Question: You have been asked to analyze two mutually exclusive projects. a) Construct the NPV profiles for Project A and Project B. (Note: plot the NPVs

You have been asked to analyze two mutually exclusive projects.

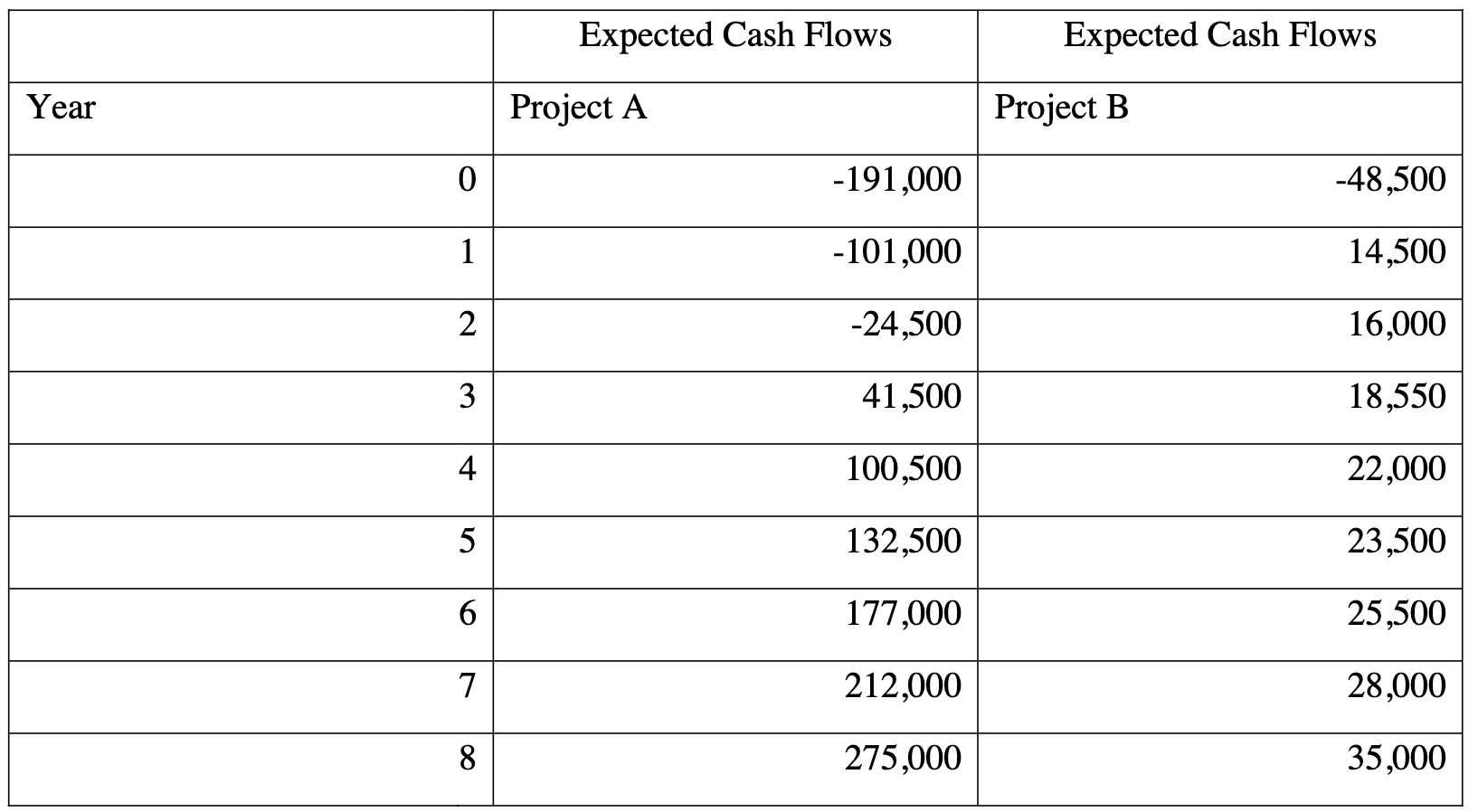

a) Construct the NPV profiles for Project A and Project B. (Note: plot the NPVs of both projects on the same graph.) The cost of capital ranges from 0% to 30% by increments of 2%. b) Calculate each projects IRR c) Calculate the crossover rate of the two projects. d) Calculate each projects MIRR at a cost of capital of 14% and reinvestment rate of 10%. e) Calculate each projects regular payback period. f) Calculate each projects discounted payback period with a cost of capital of 14%. g) Calculate each projects profitability index at a cost of capital of 14%. h) Calculate each projects NPV at a required rate of return of 14%. i) Calculate each projects NPV at a required rate of return of 28%

Please complete using excel and show all steps.

Expected Cash Flows Expected Cash Flows Year Project A Project B 0 -191,000 -48.500 1 -101,000 14,500 2 -24,500 16,000 3 41,500 18,550 4 100,500 22,000 5 132,500 23,500 6 177,000 25,500 7 212,000 28,000 8 275,000 35,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts