Question: Please just write down the answer, No need for explanation, thanks ABC Company reported the following on their financial statements: 2021 2020 Sales Revenue* $860,000

Please just write down the answer, No need for explanation, thanks

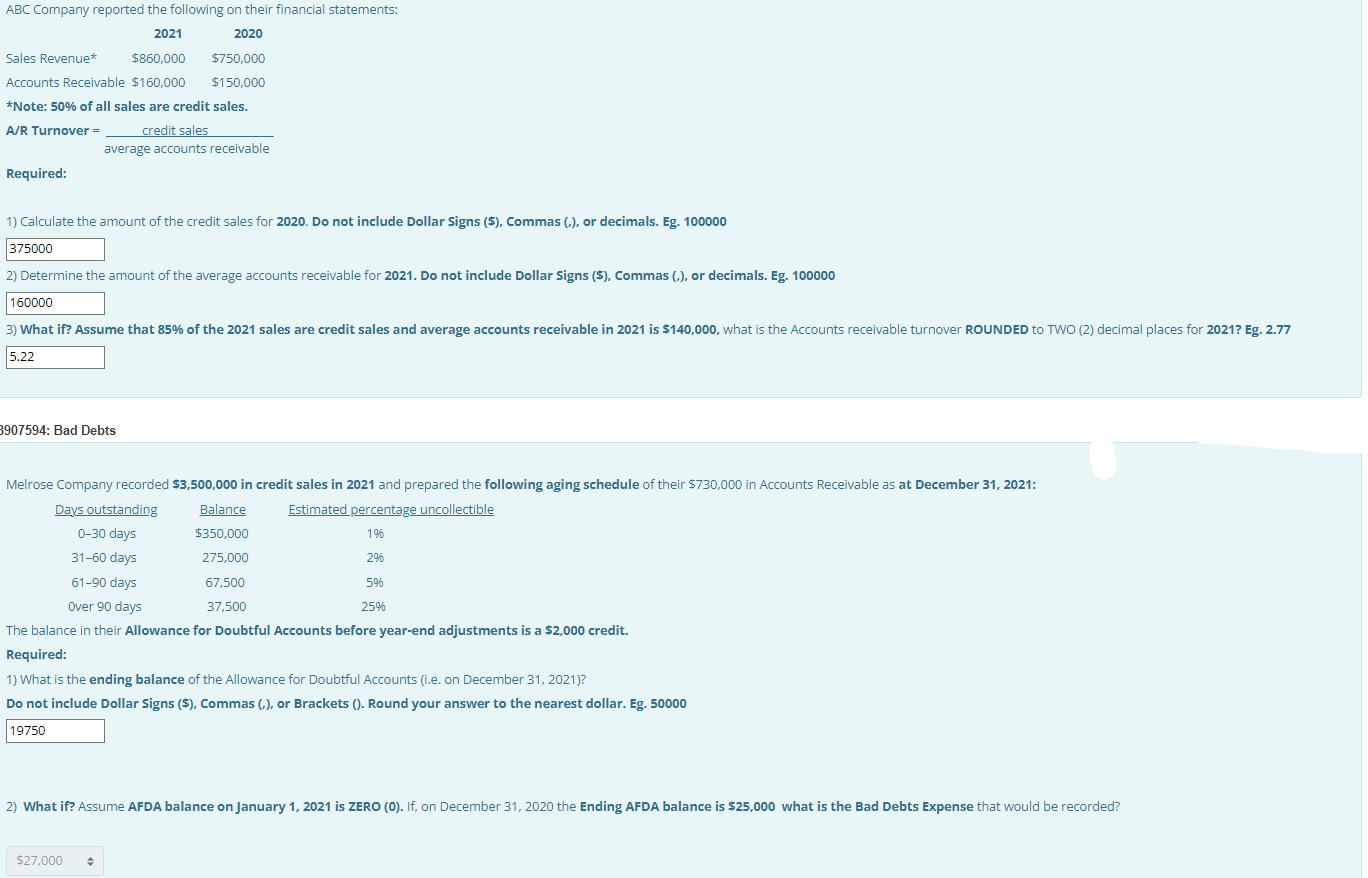

ABC Company reported the following on their financial statements: 2021 2020 Sales Revenue* $860,000 $750,000 Accounts Receivable $160,000 $150,000 *Note: 50% of all sales are credit sales. A/R Turnover = credit sales average accounts receivable Required: 1) Calculate the amount of the credit sales for 2020. Do not include Dollar Signs ($), Commas (), or decimals. Eg. 100000 375000 2) Determine the amount of the average accounts receivable for 2021. Do not include Dollar Signs (5), Commas (.), or decimals. Eg. 100000 160000 3) What if? Assume that 85% of the 2021 sales are credit sales and average accounts receivable in 2021 is $140,000, what is the Accounts receivable turnover ROUNDED to TWO (2) decimal places for 2021? Eg. 2.77 5.22 3907594: Bad Debts Melrose Company recorded $3,500,000 in credit sales in 2021 and prepared the following aging schedule of their $730,000 in Accounts Receivable as at December 31, 2021: Days outstanding Balance Estimated percentage uncollectible 0-30 days $350,000 1% 31-60 days 275,000 29 61-90 days 67,500 596 Over 90 days 37,500 25% The balance in their Allowance for Doubtful Accounts before year-end adjustments is a $2,000 credit. Required: 1) What is the ending balance of the Allowance for Doubtful Accounts (i.e. on December 31, 2021)? Do not include Dollar Signs ($), Commas (.), or Brackets (). Round your answer to the nearest dollar. Eg. 50000 19750 2) What if? Assume AFDA balance on January 1, 2021 is ZERO (O). If, on December 31, 2020 the Ending AFDA balance is $25,000 what is the Bad Debts Expense that would be recorded? $27,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts