Question: Please include detailed solutions using excel. Thank you. Problem Five (20 marks) You have been asked to analyze two mutually exclusive projects. Expected Cash Flows

Please include detailed solutions using excel. Thank you.

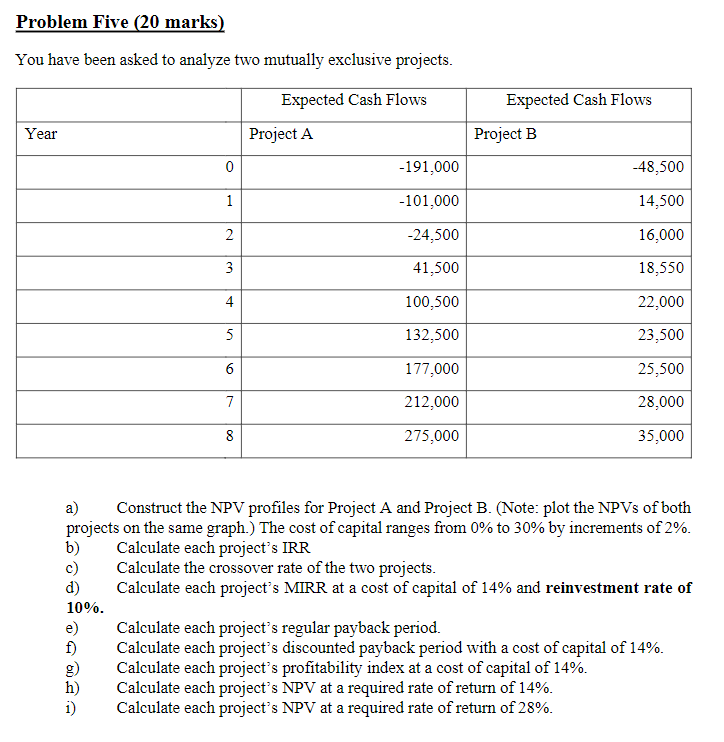

Problem Five (20 marks) You have been asked to analyze two mutually exclusive projects. Expected Cash Flows Project A Expected Cash Flows Project B Year 0 -191,000 -48,500 1 -101,000 14,500 2 -24,500 16,000 3 41,500 18,550 4 100,500 22,000 5 132,500 23,500 6 177,000 25,500 7 212,000 28.000 8 275,000 35,000 a) Construct the NPV profiles for Project A and Project B. (Note: plot the NPVs of both projects on the same graph.) The cost of capital ranges from 0% to 30% by increments of 2%. b) Calculate each project's IRR c) Calculate the crossover rate of the two projects. d) Calculate each project's MIRR at a cost of capital of 14% and reinvestment rate of 10%. e) Calculate each project's regular payback period. f) Calculate each project's discounted payback period with a cost of capital of 14%. Calculate each project's profitability index at a cost of capital of 14%. h) Calculate each project's NPV at a required rate of return of 14%. i) Calculate each project's NPV at a required rate of return of 28%. Problem Five (20 marks) You have been asked to analyze two mutually exclusive projects. Expected Cash Flows Project A Expected Cash Flows Project B Year 0 -191,000 -48,500 1 -101,000 14,500 2 -24,500 16,000 3 41,500 18,550 4 100,500 22,000 5 132,500 23,500 6 177,000 25,500 7 212,000 28.000 8 275,000 35,000 a) Construct the NPV profiles for Project A and Project B. (Note: plot the NPVs of both projects on the same graph.) The cost of capital ranges from 0% to 30% by increments of 2%. b) Calculate each project's IRR c) Calculate the crossover rate of the two projects. d) Calculate each project's MIRR at a cost of capital of 14% and reinvestment rate of 10%. e) Calculate each project's regular payback period. f) Calculate each project's discounted payback period with a cost of capital of 14%. Calculate each project's profitability index at a cost of capital of 14%. h) Calculate each project's NPV at a required rate of return of 14%. i) Calculate each project's NPV at a required rate of return of 28%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts