Question: please, i need you help with both Project Leopard costs $90,000 and is expected to produce cash flows of $21,000 per year for 6 years.

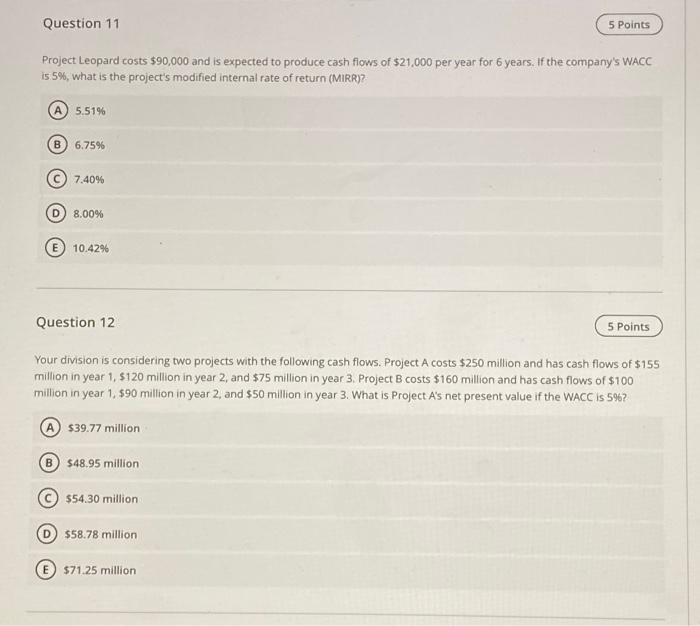

Project Leopard costs $90,000 and is expected to produce cash flows of $21,000 per year for 6 years. If the company's WACC is 5%, what is the project's modified internal rate of return (MIRR)? Question 12 Your division is considering two projects with the following cash flows. Project A costs $250 million and has cash flows of $155 million in year 1,$120 million in year 2 , and $75 million in year 3 . Project B costs $160 million and has cash flows of $100 million in year 1,$90 million in year 2 , and $50 million in year 3 . What is Project A's net present value if the WACC is 596 ? $39.77 million $48.95 million $54.30 million $58.78 million $71.25 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts