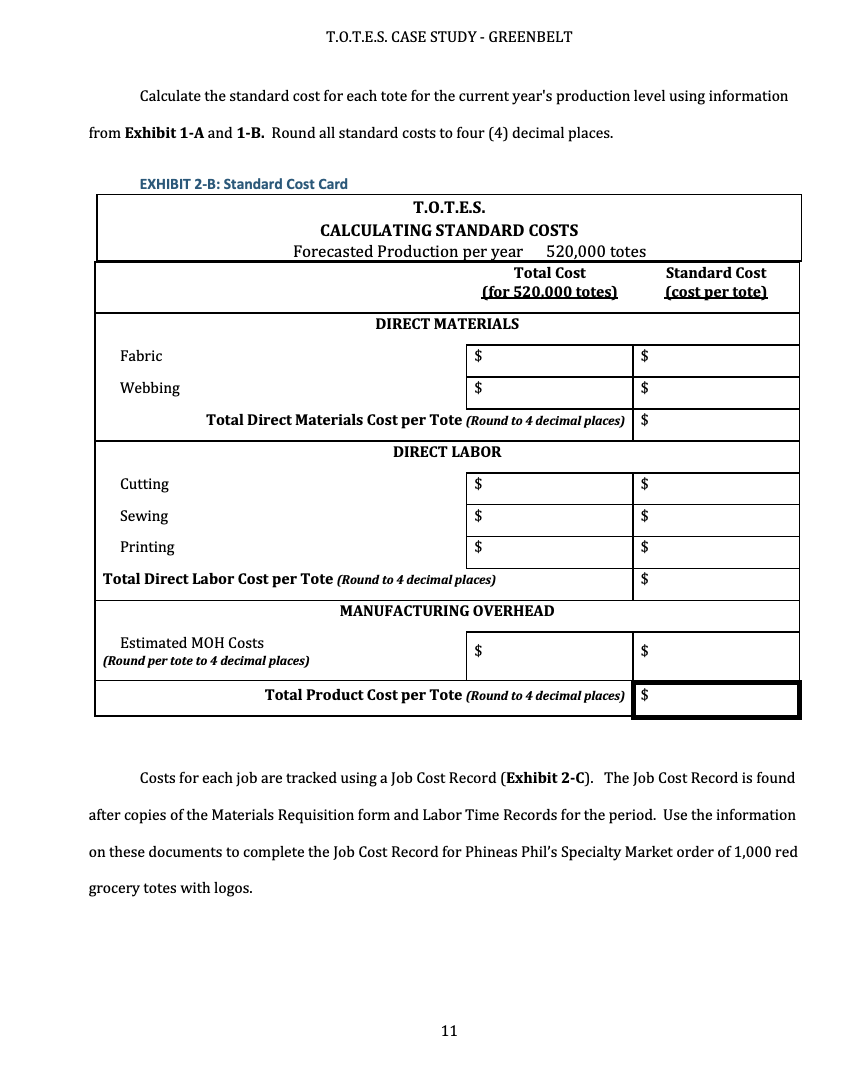

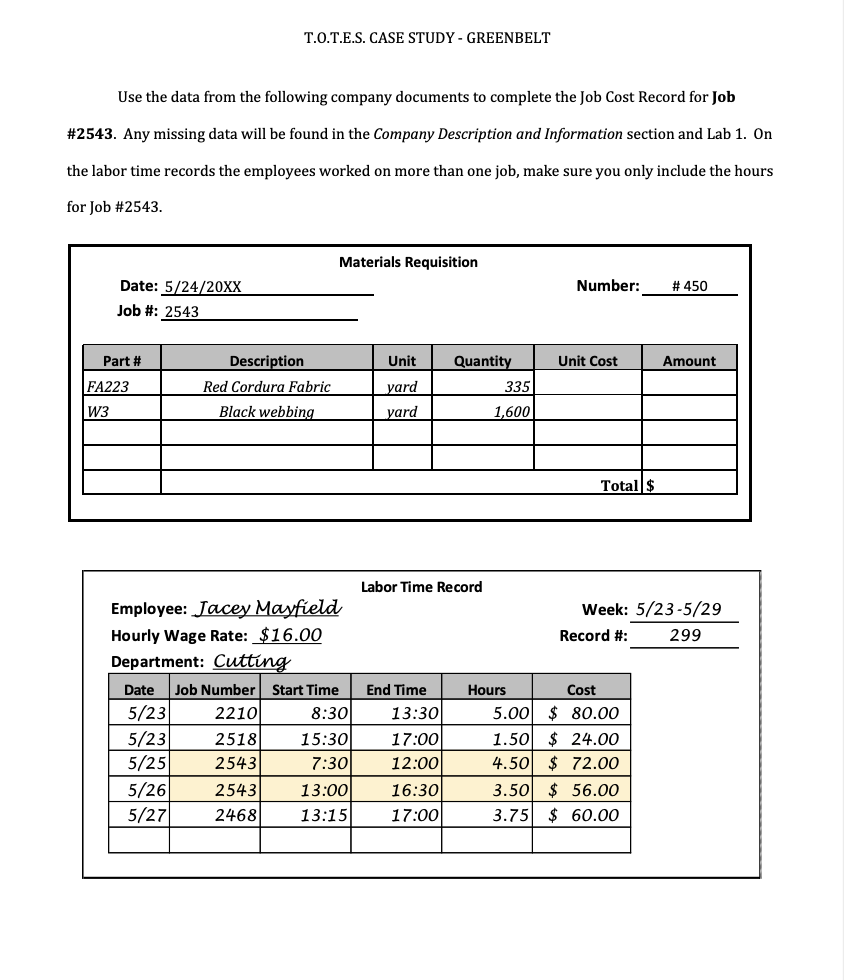

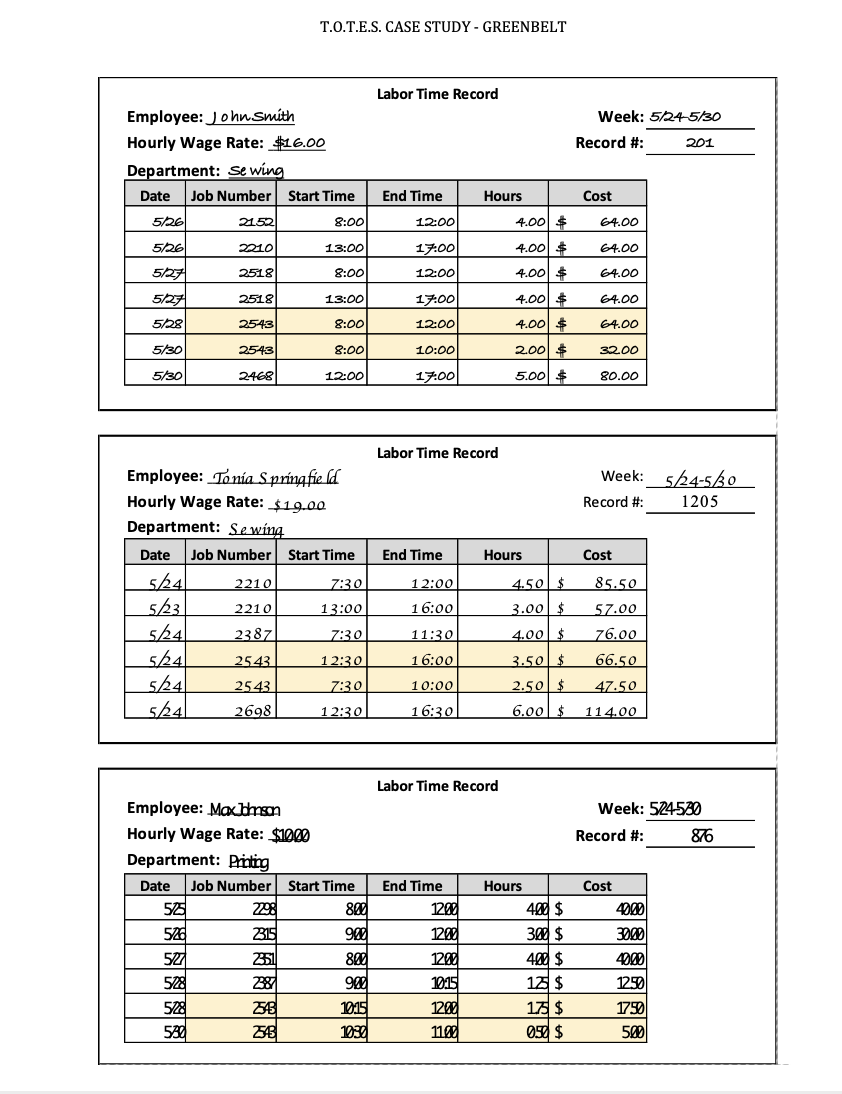

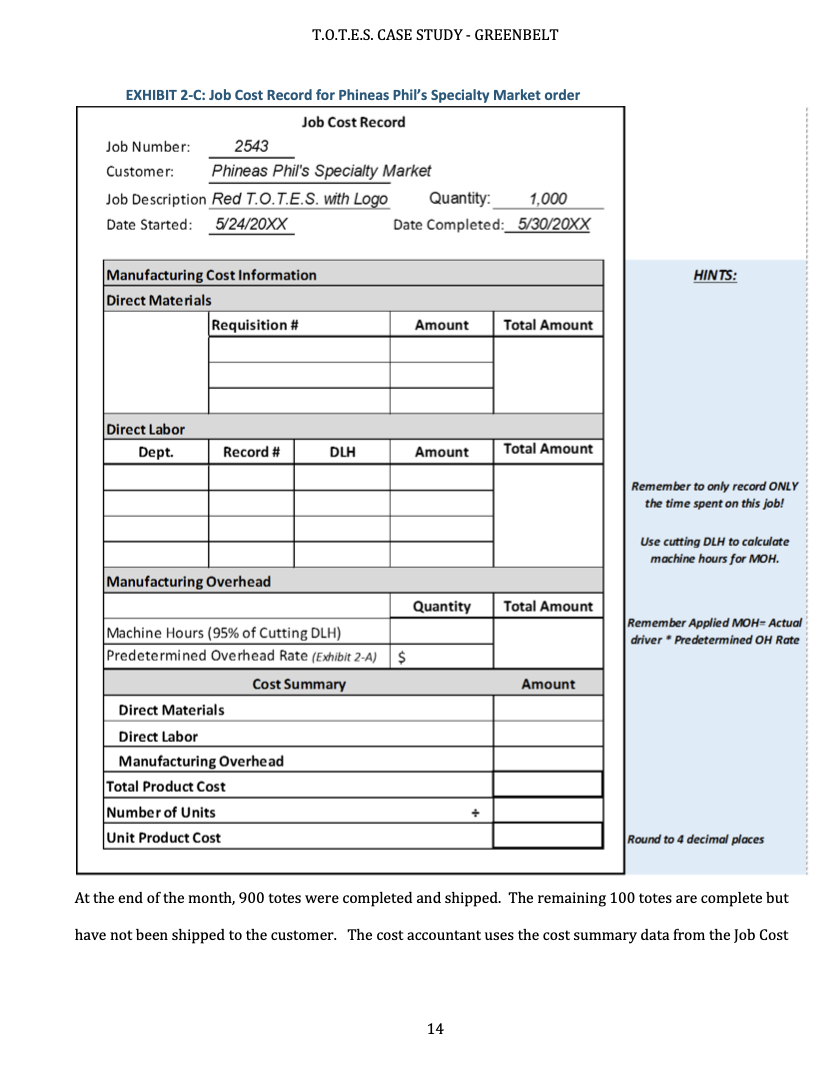

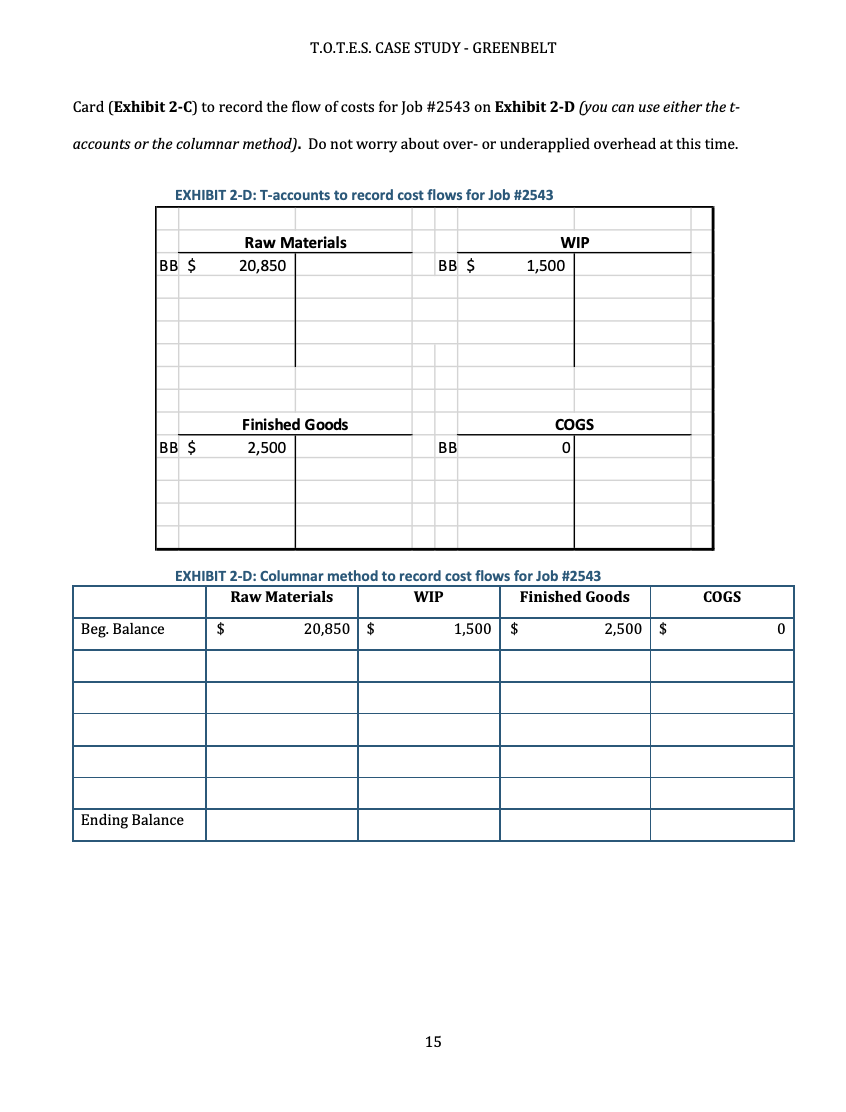

T.O.T.E.S. Case Study-GREENBELT Student Name: COST CLASSIFICATIONS AND OPERATING BUDGET LAB 1 T.O.T.E.S. is a manufacturing company and keeps close tabs on their costs in order to price their tote bags competitively and maintain profitability. Costs are assigned different classifications depending on the information needed for various managerial decisions. In this lab, students will classify costs as either product or period costs in order to prepare a basic operating budget. Product costs will then be classified as direct material direct labor or manufacturing overhead (all indirect manufacturing costs) costs so as to calculate estimated direct material costs, direct labor costs and manufacturing overhead. PART 1: Identify costs in Exhibit 1-A as a period or a product cost with respect to the totes. Further identify whether product costs are direct material (DM), direct labor (DL) or manufacturing overhead (MOH) during classification process. After verifying that costs are classified correctly, go on to PART 2. PART 2: On your computer open Excel file for Lab 1 - Complete the Operating Budget. Use classifications from Exhibit 1-A to complete the company's operating budget for 20XX using a Traditional Income Statement Format. PART 3: Using information from PART 2, complete Exhibit 2-B. 6 T.O.T.E.S. CASE STUDY - GREENBELT EXHIBIT 1-A: Classify costs as Period or Product (DM, DL or MOH) T.O.T.E.S. CLASSIFY COST Estimated Revenues And Expenses For Upcoming Year (put an X in the correct column) Forecasted Sales in units 520,000 Period Product Cost ACCOUNT NAME AMOUNT Cost DM DL MOH Sales Revenue $2,678,000 Expenses Administrative Office Supplies 3,600 Administrative Staff, e.g. accountant, etc. 125,000 Adminstrative Payroll and Fringe 156,900 Advertising, Trade Shows, Travel & Entertainment 46,000 Company Labels 4,200 Depreciation - Admin. Furniture & Equipment 2,450 Depreciation - Sewing Machines & Cutting Machines 7,600 Equipment Lease - Administrative Offices 5,000 Executive Salaries 199,650 Fabric 600,000 Factory Utilities (mixed cost) 38,000 Freight & Postage - Administrative 2,500 Insurance - Company Liability 9,000 Insurance - Plant 14,000 Legal & Professional 5,000 Logo Ink 26,000 Plant Maintenance Supervisor 32,000 Plant Manager 68,000 Rent - Administrative Building 61,000 Rent - Plant Building 42,000 Repairs and Maintenance - Plant 27,000 Sales Commissions 101,000 Sales Salaries 28,500 Shipping and Handling of Finished Product (Selling) 40,350 Thread 50,000 Wages - Cutting Department 98,000 Wages - Printing Department 13,250 Wages - Sewing Department 190,000 Webbing 540,000 Hint: There are 15 product costs, 5 of which are direct. 7 T.O.T.E.S. CASE STUDY - GREENBELT Use Excel file for Lab 1 (found on Blackboard) BEFORE completing Exhibit 1-B. Bring file to lab so that you can correct any errors. Summarize the results on Exhibit 1-B below. EXHIBIT 1-B: Operating Budget Summary HINTS: T.O.T.E.S. Use Excel file Operating Budget Summary - 20XX to determine totals. at Standard SALES REVENUES Include all ( COST OF GOODS SOLD (COGS) PRODUCT costs in Direct Materials COGS for a Direct Labor traditional Manufacturing Overhead (MOH) income statement TOTAL COST OF GOODS SOLD (PRODUCT COSTS) GROSS MARGIN SELLING & ADMINSTRATIVE COSTS Include all Total Selling PERIOD expenses. Total Administrative TOTAL SELLING & ADMIN. COSTS (PERIOD COSTS) OPERATING INCOME (LOSS) T.O.T.E.S. Case Study-GREENBELT Name: JOB COSTING LAB 2 T.O.T.E.S. currently uses a job costing system to allocate costs to each job. Although their products are very similar, each customer requires a different logo on their custom tote. Furthermore, Tonia and Tara have started experimenting with different sizes and lines of product in order to expand their market. Lab 2 has three parts - calculating standard costs, allocating costs to a specific job, and recording the flow of costs for that job. PART 1: Using the data from Lab 1 and the Company Description, students determine standard costs for direct materials, direct labor and for applied manufacturing overhead. T.O.T.E.S. uses machine hours in the cutting department for allocating manufacturing overhead. Historical records show the cutting machines operate for 95% of the hours worked by the cutting department employees. The plant operates 50 weeks per year. The company has two cutting machines. Each machine can cut 180 totes each hour. On Exhibit 2-A, calculate the standard number of direct labor hours (DLH) per tote for each activity in Step 1; calculate the estimated cutting machine hours (MH) per tote in Step 2; calculate the estimated total machine-hours per year in Step 3; and calculate the plantwide manufacturing overhead rate in Step 4. Using this information, create a Standard Cost Card for totes in Exhibit 2-B. PART 2: Costs for each job are tracked using a Job Cost Record (Exhibit 2-C). Copies of the Materials Requisition form and Labor Time Records have been copied so that students can complete the Job Cost Record for Job #2543. Complete the Materials Requisition document to calculate total cost of materials for Job #2543. All totes were completed but not shipped at the end of the month. PART 3: Using Exhibit 2-D, record the flow of costs for Job #2543 through the company's inventory accounts (Raw Materials, Work in Process, Finished Goods) to Cost of Goods Sold when product is shipped. T.O.T.E.S. CASE STUDY-GREENBELT All information is found in the Company Description and Information section and Lab 1. EXHIBIT 2-A: Calculate Standard Direct Labor Hours, Machine Hours & Predetermined Overhead Rate T.O.T.E.S. CALCULATING STANDARD COSTS Forecasted Production per year 520,000 totes DIRECT LABOR ACTIVITY STEP 1: Calculate Standard Direct Labor Hours per tote Cutting Sewing Printing a. Enter average number of hours worked per week per employee b. Number of weeks plant operates each year c. Number of employees for each activity d. Total Direct labor hours (DLH) per year (a*b*c) e. DLH per tote (Step 1d + # totes produced) Round to 4 decimal places STEP 2: Calculate Estimated Cutting Machine-Hours (MH) per tote a. Production capacity for ONE cutting machine b. Machine-hours per tote (1 = Step 2a amount) Round to 4 decimal places totes/MH MH/tote STEP 3: Calculate Machine-Hours used per year a. 95% of Total Cutting Direct-Labor Hours (from Step 1d) MH/year STEP 4: Calculate Predetermined Overhead Rate (PDOHR) and Standard MOH per tote a. Total Estimated Manufacturing Overhead (from Exhibit 1-B) b. Total machine-hours per year (from Step 3A) c. Predetermined Overhead Rate (Step 4a +Step 4b) Round to 4 decimal places $ MH per MH 10 T.O.T.E.S. CASE STUDY - GREENBELT Calculate the standard cost for each tote for the current year's production level using information from Exhibit 1-A and 1-B. Round all standard costs to four (4) decimal places. EXHIBIT 2-B: Standard Cost Card T.O.T.E.S. CALCULATING STANDARD COSTS Forecasted Production per year 520,000 totes Total Cost (for 520.000 totes) Standard Cost (cost per tote) DIRECT MATERIALS Fabric $ $ Webbing $ $ Total Direct Materials Cost per Tote (Round to 4 decimal places) $ DIRECT LABOR Cutting $ $ $ Sewing $ Printing $ Total Direct Labor Cost per Tote (Round to 4 decimal places) $ $ MANUFACTURING OVERHEAD Estimated MOH Costs (Round per tote to 4 decimal places) $ $ Total Product Cost per Tote (Round to 4 decimal places) $ Costs for each job are tracked using a Job Cost Record (Exhibit 2-C). The Job Cost Record is found after copies of the Materials Requisition form and Labor Time Records for the period. Use the information on these documents to complete the Job Cost Record for Phineas Phil's Specialty Market order of 1,000 red grocery totes with logos. 11 T.O.T.E.S. CASE STUDY - GREENBELT Use the data from the following company documents to complete the Job Cost Record for Job #2543. Any missing data will be found in the Company Description and Information section and Lab 1. On the labor time records the employees worked on more than one job, make sure you only include the hours for Job #2543. Materials Requisition Number: # 450 Date: 5/24/20XX Job #: 2543 Unit Unit Cost Amount Part # FA223 Description Red Cordura Fabric Black webbing Quantity 335 yard W3 yard 1,600 Total $ Labor Time Record Week: 5/23-5/29 Record #: 299 End Time Employee: Jacey Mayfield Hourly Wage Rate: $16.00 Department: Cutting Date Job Number Start Time 5/23 8:30 5/23 2518 15:30 5/25 2543) 7:30 5/26 2543 13:00 5/27 2468 13:15 2210 13:30 17:00 12:00 16:30 17:00 Hours Cost 5.00 $ 80.00 1.50 $ 24.00 4.50 $ 72.00 3.50 $ 56.00 3.75 $ 60.00 T.O.T.E.S. CASE STUDY - GREENBELT Labor Time Record Week: 524-5130 Record #: 201 Employee: John Smith Hourly Wage Rate: $16.00 Department: sewing Date Job Number Start Time End Time Hours Cost 5/26 2152 8:00 12:00 4.00 $ 64.00 5/26 210 13:00 17.00 64.00 4.00 $ 4.00 $ 527 2518 8:00 12:00 64.00 527 2518 13:00 17.00 4.00 $ 64.00 5/28 2543 8:00 12:00 4.00 $ 64.00 5/30 2543 8:00 10:00 2.00 $ 32.00 530 2468 12:00 17:00 5.00 $ 80.00 Labor Time Record Week: 524-5ko 1205 Record #: End Time Hours Cost 12:00 4.50 $ 85.50 Employee: Tonia Springfield Hourly Wage Rate: $19.00 Department: Sewing Date Job Number Start Time 524 221 0 7:30 523 2210 13:00 524 2387 7:30 sk4 12:30 524) 2543 7:30 s24 2698 12:30 16:00 3.00 $ 57.00 11:30 4.00 $ 25.43 3.50 $ 16:00 10:00 76.00 66.50 47.50 2.50 $ 16:301 6.00 $ 114.00 Labor Time Record Week: 524580 Record #: 876 End Time 1200 Cost 4000 Employee: Macbhnson Hourly Wage Rate: $10.00 Department: Printing Date Job Number Start Time 52 29 800 526 2015 990 527 251 800 528 287 900 528 55 1015 580 75 1030 120 120 1015 Hours 400 $ 300 $ 400 $ 12 $ 17 $ 050 $ 3000 4000 1250 1750 500 120 1190 T.O.T.E.S. CASE STUDY - GREENBELT EXHIBIT 2-C: Job Cost Record for Phineas Phil's Specialty Market order Job Cost Record Job Number: 2543 Customer: Phineas Phil's Specialty Market Job Description Red T.O.T.E.S. with Logo Quantity: 1.000 Date Started: 5/24/20XX Date Completed: 5/30/20XX HINTS: Manufacturing Cost Information Direct Materials Requisition # Amount Total Amount Direct Labor Dept. Record # DLH Amount Total Amount Remember to only record ONLY the time spent on this job! Use cutting DLH to calculate machine hours for MOH. Manufacturing Overhead Quantity Total Amount Machine Hours (95% of Cutting DLH) Predetermined Overhead Rate (Exhibit 2-A) Remember Applied MOH- Actual driver Predetermined OH Rate $ Cost Summary Amount Direct Materials Direct Labor Manufacturing Overhead Total Product Cost Number of Units Unit Product Cost Round to 4 decimal places At the end of the month, 900 totes were completed and shipped. The remaining 100 totes are complete but have not been shipped to the customer. The cost accountant uses the cost summary data from the Job Cost 14 T.O.T.E.S. CASE STUDY - GREENBELT Card (Exhibit 2-C) to record the flow of costs for Job #2543 on Exhibit 2-D (you can use either the t- accounts or the columnar method). Do not worry about over- or underapplied overhead at this time. EXHIBIT 2-D: T-accounts to record cost flows for Job #2543 Raw Materials 20,850 WIP 1,500 BB $ BB $ Finished Goods 2,500 COGS 0 BB $ BB EXHIBIT 2-D: Columnar method to record cost flows for Job #2543 Raw Materials WIP Finished Goods COGS Beg. Balance $ 20,850 $ 1,500 2,500 $ 0 Ending Balance 15 T.O.T.E.S. Case Study-GREENBELT Student Name: COST CLASSIFICATIONS AND OPERATING BUDGET LAB 1 T.O.T.E.S. is a manufacturing company and keeps close tabs on their costs in order to price their tote bags competitively and maintain profitability. Costs are assigned different classifications depending on the information needed for various managerial decisions. In this lab, students will classify costs as either product or period costs in order to prepare a basic operating budget. Product costs will then be classified as direct material direct labor or manufacturing overhead (all indirect manufacturing costs) costs so as to calculate estimated direct material costs, direct labor costs and manufacturing overhead. PART 1: Identify costs in Exhibit 1-A as a period or a product cost with respect to the totes. Further identify whether product costs are direct material (DM), direct labor (DL) or manufacturing overhead (MOH) during classification process. After verifying that costs are classified correctly, go on to PART 2. PART 2: On your computer open Excel file for Lab 1 - Complete the Operating Budget. Use classifications from Exhibit 1-A to complete the company's operating budget for 20XX using a Traditional Income Statement Format. PART 3: Using information from PART 2, complete Exhibit 2-B. 6 T.O.T.E.S. CASE STUDY - GREENBELT EXHIBIT 1-A: Classify costs as Period or Product (DM, DL or MOH) T.O.T.E.S. CLASSIFY COST Estimated Revenues And Expenses For Upcoming Year (put an X in the correct column) Forecasted Sales in units 520,000 Period Product Cost ACCOUNT NAME AMOUNT Cost DM DL MOH Sales Revenue $2,678,000 Expenses Administrative Office Supplies 3,600 Administrative Staff, e.g. accountant, etc. 125,000 Adminstrative Payroll and Fringe 156,900 Advertising, Trade Shows, Travel & Entertainment 46,000 Company Labels 4,200 Depreciation - Admin. Furniture & Equipment 2,450 Depreciation - Sewing Machines & Cutting Machines 7,600 Equipment Lease - Administrative Offices 5,000 Executive Salaries 199,650 Fabric 600,000 Factory Utilities (mixed cost) 38,000 Freight & Postage - Administrative 2,500 Insurance - Company Liability 9,000 Insurance - Plant 14,000 Legal & Professional 5,000 Logo Ink 26,000 Plant Maintenance Supervisor 32,000 Plant Manager 68,000 Rent - Administrative Building 61,000 Rent - Plant Building 42,000 Repairs and Maintenance - Plant 27,000 Sales Commissions 101,000 Sales Salaries 28,500 Shipping and Handling of Finished Product (Selling) 40,350 Thread 50,000 Wages - Cutting Department 98,000 Wages - Printing Department 13,250 Wages - Sewing Department 190,000 Webbing 540,000 Hint: There are 15 product costs, 5 of which are direct. 7 T.O.T.E.S. CASE STUDY - GREENBELT Use Excel file for Lab 1 (found on Blackboard) BEFORE completing Exhibit 1-B. Bring file to lab so that you can correct any errors. Summarize the results on Exhibit 1-B below. EXHIBIT 1-B: Operating Budget Summary HINTS: T.O.T.E.S. Use Excel file Operating Budget Summary - 20XX to determine totals. at Standard SALES REVENUES Include all ( COST OF GOODS SOLD (COGS) PRODUCT costs in Direct Materials COGS for a Direct Labor traditional Manufacturing Overhead (MOH) income statement TOTAL COST OF GOODS SOLD (PRODUCT COSTS) GROSS MARGIN SELLING & ADMINSTRATIVE COSTS Include all Total Selling PERIOD expenses. Total Administrative TOTAL SELLING & ADMIN. COSTS (PERIOD COSTS) OPERATING INCOME (LOSS) T.O.T.E.S. Case Study-GREENBELT Name: JOB COSTING LAB 2 T.O.T.E.S. currently uses a job costing system to allocate costs to each job. Although their products are very similar, each customer requires a different logo on their custom tote. Furthermore, Tonia and Tara have started experimenting with different sizes and lines of product in order to expand their market. Lab 2 has three parts - calculating standard costs, allocating costs to a specific job, and recording the flow of costs for that job. PART 1: Using the data from Lab 1 and the Company Description, students determine standard costs for direct materials, direct labor and for applied manufacturing overhead. T.O.T.E.S. uses machine hours in the cutting department for allocating manufacturing overhead. Historical records show the cutting machines operate for 95% of the hours worked by the cutting department employees. The plant operates 50 weeks per year. The company has two cutting machines. Each machine can cut 180 totes each hour. On Exhibit 2-A, calculate the standard number of direct labor hours (DLH) per tote for each activity in Step 1; calculate the estimated cutting machine hours (MH) per tote in Step 2; calculate the estimated total machine-hours per year in Step 3; and calculate the plantwide manufacturing overhead rate in Step 4. Using this information, create a Standard Cost Card for totes in Exhibit 2-B. PART 2: Costs for each job are tracked using a Job Cost Record (Exhibit 2-C). Copies of the Materials Requisition form and Labor Time Records have been copied so that students can complete the Job Cost Record for Job #2543. Complete the Materials Requisition document to calculate total cost of materials for Job #2543. All totes were completed but not shipped at the end of the month. PART 3: Using Exhibit 2-D, record the flow of costs for Job #2543 through the company's inventory accounts (Raw Materials, Work in Process, Finished Goods) to Cost of Goods Sold when product is shipped. T.O.T.E.S. CASE STUDY-GREENBELT All information is found in the Company Description and Information section and Lab 1. EXHIBIT 2-A: Calculate Standard Direct Labor Hours, Machine Hours & Predetermined Overhead Rate T.O.T.E.S. CALCULATING STANDARD COSTS Forecasted Production per year 520,000 totes DIRECT LABOR ACTIVITY STEP 1: Calculate Standard Direct Labor Hours per tote Cutting Sewing Printing a. Enter average number of hours worked per week per employee b. Number of weeks plant operates each year c. Number of employees for each activity d. Total Direct labor hours (DLH) per year (a*b*c) e. DLH per tote (Step 1d + # totes produced) Round to 4 decimal places STEP 2: Calculate Estimated Cutting Machine-Hours (MH) per tote a. Production capacity for ONE cutting machine b. Machine-hours per tote (1 = Step 2a amount) Round to 4 decimal places totes/MH MH/tote STEP 3: Calculate Machine-Hours used per year a. 95% of Total Cutting Direct-Labor Hours (from Step 1d) MH/year STEP 4: Calculate Predetermined Overhead Rate (PDOHR) and Standard MOH per tote a. Total Estimated Manufacturing Overhead (from Exhibit 1-B) b. Total machine-hours per year (from Step 3A) c. Predetermined Overhead Rate (Step 4a +Step 4b) Round to 4 decimal places $ MH per MH 10 T.O.T.E.S. CASE STUDY - GREENBELT Calculate the standard cost for each tote for the current year's production level using information from Exhibit 1-A and 1-B. Round all standard costs to four (4) decimal places. EXHIBIT 2-B: Standard Cost Card T.O.T.E.S. CALCULATING STANDARD COSTS Forecasted Production per year 520,000 totes Total Cost (for 520.000 totes) Standard Cost (cost per tote) DIRECT MATERIALS Fabric $ $ Webbing $ $ Total Direct Materials Cost per Tote (Round to 4 decimal places) $ DIRECT LABOR Cutting $ $ $ Sewing $ Printing $ Total Direct Labor Cost per Tote (Round to 4 decimal places) $ $ MANUFACTURING OVERHEAD Estimated MOH Costs (Round per tote to 4 decimal places) $ $ Total Product Cost per Tote (Round to 4 decimal places) $ Costs for each job are tracked using a Job Cost Record (Exhibit 2-C). The Job Cost Record is found after copies of the Materials Requisition form and Labor Time Records for the period. Use the information on these documents to complete the Job Cost Record for Phineas Phil's Specialty Market order of 1,000 red grocery totes with logos. 11 T.O.T.E.S. CASE STUDY - GREENBELT Use the data from the following company documents to complete the Job Cost Record for Job #2543. Any missing data will be found in the Company Description and Information section and Lab 1. On the labor time records the employees worked on more than one job, make sure you only include the hours for Job #2543. Materials Requisition Number: # 450 Date: 5/24/20XX Job #: 2543 Unit Unit Cost Amount Part # FA223 Description Red Cordura Fabric Black webbing Quantity 335 yard W3 yard 1,600 Total $ Labor Time Record Week: 5/23-5/29 Record #: 299 End Time Employee: Jacey Mayfield Hourly Wage Rate: $16.00 Department: Cutting Date Job Number Start Time 5/23 8:30 5/23 2518 15:30 5/25 2543) 7:30 5/26 2543 13:00 5/27 2468 13:15 2210 13:30 17:00 12:00 16:30 17:00 Hours Cost 5.00 $ 80.00 1.50 $ 24.00 4.50 $ 72.00 3.50 $ 56.00 3.75 $ 60.00 T.O.T.E.S. CASE STUDY - GREENBELT Labor Time Record Week: 524-5130 Record #: 201 Employee: John Smith Hourly Wage Rate: $16.00 Department: sewing Date Job Number Start Time End Time Hours Cost 5/26 2152 8:00 12:00 4.00 $ 64.00 5/26 210 13:00 17.00 64.00 4.00 $ 4.00 $ 527 2518 8:00 12:00 64.00 527 2518 13:00 17.00 4.00 $ 64.00 5/28 2543 8:00 12:00 4.00 $ 64.00 5/30 2543 8:00 10:00 2.00 $ 32.00 530 2468 12:00 17:00 5.00 $ 80.00 Labor Time Record Week: 524-5ko 1205 Record #: End Time Hours Cost 12:00 4.50 $ 85.50 Employee: Tonia Springfield Hourly Wage Rate: $19.00 Department: Sewing Date Job Number Start Time 524 221 0 7:30 523 2210 13:00 524 2387 7:30 sk4 12:30 524) 2543 7:30 s24 2698 12:30 16:00 3.00 $ 57.00 11:30 4.00 $ 25.43 3.50 $ 16:00 10:00 76.00 66.50 47.50 2.50 $ 16:301 6.00 $ 114.00 Labor Time Record Week: 524580 Record #: 876 End Time 1200 Cost 4000 Employee: Macbhnson Hourly Wage Rate: $10.00 Department: Printing Date Job Number Start Time 52 29 800 526 2015 990 527 251 800 528 287 900 528 55 1015 580 75 1030 120 120 1015 Hours 400 $ 300 $ 400 $ 12 $ 17 $ 050 $ 3000 4000 1250 1750 500 120 1190 T.O.T.E.S. CASE STUDY - GREENBELT EXHIBIT 2-C: Job Cost Record for Phineas Phil's Specialty Market order Job Cost Record Job Number: 2543 Customer: Phineas Phil's Specialty Market Job Description Red T.O.T.E.S. with Logo Quantity: 1.000 Date Started: 5/24/20XX Date Completed: 5/30/20XX HINTS: Manufacturing Cost Information Direct Materials Requisition # Amount Total Amount Direct Labor Dept. Record # DLH Amount Total Amount Remember to only record ONLY the time spent on this job! Use cutting DLH to calculate machine hours for MOH. Manufacturing Overhead Quantity Total Amount Machine Hours (95% of Cutting DLH) Predetermined Overhead Rate (Exhibit 2-A) Remember Applied MOH- Actual driver Predetermined OH Rate $ Cost Summary Amount Direct Materials Direct Labor Manufacturing Overhead Total Product Cost Number of Units Unit Product Cost Round to 4 decimal places At the end of the month, 900 totes were completed and shipped. The remaining 100 totes are complete but have not been shipped to the customer. The cost accountant uses the cost summary data from the Job Cost 14 T.O.T.E.S. CASE STUDY - GREENBELT Card (Exhibit 2-C) to record the flow of costs for Job #2543 on Exhibit 2-D (you can use either the t- accounts or the columnar method). Do not worry about over- or underapplied overhead at this time. EXHIBIT 2-D: T-accounts to record cost flows for Job #2543 Raw Materials 20,850 WIP 1,500 BB $ BB $ Finished Goods 2,500 COGS 0 BB $ BB EXHIBIT 2-D: Columnar method to record cost flows for Job #2543 Raw Materials WIP Finished Goods COGS Beg. Balance $ 20,850 $ 1,500 2,500 $ 0 Ending Balance 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts