Question: please include work i would like to understand, thank you! :) At December 31, 2020, Skysong Corporation owes $521.000 on a note payable due February

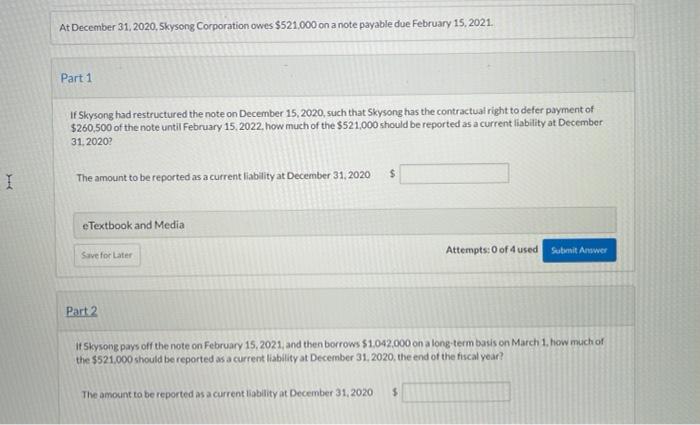

At December 31, 2020, Skysong Corporation owes $521.000 on a note payable due February 15, 2021. Part 1 If Skysong had restructured the note on December 15, 2020, such that Skysong has the contractual right to defer payment of $260.500 of the note until February 15, 2022. how much of the $521,000 should be reported as a current liability at December 31.20202 $ I The amount to be reported as a current liability at December 31, 2020 eTextbook and Media Save for Later Attempts: 0 of 4 used Submit Answer Part 2 it Skysone pays off the note on February 15, 2021, and then borrows $1,042,000 on a long-term basis on March 1, how much of the $521.000 should be reported as a current liability at December 31, 2020, the end of the fiscal year? The amount to be reported as a current liability at December 31, 2020 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts