Question: Please indicate true or false for questions 9,10,11 9. Examples of exclusions from income for a taxpayer generly are gits life insurance proceeds and 10.

Please indicate true or false for questions 9,10,11

Please indicate true or false for questions 9,10,11

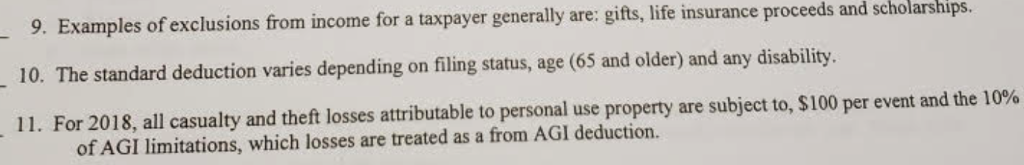

9. Examples of exclusions from income for a taxpayer generly are gits life insurance proceeds and 10. The standard deduction varies depending on filing status, age (65 and older) and any disability. 11. For 2018, all casualty and theft losses attributable to personal use property are subject to, $100 of exclusions from income for a taxpayer generally are: gifts, life insurance proceeds and scholarships. per event and the 10% of AGI limitations, which losses are treated as a from AGI deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts