Question: Please identify the following based on the case study above. It can't be less than 600 words. Thank you!!!!! 1. Strengths and Weaknesses : Identify

Please identify the following based on the case study above. It can't be less than 600 words. Thank you!!!!!

1. Strengths and Weaknesses: Identify the company's internal strengths and weaknesses and how they relate to the company's value function.

2. Opportunities and Threats: Identify the opportunities and threats in the company's environment and analyze them using the Competitive Forces Model and life-cycle model.

3. Corporate-Level Strategy: Identify the company's mission and goals and evaluate the company's corporate strategy based on lines of business, subsidiaries, and acquisitions.

4. Business-Level Strategy: Determine if the company is using a differentiation, focus, or low-cost strategy and what the company's investment strategy is. Decide if the company's functional competencies are sufficient for achieving the SWOT strategy.

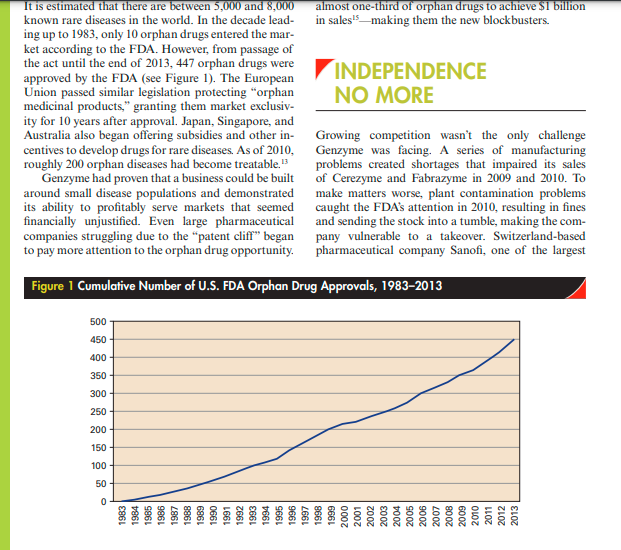

240 210 GENZYME'S FOC ON ORPHAN DRUGS In 2015, Genzyme, a subsidiary of Sanofi, was one the drug market for rare diseases a more hotly con- of the world's leading biotech companies. Genzyme's tested one. products and services were focused on rare, inher- ited disorders and diseases, and multiple sclerosis. The company was consistently recognized as a leader HUMBLE BEGINNINGS across many dimensions of its operations. It had been named to numerous national "best places to work." lists, and the journal Science had regularly named Genzyme was founded in Boston, in 1981, by a small Genzyme a "Top Employer" in its annual survey of group of scientists who were researching genetically scientists. The company had also won numerous inherited enzyme diseases. People with these rare dis- awards for practicing environmental sustainability orders (for example, Gaucher disease, Fabry disease, and ethical responsibility. In 2007, Genzyme received MPS-1) lack key enzymes that regulate the body's the National Medal of Technology, the highest hon- metabolism, causing sugar, fats, or proteins to build or awarded by the President of the United States for up in the body and resulting in constant pain and technological innovation. early death. In 1983, the scientists were working out Genzyme's focus on rare diseases had made it very of the 15th floor of an old building in Boston's seedy unique in its early history. However, by 2015, many "Combat Zone," when they were joined by Henri competitors were beginning to explore the orphan Termeer, who took the role of president and eventu- drug opportunity ("orphan drugs" are those that re- ally chief executive officer of the company. Termeer ceive special government protection to target rare dis- had left a well-paying, executive vice president posi- eases). Many large pharmaceutical companies were tion at Baxter to join the 2-year-old start-up, and falling off a patent cliff"the patents of large num- many people thought he was crazy to do so." However, bers of blockbuster drugs were expiring, leaving com- Termeer thought Genzyme was well positioned to panies scrambling to refill their drug pipelines. As a pursue a novel strategy in the drug industry: target the result of this, and the fact that orphan drugs could small markets for rare diseases. Focusing on rare dis- be sold for extremely high prices and received special eases was close to heresy in the pharmaceutical indus- protection and incentives, "Big Pharma" companies try. Developing a drug takes 10 to 14 years and costs were now actively pursuing orphan drugs, making an average of $1.9 billion to perform the research, run the clinical trials, get Food and Drug Adminis- important medical need, the race was on by com- tration (FDA) approval, and bring a drug to market. petitors to introduce a different (hopefully improved) Pharmaceutical companies thus focused on potential version of the drug that could also be patented and "blockbuster" drugs that would serve a market that compete with the original drug. Drugs for orphan numbered in the millions. A drug was considered a diseases would be shielded from such competition for "blockbuster" if it earned revenues of $1 billion or 7 years, potentially permitting them to recoup their more, and achieving this level required many thousands development costs and earn a rate of return that of patients with chronic diseases such as hypertension, would make the venture attractive. diabetes, or high cholesterol. Genzyme, however, chal- To qualify for orphan drug status in the United lenged the notion that a firm needed a blockbuster States, a disease had to afflict less than 200,000 people drug to succeed. Genzyme would focus on drugs that worldwide. Big Pharma was typically uninterested were needed by only a few thousand patients with se- because of the small market sizes and high risks of vere, life-threatening diseases. Though there would developing therapies for them. Even most biotech be few patients for these drugs, there would also be firms failed to see the opportunity inherent in the few competitors. Furthermore, the small number of Orphan Drug Act that might suit their rapidly evolv- patients and the severity of the diseases would make ing technologies. Genzyme's eventual success, how- insurance companies less likely to actively resist reim- ever, would ultimately attract their attention to this bursement. Both of these factors suggested that drugs small but lucrative market. for rare diseases might support higher margins than typical drugs. Additionally, whereas pharmaceutical companies typically needed large sales forces and con- THE FIRST BIG SUCCESS siderable marketing budgets to promote their drugs, a company focusing on drugs for rare diseases could have a much smaller, more targeted sales approach. Genzyme's first commercial product was Ceredase There were only a small number of physicians special- a replacement protein designed to treat fewer than izing in rare diseases, so Genzyme could go directly 10,000 people afflicted with a deadly, rare, genetic to those doctors rather than funding a large sales disorder called Gaucher's disease. Children born force and expensive ad campaigns. Finally, therapies with this disease rarely live past their 10th birthday, with significant clinical value in smaller populations and adults who develop this fatal disease suffer from required much smaller clinical trials (though it was chronic, liver, kidney, heart, and spleen damage. Clini- more difficult to find the study candidates). cal trials for Ceredase began in 1984, and in March 1985 the FDA designated Ceredase an orphan drug. Genzyme was first allowed to make Ceredase available THE ORPHAN DRUG ACT to patients outside of the United States in 1990, and was approved by the FDA to market Ceredase in the Genzyme's timing was auspicious. In 1983, the FDA United States in 1991. established the Orphan Drug Act to induce devel- Creating a therapy to treat a patient with Gau- from the United States were passing through the French plant. Ceredase was the only drug IN BIOTECH made from placentas that the U.K. government allowed to be used in Britain." The global biotechnology industry included about By 1991, Genzyme was collecting a million pla- 10,000 companies in 2015, with total revenues of centas a year, and knew it could not produce enough about $289 billion.'Major players included U.S-based of the enzyme to treat all the patients who needed Gilead Sciences ($24.9 billion), Amgen ($20 billion), it. Fortunately, by 1993, Genzyme had developed a Monsanto ($15.9 billion), Biogen Idec ($9.7 billion), recombinant form of the enzyme, Cerezyme, which and Genentech (owned by Switzerland-based Roche, obviated the need for human tissue and made efficient $50.4 billion), as well as Australia's CSL ($5.3 billion), production possible. In the meantime, Genzyme had Germany's Merck KGaA ($15.3 billion), Denmark's also begun work on gene therapies and begun inves- Novo Nordisk ($15.4 billion), and the biotech tigating potential treatments for another rare enzyme research arms of major international pharmaceuti- disorder, Fabry disease cal companies.." Genentech was the oldest, formed in 1976; Amgen and Genzyme were established in the early 1980s. Many competitors were small, emerging REMAINING companies with less than 500 employees. In fact, more than 50 percent of biotech companies had fewer than INDEPENDENT 50 employees." Most biotech start-ups followed a similar path of evolution. The firm would begin as a research and Genzyme also broke with industry norms in its deci- development firm, with employees coming from univer- sion to not work with large pharmaceutical compa- sity science labs or Big Pharma. If the start-up survived nies. Whereas most biotech companies licensed their the lean years and had prospects for producing a com- technologies to large pharmaceutical firms to tap the mercially viable therapy, it would seek alliances with larger companies' greater capital resources, manufac- large firms for late-stage development, manufactur- turing capabilities and marketing and distribution ing, and marketing. For example, both Genentech and assets, Termeer felt strongly that the company should Gilead formed relationships with Roche, and Amgen remain independent, stating, "If we worked with a formed a relationship with Abbott Laboratories. If very large corporation, we would lose our strategic a firm's drugs achieved commercial success, it could direction and be dependent ... we've tried to stay as negotiate higher royalties and attract capital investment. self-sufficient as we possibly can." Performing its own Genzyme differed from all its peers and from testing, manufacturing, and sales meant incurring later biotech companies by being profitable early on much greater risks, but it also meant that the company (Genzyme posted a profit of just over $20 million in would keep all of the profits its drugs earned. To gen- 1991, losses in 1992 and 1993, and a profit of over erate revenues to fund the research, Termeer entered $16 million in 1994), and until only recently, remain- into a number of side ventures, including a chemical ing independent of partners. We wanted a diversi- supplies business, a genetic counseling business, and a fied company that could use technology to make a supplies business, a genetic counseling business, and a fied company that could use technology to make a diagnostic testing business. He also took the company difference for people with serious diseases, and to get public in 1986, raising $27 million. Termeer's gamble profitable so we can continue to develop new medi- paid off: Patients taking Cerezyme paid an average of cines," Termeer said. In the late 2000s, most analysts $170,000 a year for their medication, and with about believed that no other developer was likely to pursue 2277_Case24_rev02.indd 197 01/10/15 6:16 PM C-198 Case 24 Genzyme's Focus on Orphan Drugs Genzyme's strategic path, even with the benefits of fered under the Orphan Drug Act. While both Amgen and Genentech had produced orphan drugs, it had not been their strategic focus. THE GROWING COMPETITION IN ORPHAN DRUGS While this was good news for sufferers of rare diseases, it meant significantly more competition for Genzyme. Companies such as Pfizer, Isis Pharmaceutical, NPS Pharmaceuticals, GlaxoSmithKline, and Shire were all beginning to target orphan drugs. As noted by Francois Nader, chief executive of NPS Pharmaceu- ticals, shifts in science and economics had made the orphan drug market more viable. Researchers could identify ahead of time "the patients that would benefit from a particular drug, rather than using the shotgun approach we used in the past." Ironically, despite the small numbers of patients served, high prices enabled almost one-third of orphan drugs to achieve $1 billion in sales!smaking them the new blockbusters. It is estimated that there are between 5,000 and 8,000 known rare diseases in the world. In the decade lead- ing up to 1983, only 10 orphan drugs entered the mar- ket according to the FDA. However, from passage of 11.2017 It is estimated that there are between 5,000 and 8,000 almost one-third of orphan drugs to achieve $1 billion known rare diseases in the world. In the decade lead- in sales!making them the new blockbusters. ing up to 1983, only 10 orphan drugs entered the mar- ket according to the FDA. However, from passage of the act until the end of 2013, 447 orphan drugs were approved by the FDA (see Figure 1). The European INDEPENDENCE Union passed similar legislation protecting "orphan NO MORE medicinal products," granting them market exclusiv- ity for 10 years after approval. Japan, Singapore, and Australia also began offering subsidies and other in- Growing competition wasn't the only challenge centives to develop drugs for rare diseases. As of 2010, Genzyme was facing. A series of manufacturing roughly 200 orphan diseases had become treatable. 13 problems created shortages that impaired its sales Genzyme had proven that a business could be built of Cerezyme and Fabrazyme in 2009 and 2010. To around small disease populations and demonstrated make matters worse, plant contamination problems its ability to profitably serve markets that seemed caught the FDA's attention in 2010, resulting in fines financially unjustified. Even large pharmaceutical and sending the stock into a tumble, making the com- companies struggling due to the "patent cliff" began pany vulnerable to a takeover. Switzerland-based to pay more attention to the orphan drug opportunity. pharmaceutical company Sanofi, one of the largest Figure 1 Cumulative Number of U.S. FDA Orphan Drug Approvals, 1983-2013 500 450 400 350 300 250 200 150 100 50 0 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 pharmaceutical companies in the world, 6 began mak- ing overtures. Genzyme rebuffed the initial offers," but after months of negotiation Genzyme was acquired by Sanofi for $20.1 billion in February 2011, ending its 30- year run as an independent biotechnology drug maker. Henri Termeer resigned, and Sanofi CEO Christopher Viehbacher took over. The company retained its name and its facilities in Cambridge, Massachusetts, becom- ing Sanofi's new headquarters for rare diseases. With the backing of Sanofi, Genzyme was able to expand its manufacturing capabilities, opening up a manufactur- ing plant in the United States and expanding its pro- duction facility in Ireland. In September 2012, the FDA approved Genzyme's first multiple sclerosis drug, Aubagio, a once-daily oral drug, and in November 2014 the FDA approved Genzyme's second multiple sclerosis drug, Lemtrada, an intravenous drug delivered through two sets of injections, a year apart. Unlike Genzyme's other targeted diseases, multiple sclerosis was not rare: 2.3 million people were estimated to suffer from it worldwide, including 400,000 in the United States.19 The two drugs made Genzymeand parent Sanofi among the most visible competitors in multiple sclero- sis treatments. Genzyme had also proven to be among the fastest-growing holdings of Sanofi, rapidly earn- ing far more than the $20.1 billion Sanofi had paid for it, and significantly boosting Sanofi's stock price. When Sanofi had acquired Genzyme in February 2011, its stock had traded at roughly $34 a share; by late 2014, the stock was trading at over $50 a share. 20 As noted by Sanofi CEO Chris Viehbacher, "Once we had Genzyme, that changed investor perception about Sanofi ... It significantly increased the visibility of Sanofi in the United States. It signaled that Sanofi was a company that was serious about biotechnology and research and development."21Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts