Question: Please help with questions E-H. Thanks! PROBLEM 6 (50 points) Suppose that you know today that you will be selling 15,000 bushels of corn a

Please help with questions "E-H". Thanks!

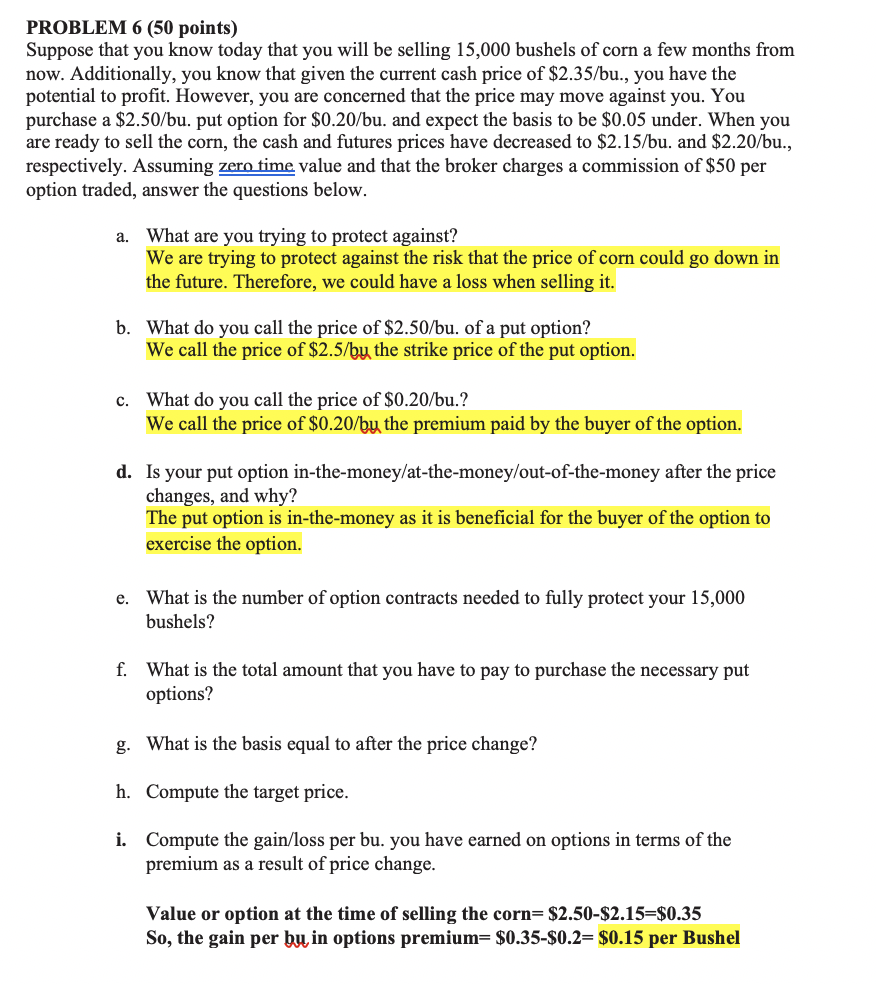

PROBLEM 6 (50 points) Suppose that you know today that you will be selling 15,000 bushels of corn a few months from now. Additionally, you know that given the current cash price of $2.35/bu., you have the potential to profit. However, you are concerned that the price may move against you. You purchase a $2.50/bu. put option for $0.20/bu. and expect the basis to be $0.05 under. When you are ready to sell the corn, the cash and futures prices have decreased to $2.15/bu. and $2.20/bu., respectively. Assuming zero time value and that the broker charges a commission of $50 per option traded, answer the questions below. a. What are you trying to protect against? We are trying to protect against the risk that the price of corn could go down in the future. Therefore, we could have a loss when selling it. b. What do you call the price of $2.50/bu. of a put option? We call the price of $2.5/by the strike price of the put option. c. What do you call the price of $0.20/bu.? We call the price of $0.20/by the premium paid by the buyer of the option. d. Is your put option in-the-money/at-the-money/out-of-the-money after the price changes, and why? The put option is in-the-money as it is beneficial for the buyer of the option to exercise the option. e. What is the number of option contracts needed to fully protect your 15,000 bushels? f. What is the total amount that you have to pay to purchase the necessary put options? g. What is the basis equal to after the price change? h. Compute the target price. i. Compute the gain/loss per bu. you have earned on options in terms of the premium as a result of price change. Value or option at the time of selling the corn=$2.50-$2.15=$0.35 So, the gain per bu in options premium=$0.35-$0.2= $0.15 per Bushel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts