Question: Please help with this problem. I can't figure out the answers to 1(a), 1(c), and 1(d). The LIFO inventory flow assumption is used throughout the

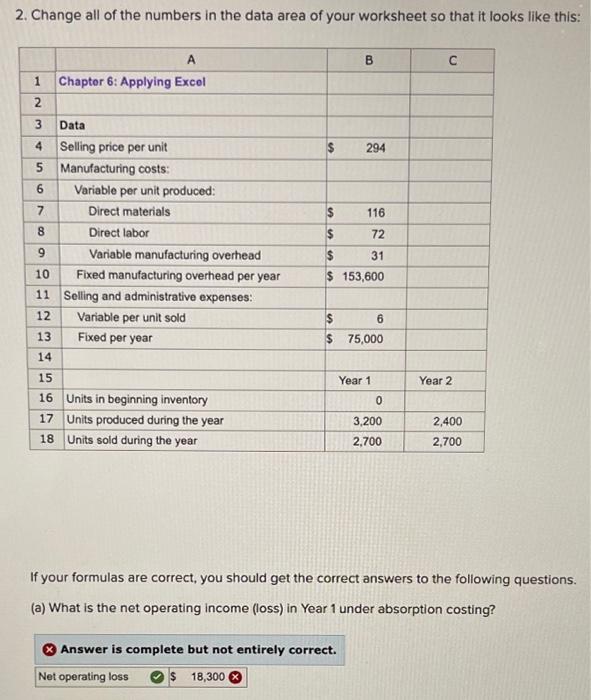

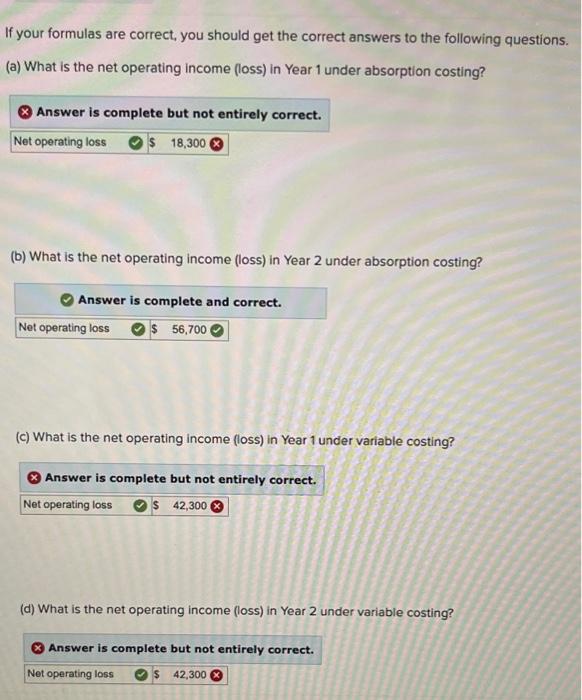

2. Change all of the numbers in the data area of your worksheet so that it looks like this: A B 1 Chapter 6: Applying Excel N 3 Data $ 294 $ 116 9 D 72 $ 31 $ 153,600 4 Selling price per unit 5 Manufacturing costs: 6 Variable per unit produced: 7 Direct materials 8 Direct labor Variable manufacturing overhead 10 Fixed manufacturing overhead per year 11 Selling and administrative expenses: 12 Variable per unit sold 13 Fixed per year 14 15 16 Units in beginning inventory 17 Units produced during the year 18 Units sold during the year 6 $ 75,000 Year 2 Year 1 0 3,200 2,700 2,400 2,700 If your formulas are correct, you should get the correct answers to the following questions. (a) What is the net operating income (loss) in Year 1 under absorption costing? Answer is complete but not entirely correct. Net operating loss $ 18,300 If your formulas are correct, you should get the correct answers to the following questions. (a) What is the net operating income (loss) in Year 1 under absorption costing? Answer is complete but not entirely correct. Net operating loss $ 18,300 (b) What is the net operating income (loss) in Year 2 under absorption costing? Answer is complete and correct. Net operating loss $ 56,700 (c) What is the net operating income (loss) in Year 1 under variable costing? Answer is complete but not entirely correct. Net operating loss $ 42,300 (d) What is the net operating income (loss) in Year 2 under variable costing? Answer is complete but not entirely correct. Net operating loss $ 42,300 x 2. Change all of the numbers in the data area of your worksheet so that it looks like this: A B 1 Chapter 6: Applying Excel N 3 Data $ 294 $ 116 9 D 72 $ 31 $ 153,600 4 Selling price per unit 5 Manufacturing costs: 6 Variable per unit produced: 7 Direct materials 8 Direct labor Variable manufacturing overhead 10 Fixed manufacturing overhead per year 11 Selling and administrative expenses: 12 Variable per unit sold 13 Fixed per year 14 15 16 Units in beginning inventory 17 Units produced during the year 18 Units sold during the year 6 $ 75,000 Year 2 Year 1 0 3,200 2,700 2,400 2,700 If your formulas are correct, you should get the correct answers to the following questions. (a) What is the net operating income (loss) in Year 1 under absorption costing? Answer is complete but not entirely correct. Net operating loss $ 18,300 If your formulas are correct, you should get the correct answers to the following questions. (a) What is the net operating income (loss) in Year 1 under absorption costing? Answer is complete but not entirely correct. Net operating loss $ 18,300 (b) What is the net operating income (loss) in Year 2 under absorption costing? Answer is complete and correct. Net operating loss $ 56,700 (c) What is the net operating income (loss) in Year 1 under variable costing? Answer is complete but not entirely correct. Net operating loss $ 42,300 (d) What is the net operating income (loss) in Year 2 under variable costing? Answer is complete but not entirely correct. Net operating loss $ 42,300 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts