Question: Please. I need help on this review, I dont even know where to start. Thank you. You are hired as a new staff accountant for

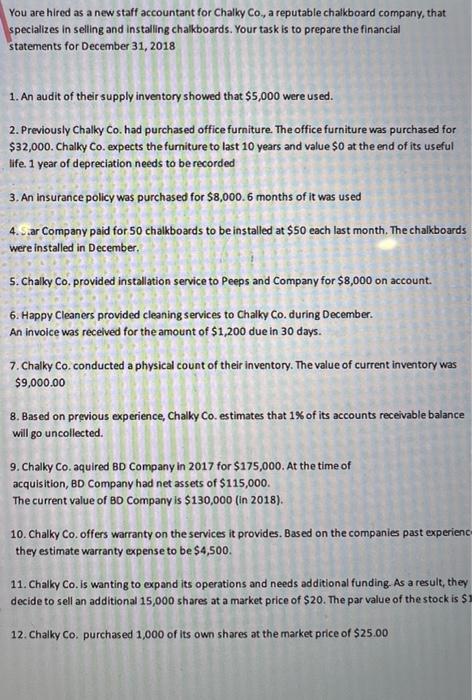

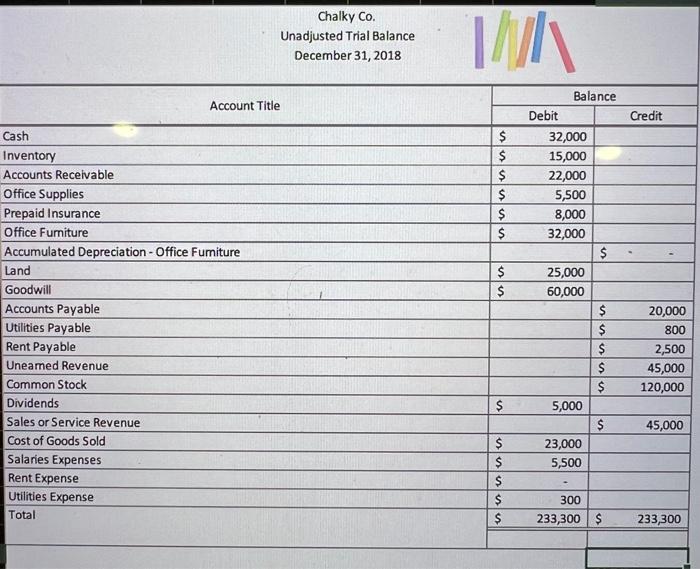

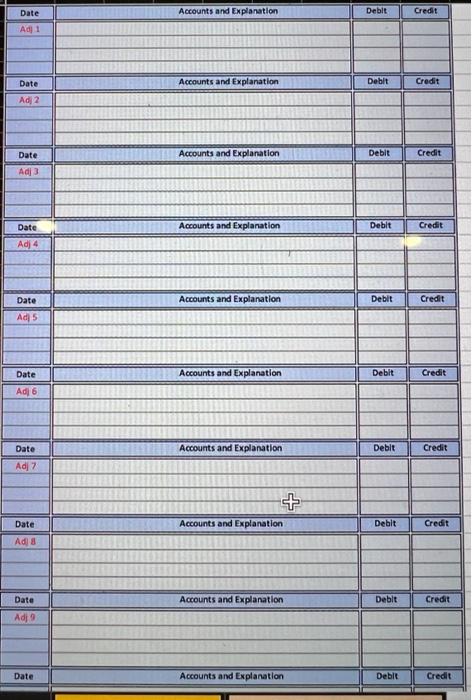

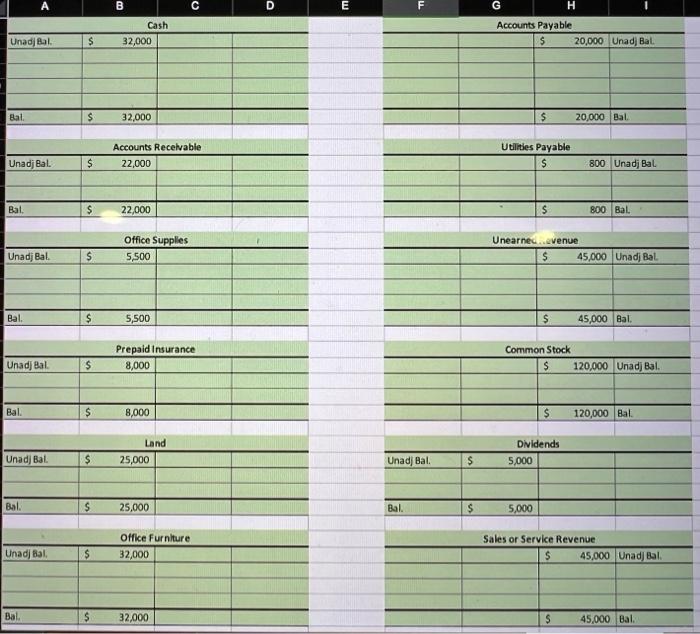

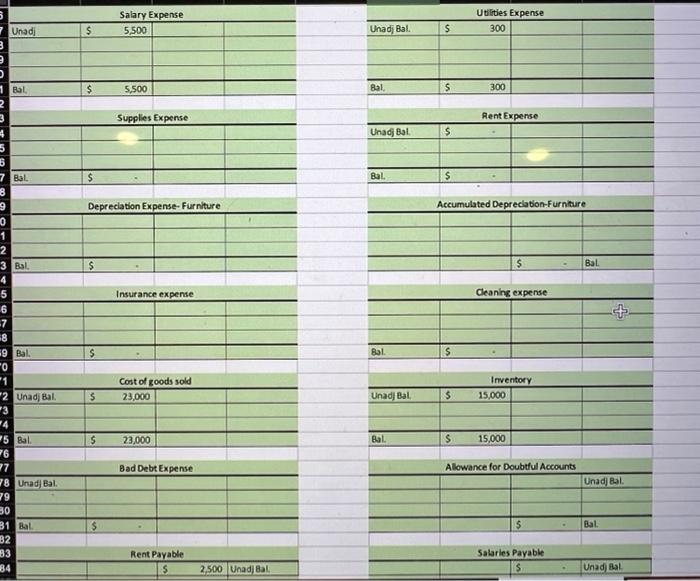

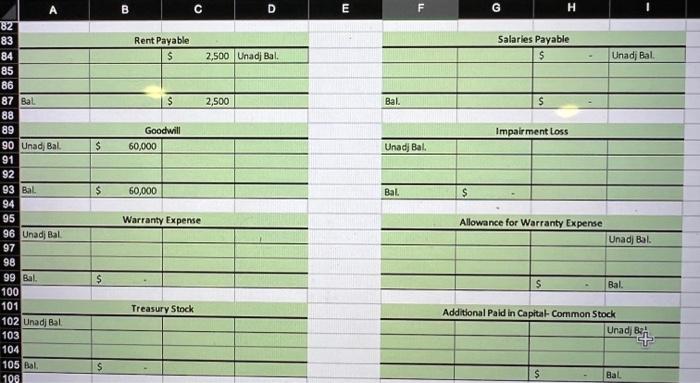

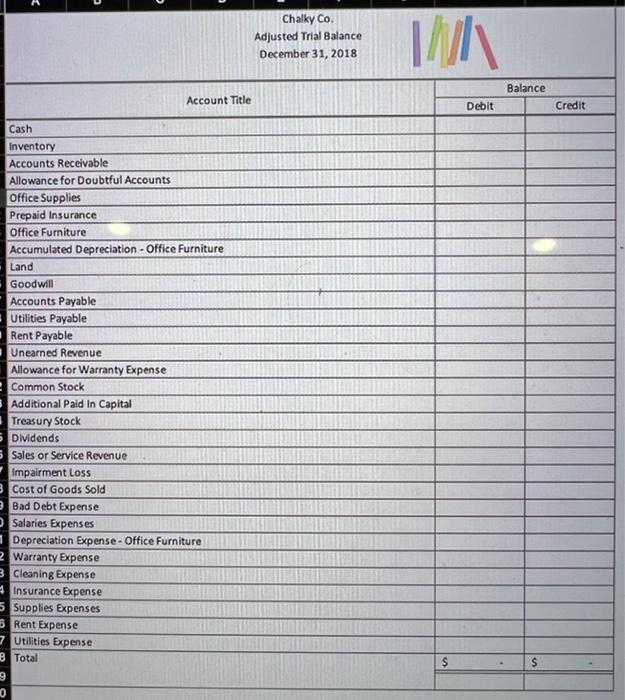

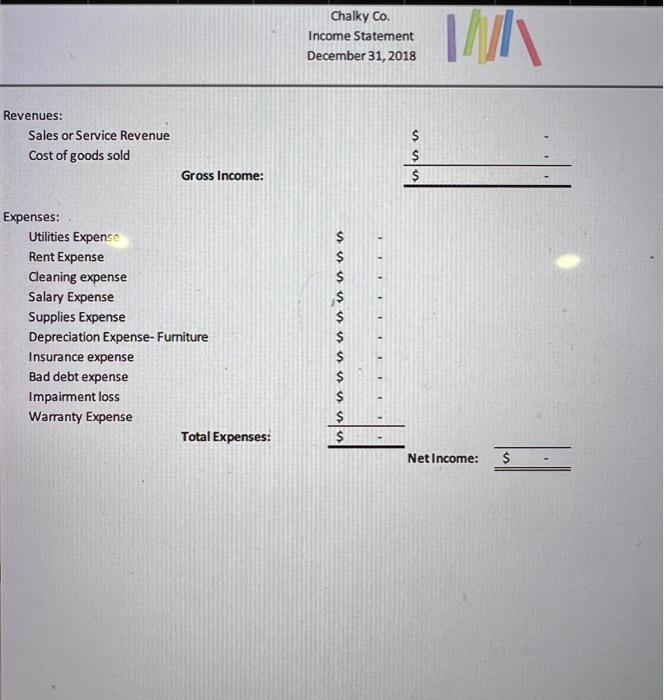

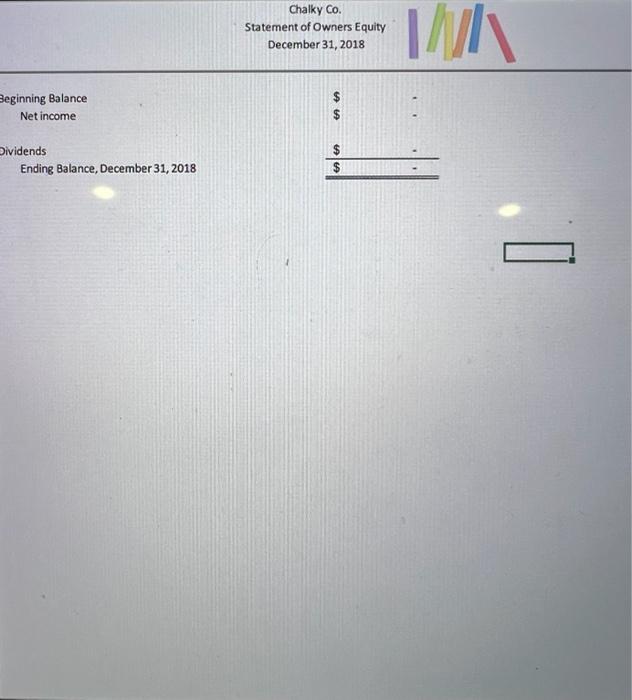

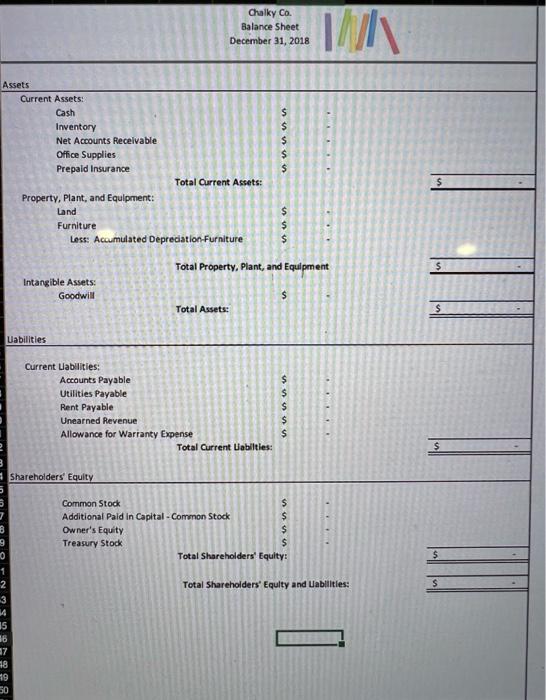

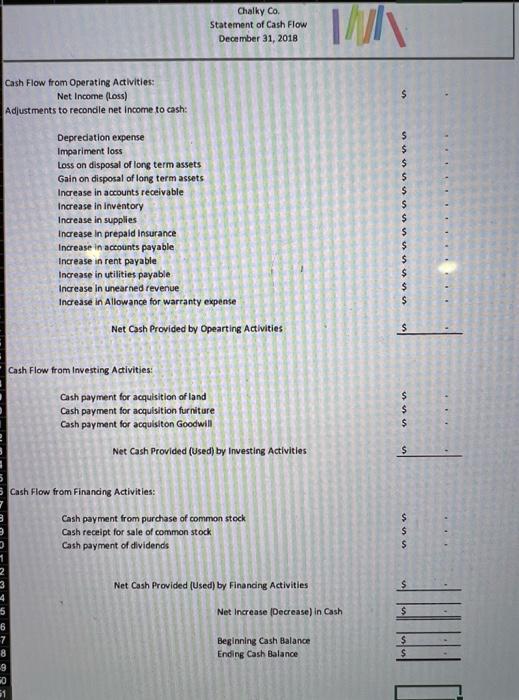

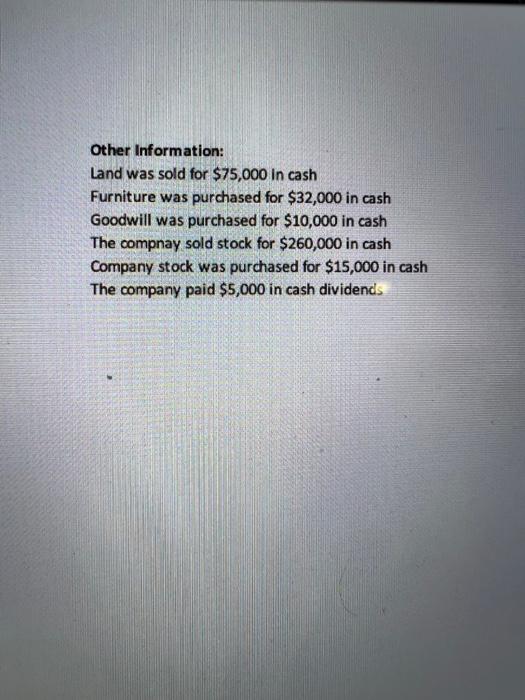

You are hired as a new staff accountant for Chalky Co., a reputable chalkboard company, that specializes in selling and installing chalkboards. Your task is to prepare the financial statements for December 31, 2018 1. An audit of their supply inventory showed that $5,000 were used. 2. Previously Chalky Co. had purchased office furniture. The office furniture was purchased for $32,000. Chalky Co. expects the furniture to last 10 years and value $0 at the end of its useful life. 1 year of depreciation needs to be recorded 3. An insurance policy was purchased for $8,000. 6 months of it was used 4.5.ar Company paid for 50 chalkboards to be installed at $50 each last month. The chalkboards were installed in December. 5. Chalky Co. provided installation service to Peeps and Company for $8,000 on account. 6. Happy Cleaners provided cleaning services to Chalky Co. during December. An invoice was received for the amount of $1,200 due in 30 days. 7. Chalky Co. conducted a physical count of their inventory. The value of current inventory was $9,000.00 8. Based on previous experience, Chalky Co. estimates that 1% of its accounts receivable balance will go uncollected. 9. Chalky Co. aquired BD Company in 2017 for $175,000. At the time of acquisition, BD Company had net assets of $115,000. The current value of BD Company is $130,000 (in 2018). 10. Chalky Co. offers warranty on the services it provides. Based on the companies past experienc they estimate warranty expense to be $4,500. 11. Chalky Co. is wanting to expand its operations and needs additional funding. As a result, they decide to sell an additional 15,000 shares at a market price of $20. The par value of the stock is $ 12. Chalky Co. purchased 1,000 of its own shares at the market price of $25.00 Cash Inventory Accounts Receivable Office Supplies Prepaid Insurance Office Furniture Accumulated Depreciation - Office Furniture Land Goodwill Accounts Payable Utilities Payable Rent Payable Uneamed Revenue Common Stock Dividends Sales or Service Revenue Cost of Goods Sold Salaries Expenses Rent Expense Utilities Expense Total Chalky Co. Unadjusted Trial Balance December 31, 2018 Account Title MWA $ $ $ SSS $ $ $ $ $ $ SSSSS $ $ $ $ $ Debit Balance 32,000 15,000 22,000 5,500 8,000 32,000 25,000 60,000 5,000 23,000 5,500 $ $ $ $ $ $ $ 300 233,300 $ Credit 20,000 800 2,500 45,000 120,000 45,000 233,300 Date Adj 1 Date Adj 2 Date Adj 3 Date Adj 4 Date Ad 5 Date Adj 6 Date Adj 7 Date Ad) 8 Date Adj 9 Date Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation + Accounts and Explanation Accounts and Explanation Accounts and Explanation Debit Debit Debit UN Debit Debit Debit Debit Debit Debit Debit Credit Credit Credit Credit Credit Credit 1 Credit Credit Credit Credit ULICHIE Unadj Bal. Bal. Unadj Bal. Bal. Unadj Bal. Bal. A Unadj Bal. Bal. Unadj Bal. Bal. Unadj Bal. Bal. $ $ $ $ $ $ $ $ $ $ $ $ B Cash 32,000 32,000 Accounts Receivable 22,000 22,000 Office Supplies 5,500 5,500 Prepaid Insurance 8,000 8,000 Land 25,000 25,000 Office Furniture 32,000 32,000 D E Unadj Bal. Bal. $ $ G Accounts Payable $ $ Utilities Payable $ $ 5,000 5,000 Unearned..evenue $ $ Common Stock $ H Dividends $ 20,000 Unadj Bal. $ 20,000 Bal.. 800 Unadi Bal 800 Bal 45,000 Unadj Bal. 45,000 Bal 120,000 Unadj Bal. 120,000 Bal Sales or Service Revenue) $ 45,000 Unadj Bal. 45,000 Bal.. D 1 Bal 3 4 5 3 7 Bal 9 10 1 2 Unadj 3 Bal 4 5 6 -7 8 59 Bal. "0 "1 2 Unadj Bal. 3 4 5 Bal 76 27 78 Unadj Bal. 79 30 31 Bal 32 83 34 $ $ $ $ $ Depreciation Expense-Furniture S $ Salary Expense 5,500 $ 5,500 Supplies Expense Insurance expense Cost of goods sold 23,000 23,000 Bad Debt Expense Rent Payable $ 2,500 Unadj Bal Unadj Bal. Bal Unadj Bal Bal. Bal. Unadj Bal Bal. S S $ $ S Utilities Expense 300 $ 300 Accumulated Depreciation-Furniture Rent Expense $ Cleaning expense Inventory 15,000 $ 15,000 Allowance for Doubtful Accounts $ Salaries Payable $ Bal Unadj Bal. Bal Unadj Bal 82 83 A 84 85 86 87 Bal 88 89 90 Unad, Bal 91 92 93 Bal 94 95 96 Unadj Bal 97 98 99 Bal. 100 101 102 Unadj Bal 103 104 105 Bal. 106 $ $ $ $ B Rent Payable $ Goodwill 60,000 $ 60,000 C Warranty Expense Treasury Stock D 2,500 Unadj Bal. 2,500 E Bal. LL Bal. F Unadj Bal. $ G Salaries Payable $ $ H Impairment Loss Allowance for Warranty Expense $ $ Unadj Bal. Unadj Bal. Bal. Additional Paid in Capital Common Stock Unadj B Bal 154 Cash Inventory Accounts Receivable Allowance for Doubtful Accounts Office Supplies Prepaid Insurance Office Furniture Accumulated Depreciation - Office Furniture Land Goodwill Accounts Payable Utilities Payable Rent Payable B 9 10 Unearned Revenue Allowance for Warranty Expense Common Stock Additional Paid In Capital Treasury Stock Dividends Sales or Service Revenue Impairment Loss Cost of Goods Sold Bad Debt Expense O Salaries Expenses Depreciation Expense-Office Furniture 2 Warranty Expense 3 Cleaning Expense Insurance Expense 5 Supplies Expenses 5 Rent Expense Account Title Utilities Expense Total Chalky Co. Adjusted Trial Balance December 31, 2018 WA $ Debit Balance $ Credit Revenues: Sales or Service Revenue Cost of goods sold Expenses: Utilities Expense Rent Expense Cleaning expense Salary Expense Supplies Expense Gross Income: Depreciation Expense- Furniture Insurance expense Bad debt expense Impairment loss Warranty Expense Total Expenses: Chalky Co. Income Statement December 31, 2018 sssssssss $ $ $ $ $ E SSS $ $ $ WA Net Income: $- - Beginning Balance Net income Dividends Ending Balance, December 31, 2018 Chalky Co. Statement of Owners Equity December 31, 2018 SS $ IN Assets 15 16 37 18 Current Assets: Cash Uabilities 19 50 Inventory Net Accounts Receivable Office Supplies Prepaid Insurance Property, Plant, and Equipment: Land Intangible Assets: Goodwill Furniture Less: Accumulated Depreciation Furniture Current Liabilities: Chalky Co. Balance Sheet December 31, 2018 Total Current Assets: Shareholders' Equity Accounts Payable Utilities Payable Rent Payable Unearned Revenue Allowance for Warranty Expense Total Assets: Total Current Liabilties: sssssss Common Stock Additional Paid in Capital - Common Stock Owner's Equity Treasury Stock $ $ $ $ $ Total Property, Plant, and Equipment $ $ $ SSSSS $ $ $ $ SSSS WA $ . Total Shareholders' Equity: Total Shareholders' Equity and abilities: $ $ $ $ $ Cash Flow from Operating Activities: Net Income (Loss) Adjustments to reconcile net income to cash: 6 8 -9 50 51 Depredation expense Impariment loss Loss on disposal of long term assets Gain on disposal of long term assets Increase in accounts receivable Increase in inventory Increase in supplies Increase in prepaid Insurance Increase in accounts payable Increase in rent payable Increase in utilities payable Increase in unearned revenue Increase in Allowance for warranty expense Chalky Co. Statement of Cash Flow December 31, 2018 Net Cash Provided by Opearting Activities Cash Flow from Investing Activities: Cash payment for acquisition of land Cash payment for acquisition furniture Cash payment for acquisiton Goodwill Net Cash Provided (Used) by Investing Activities Cash Flow from Financing Activities: Cash payment from purchase of common stock Cash receipt for sale of common stock Cash payment of dividends Net Cash Provided (Used) by Financing Activities WAN Net Increase (Decrease) in Cash Beginning Cash Balance Ending Cash Balance s sssssssssssss $ $ $ $ $ $ $ sss $ $ $ $ $ $ $ $ $ $ ... Other Information: Land was sold for $75,000 in cash Furniture was purchased for $32,000 in cash Goodwill was purchased for $10,000 in cash The compnay sold stock for $260,000 in cash Company stock was purchased for $15,000 in cash The company paid $5,000 in cash dividends You are hired as a new staff accountant for Chalky Co., a reputable chalkboard company, that specializes in selling and installing chalkboards. Your task is to prepare the financial statements for December 31, 2018 1. An audit of their supply inventory showed that $5,000 were used. 2. Previously Chalky Co. had purchased office furniture. The office furniture was purchased for $32,000. Chalky Co. expects the furniture to last 10 years and value $0 at the end of its useful life. 1 year of depreciation needs to be recorded 3. An insurance policy was purchased for $8,000. 6 months of it was used 4.5.ar Company paid for 50 chalkboards to be installed at $50 each last month. The chalkboards were installed in December. 5. Chalky Co. provided installation service to Peeps and Company for $8,000 on account. 6. Happy Cleaners provided cleaning services to Chalky Co. during December. An invoice was received for the amount of $1,200 due in 30 days. 7. Chalky Co. conducted a physical count of their inventory. The value of current inventory was $9,000.00 8. Based on previous experience, Chalky Co. estimates that 1% of its accounts receivable balance will go uncollected. 9. Chalky Co. aquired BD Company in 2017 for $175,000. At the time of acquisition, BD Company had net assets of $115,000. The current value of BD Company is $130,000 (in 2018). 10. Chalky Co. offers warranty on the services it provides. Based on the companies past experienc they estimate warranty expense to be $4,500. 11. Chalky Co. is wanting to expand its operations and needs additional funding. As a result, they decide to sell an additional 15,000 shares at a market price of $20. The par value of the stock is $ 12. Chalky Co. purchased 1,000 of its own shares at the market price of $25.00 Cash Inventory Accounts Receivable Office Supplies Prepaid Insurance Office Furniture Accumulated Depreciation - Office Furniture Land Goodwill Accounts Payable Utilities Payable Rent Payable Uneamed Revenue Common Stock Dividends Sales or Service Revenue Cost of Goods Sold Salaries Expenses Rent Expense Utilities Expense Total Chalky Co. Unadjusted Trial Balance December 31, 2018 Account Title MWA $ $ $ SSS $ $ $ $ $ $ SSSSS $ $ $ $ $ Debit Balance 32,000 15,000 22,000 5,500 8,000 32,000 25,000 60,000 5,000 23,000 5,500 $ $ $ $ $ $ $ 300 233,300 $ Credit 20,000 800 2,500 45,000 120,000 45,000 233,300 Date Adj 1 Date Adj 2 Date Adj 3 Date Adj 4 Date Ad 5 Date Adj 6 Date Adj 7 Date Ad) 8 Date Adj 9 Date Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation + Accounts and Explanation Accounts and Explanation Accounts and Explanation Debit Debit Debit UN Debit Debit Debit Debit Debit Debit Debit Credit Credit Credit Credit Credit Credit 1 Credit Credit Credit Credit ULICHIE Unadj Bal. Bal. Unadj Bal. Bal. Unadj Bal. Bal. A Unadj Bal. Bal. Unadj Bal. Bal. Unadj Bal. Bal. $ $ $ $ $ $ $ $ $ $ $ $ B Cash 32,000 32,000 Accounts Receivable 22,000 22,000 Office Supplies 5,500 5,500 Prepaid Insurance 8,000 8,000 Land 25,000 25,000 Office Furniture 32,000 32,000 D E Unadj Bal. Bal. $ $ G Accounts Payable $ $ Utilities Payable $ $ 5,000 5,000 Unearned..evenue $ $ Common Stock $ H Dividends $ 20,000 Unadj Bal. $ 20,000 Bal.. 800 Unadi Bal 800 Bal 45,000 Unadj Bal. 45,000 Bal 120,000 Unadj Bal. 120,000 Bal Sales or Service Revenue) $ 45,000 Unadj Bal. 45,000 Bal.. D 1 Bal 3 4 5 3 7 Bal 9 10 1 2 Unadj 3 Bal 4 5 6 -7 8 59 Bal. "0 "1 2 Unadj Bal. 3 4 5 Bal 76 27 78 Unadj Bal. 79 30 31 Bal 32 83 34 $ $ $ $ $ Depreciation Expense-Furniture S $ Salary Expense 5,500 $ 5,500 Supplies Expense Insurance expense Cost of goods sold 23,000 23,000 Bad Debt Expense Rent Payable $ 2,500 Unadj Bal Unadj Bal. Bal Unadj Bal Bal. Bal. Unadj Bal Bal. S S $ $ S Utilities Expense 300 $ 300 Accumulated Depreciation-Furniture Rent Expense $ Cleaning expense Inventory 15,000 $ 15,000 Allowance for Doubtful Accounts $ Salaries Payable $ Bal Unadj Bal. Bal Unadj Bal 82 83 A 84 85 86 87 Bal 88 89 90 Unad, Bal 91 92 93 Bal 94 95 96 Unadj Bal 97 98 99 Bal. 100 101 102 Unadj Bal 103 104 105 Bal. 106 $ $ $ $ B Rent Payable $ Goodwill 60,000 $ 60,000 C Warranty Expense Treasury Stock D 2,500 Unadj Bal. 2,500 E Bal. LL Bal. F Unadj Bal. $ G Salaries Payable $ $ H Impairment Loss Allowance for Warranty Expense $ $ Unadj Bal. Unadj Bal. Bal. Additional Paid in Capital Common Stock Unadj B Bal 154 Cash Inventory Accounts Receivable Allowance for Doubtful Accounts Office Supplies Prepaid Insurance Office Furniture Accumulated Depreciation - Office Furniture Land Goodwill Accounts Payable Utilities Payable Rent Payable B 9 10 Unearned Revenue Allowance for Warranty Expense Common Stock Additional Paid In Capital Treasury Stock Dividends Sales or Service Revenue Impairment Loss Cost of Goods Sold Bad Debt Expense O Salaries Expenses Depreciation Expense-Office Furniture 2 Warranty Expense 3 Cleaning Expense Insurance Expense 5 Supplies Expenses 5 Rent Expense Account Title Utilities Expense Total Chalky Co. Adjusted Trial Balance December 31, 2018 WA $ Debit Balance $ Credit Revenues: Sales or Service Revenue Cost of goods sold Expenses: Utilities Expense Rent Expense Cleaning expense Salary Expense Supplies Expense Gross Income: Depreciation Expense- Furniture Insurance expense Bad debt expense Impairment loss Warranty Expense Total Expenses: Chalky Co. Income Statement December 31, 2018 sssssssss $ $ $ $ $ E SSS $ $ $ WA Net Income: $- - Beginning Balance Net income Dividends Ending Balance, December 31, 2018 Chalky Co. Statement of Owners Equity December 31, 2018 SS $ IN Assets 15 16 37 18 Current Assets: Cash Uabilities 19 50 Inventory Net Accounts Receivable Office Supplies Prepaid Insurance Property, Plant, and Equipment: Land Intangible Assets: Goodwill Furniture Less: Accumulated Depreciation Furniture Current Liabilities: Chalky Co. Balance Sheet December 31, 2018 Total Current Assets: Shareholders' Equity Accounts Payable Utilities Payable Rent Payable Unearned Revenue Allowance for Warranty Expense Total Assets: Total Current Liabilties: sssssss Common Stock Additional Paid in Capital - Common Stock Owner's Equity Treasury Stock $ $ $ $ $ Total Property, Plant, and Equipment $ $ $ SSSSS $ $ $ $ SSSS WA $ . Total Shareholders' Equity: Total Shareholders' Equity and abilities: $ $ $ $ $ Cash Flow from Operating Activities: Net Income (Loss) Adjustments to reconcile net income to cash: 6 8 -9 50 51 Depredation expense Impariment loss Loss on disposal of long term assets Gain on disposal of long term assets Increase in accounts receivable Increase in inventory Increase in supplies Increase in prepaid Insurance Increase in accounts payable Increase in rent payable Increase in utilities payable Increase in unearned revenue Increase in Allowance for warranty expense Chalky Co. Statement of Cash Flow December 31, 2018 Net Cash Provided by Opearting Activities Cash Flow from Investing Activities: Cash payment for acquisition of land Cash payment for acquisition furniture Cash payment for acquisiton Goodwill Net Cash Provided (Used) by Investing Activities Cash Flow from Financing Activities: Cash payment from purchase of common stock Cash receipt for sale of common stock Cash payment of dividends Net Cash Provided (Used) by Financing Activities WAN Net Increase (Decrease) in Cash Beginning Cash Balance Ending Cash Balance s sssssssssssss $ $ $ $ $ $ $ sss $ $ $ $ $ $ $ $ $ $ ... Other Information: Land was sold for $75,000 in cash Furniture was purchased for $32,000 in cash Goodwill was purchased for $10,000 in cash The compnay sold stock for $260,000 in cash Company stock was purchased for $15,000 in cash The company paid $5,000 in cash dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts