Question: please help with the following financial math problem. l know how to work with the 3rd period Gn, however, l was not sure how to

please help with the following financial math problem. l know how to work with the 3rd period Gn, however, l was not sure how to compute the time zero price and optimal exercise time. Is there any comments or hints for that?

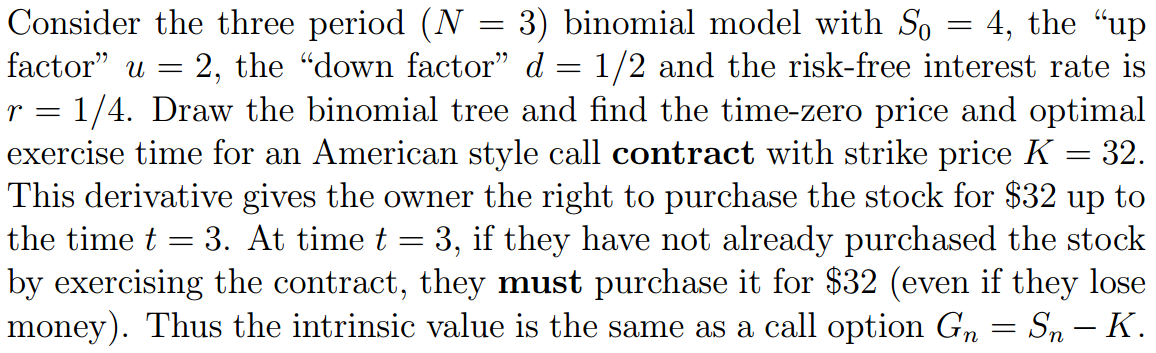

Consider the three period ( N = 3 ) binomial model with So = 4 , the " up factor " u = 2 , the " down factor " d = 1 / 2 and the risk- free interest rate is r = 1 / 4. Draw the binomial tree and find the time- zero price and optimal exercise time for an American style call contract with strike price * = 32 . This derivative gives the owner the right to purchase the stock for $32 up to the time t = 3 . At time t = 3 , if they have not already purchased the stock by exercising the contract , they must purchase it for $32 ( even if they lose* money ) . Thus the intrinsic value is the same as a call option G = S - K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts