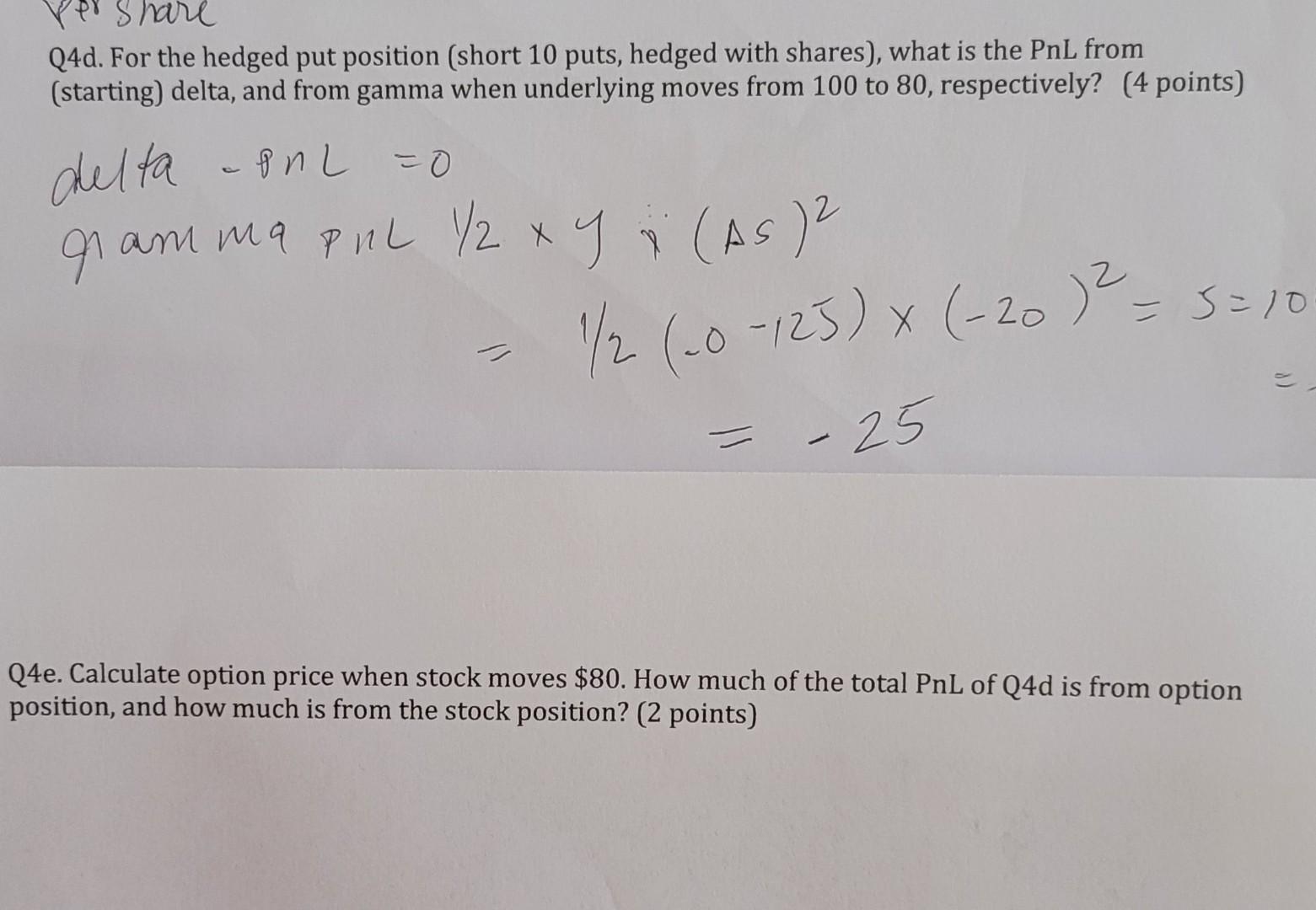

Question: Please help with question 4e Share Q4d. For the hedged put position (short 10 puts, hedged with shares), what is the PnL from (starting) delta,

Please help with question 4e

Share Q4d. For the hedged put position (short 10 puts, hedged with shares), what is the PnL from (starting) delta, and from gamma when underlying moves from 100 to 80, respectively? (4 points) delta uanl = 0 8 gramma pul 1/2 x 4 P (AS) 1/2 (0-125) (-20) = 5=10 - 25 X = - Q4e. Calculate option price when stock moves $80. How much of the total PnL of Q4d is from option position, and how much is from the stock position? (2 points) Share Q4d. For the hedged put position (short 10 puts, hedged with shares), what is the PnL from (starting) delta, and from gamma when underlying moves from 100 to 80, respectively? (4 points) delta uanl = 0 8 gramma pul 1/2 x 4 P (AS) 1/2 (0-125) (-20) = 5=10 - 25 X = - Q4e. Calculate option price when stock moves $80. How much of the total PnL of Q4d is from option position, and how much is from the stock position? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts