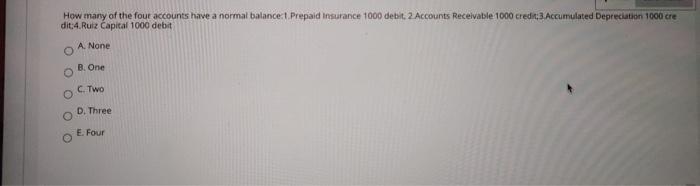

Question: please i need help , please answer all the questions How many of the four accounts have a normal balance:1.Prepaid Insurance 1000 debit, 2 Accounts

please i need help , please answer all the questions

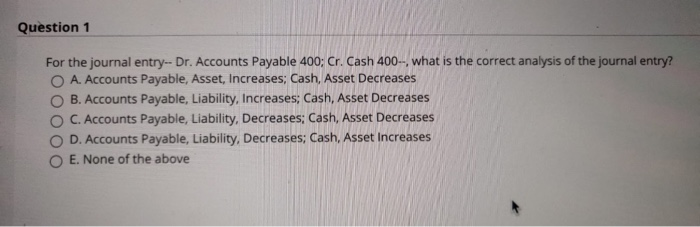

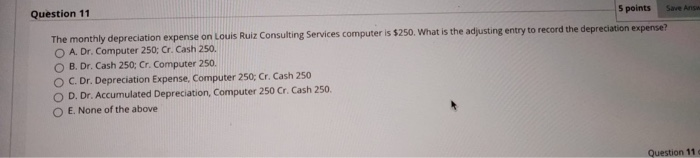

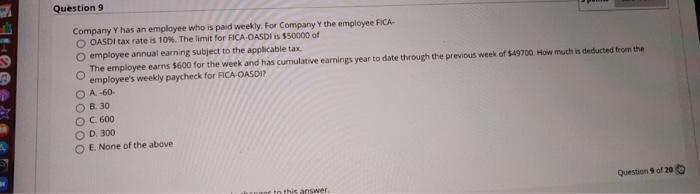

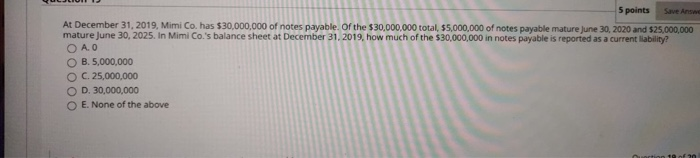

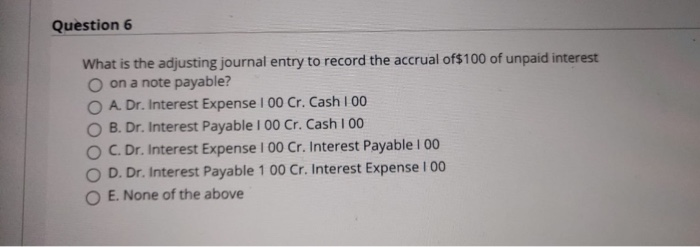

please i need help , please answer all the questions How many of the four accounts have a normal balance:1.Prepaid Insurance 1000 debit, 2 Accounts Receivable 1000 credit,3.Accumulated Depreciation 1000 cre dit:4. Ruiz Capital 1000 debit A. None B. One o C. Two D. Three E. Four Question 1 For the journal entry-- Dr. Accounts Payable 400; Cr. Cash 400-, what is the correct analysis of the journal entry? A. Accounts Payable, Asset, Increases; Cash, Asset Decreases B. Accounts Payable, Liability, Increases; Cash, Asset Decreases C. Accounts Payable, Liability, Decreases: Cash, Asset Decreases D. Accounts Payable, Liability, Decreases; Cash, Asset Increases E. None of the above Question 11 5 points Save As The monthly depreciation expense on Louis Ruiz Consulting Services computer is $250. What is the adjusting entry to record the depreciation expense? O A. Dr. Computer 250: Cr. Cash 250. OB. Dr. Cash 250; Cr. Computer 250 O C. Dr. Depreciation Expense, Computer 250; Cr. Cash 250 O D. Dr. Accumulated Depreciation, Computer 250 Cr. Cash 250 E. None of the above Question 11 Question 9 Company Y has an employee who is paid weekly. For Company Y the employee FICA- O OASDI tax rate is 10%. The limit for FICA-CASDI is 550000 of O employee annual earning subject to the applicable tax. The employee earns $600 for the week and has cumulative earnings year to date through the previous week of 549700. How much is deducted from the employee's weekly paycheck for FICA OASDI? O A 60. B. 30 O C. 600 OD 300 E. None of the above Question 9 of 20 In this answer 5 points Save Answer At December 31, 2019, Mimi Co. has $30,000,000 of notes payable. Of the $30,000,000 total, $5,000,000 of notes payable mature June 30, 2020 and $25,000,000 mature June 30, 2025. In Mimi Co.'s balance sheet at December 31, 2019, how much of the 530,000,000 in notes payable is reported as a current liability? O AO O B. 5,000,000 OC. 25,000,000 D. 30,000,000 O E. None of the above Question 6 What is the adjusting journal entry to record the accrual of$100 of unpaid interest O on a note payable? O A. Dr. Interest Expense 1 00 Cr. Cash 100 O B. Dr. Interest Payable 1 00 Cr. Cash 100 C. Dr. Interest Expense 1 00 Cr. Interest Payable 1 00 O D. Dr. Interest Payable 100 Cr. Interest Expense 1 00 O E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts