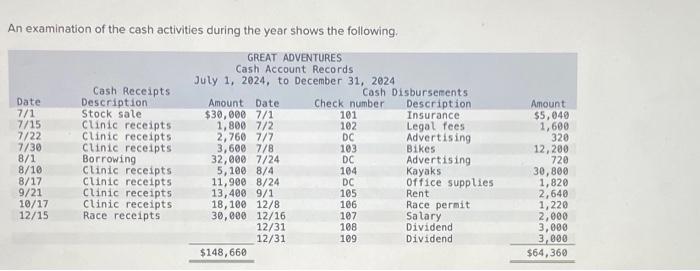

Question: Please help with the following question! Part 1 & 2!!! Thanks!! An examination of the cash activities during the year shows the following. Suzie has

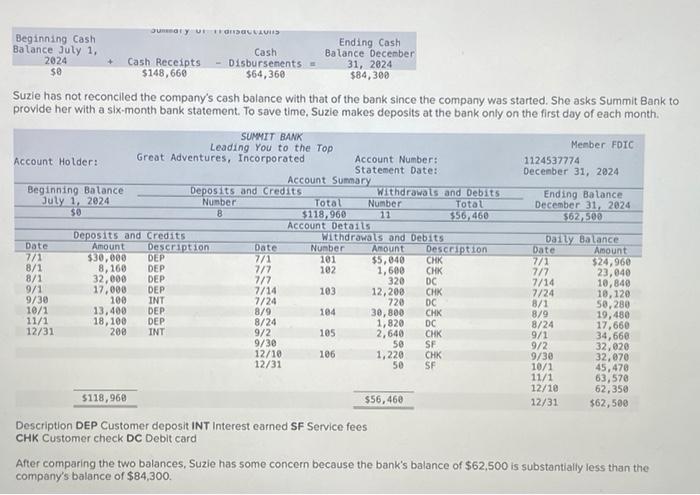

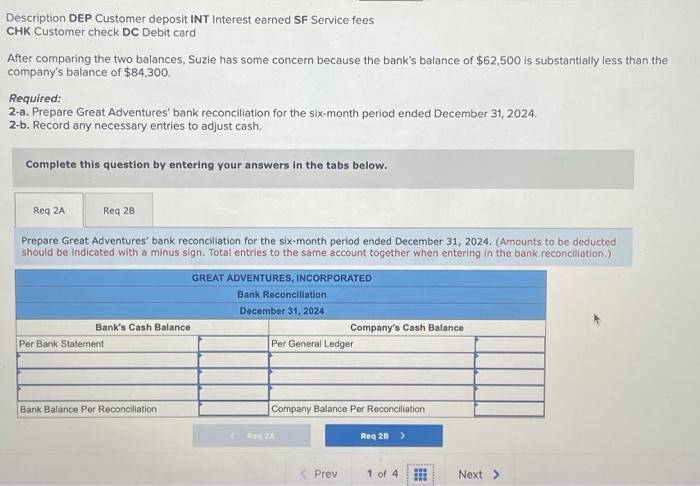

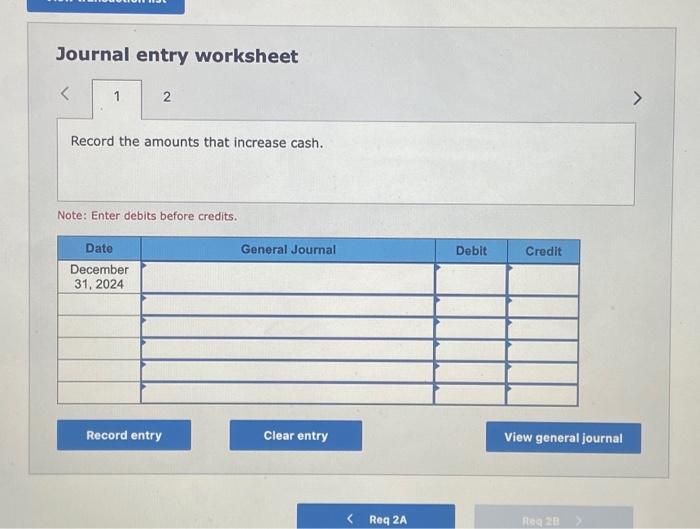

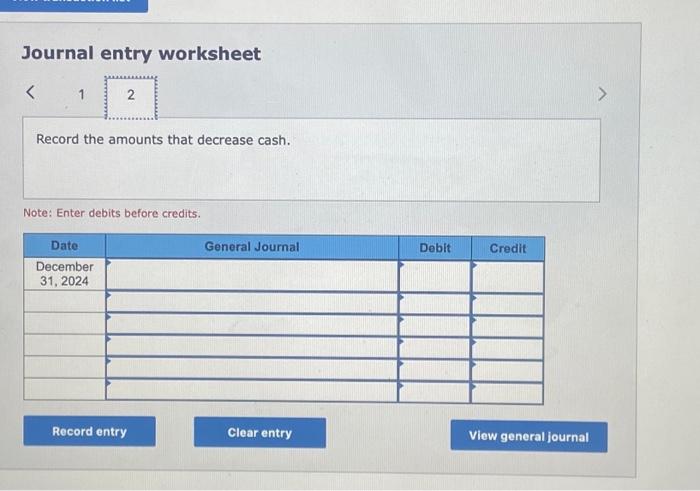

An examination of the cash activities during the year shows the following. Suzie has not reconciled the company's cash balance with that of the bank since the company was started. She asks Summit Bank to provide her with a six-month bank statement. To save time, Suzie makes deposits at the bank only on the first day of each month. Description DEP Customer deposit INT Interest earned SF Service fees CHK Customer check DC Debit card After comparing the two balances, Suzie has some concern because the bank's balance of $62,500 is substantialily less than the company's balance of $84,300. Description DEP Customer deposit INT Interest earned SF Service fees CHK Customer check DC Debit card After comparing the two balances, Suzie has some concern because the bank's balance of $62,500 is substantially less than the company's balance of $84,300. Required: 2-a. Prepare Great Adventures' bank reconcillation for the six-month period ended December 31, 2024. 2-b. Record any necessary entries to adjust cash. Complete this question by entering your answers in the tabs below. Prepare Great Adventures' bank reconciliation for the six-month period ended December 31, 2024. (Amounts to be deducted should be indicated with a minus sign. Total entries to the same account together when entering in the bank reconciliation.) Journal entry worksheet Record the amounts that increase cash. Note: Enter debits before credits. Journal entry worksheet Record the amounts that decrease cash. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts