Question: please just show work on this and what different steps mean, thanks! 3) Here are data on two companies. The risk-free rate is 4% and

please just show work on this and what different steps mean, thanks!

please just show work on this and what different steps mean, thanks!

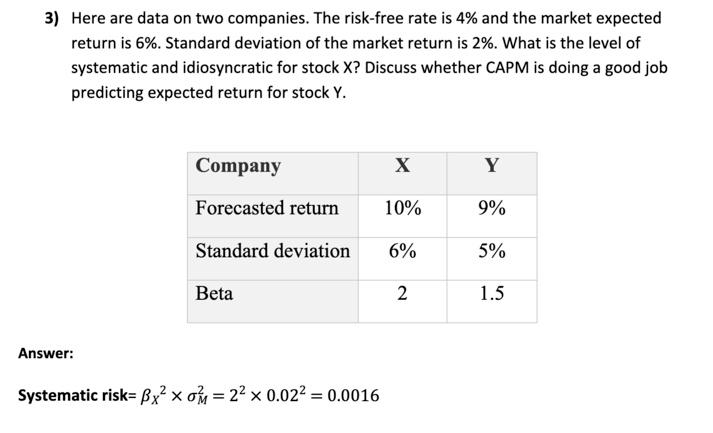

3) Here are data on two companies. The risk-free rate is 4% and the market expected return is 6%. Standard deviation of the market return is 2%. What is the level of systematic and idiosyncratic for stock X? Discuss whether CAPM is doing a good job predicting expected return for stock Y. Company X Y Forecasted return 10% 9% Standard deviation 6% 5% Beta 2 1.5 Answer: Systematic risku Bxx = 22 x 0.022 = 0.0016 =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts