Question: Please keep at least 2 decimal points for dollar amounts and at least 4 significant digits for rates. We are using this book: Ross, Westerfield,

Please keep at least 2 decimal points for dollar amounts and at least 4 significant digits for rates. We are using this book: Ross, Westerfield, Jaffe, and Driss, Corporate Finance. McGraw-Hill Ryerson, 9th Canadian edition 2022.

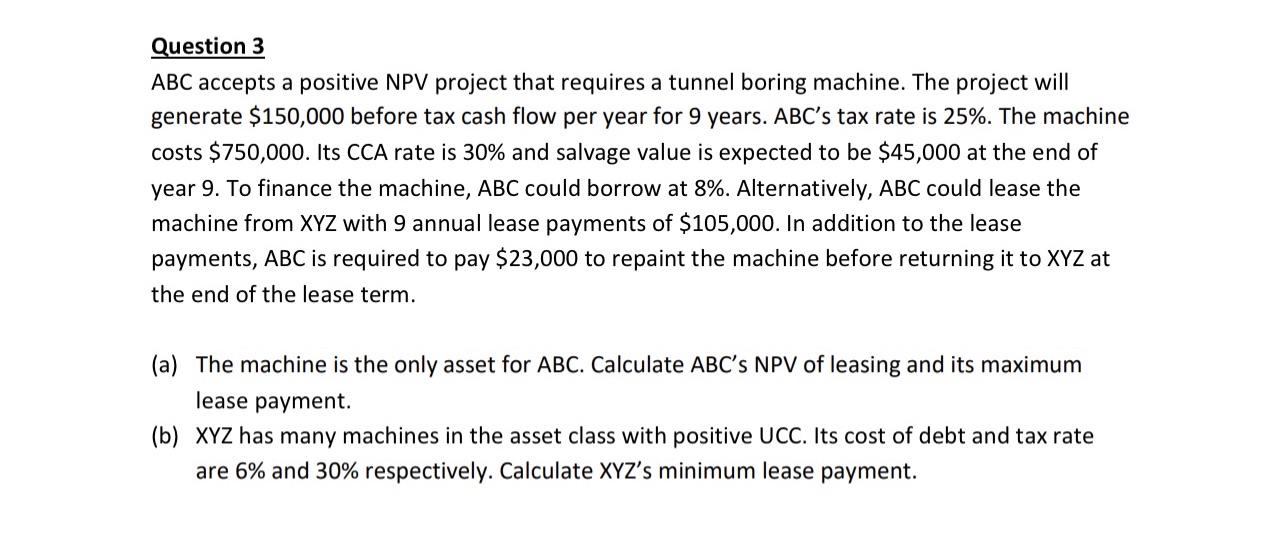

Question 3 ABC accepts a positive NPV project that requires a tunnel boring machine. The project will generate $150,000 before tax cash flow per year for 9 years. ABC's tax rate is 25%. The machine costs $750,000. Its CCA rate is 30% and salvage value is expected to be $45,000 at the end of year 9. To finance the machine, ABC could borrow at 8%. Alternatively, ABC could lease the machine from XYZ with 9 annual lease payments of $105,000. In addition to the lease payments, ABC is required to pay $23,000 to repaint the machine before returning it to XYZ at the end of the lease term. (a) The machine is the only asset for ABC. Calculate ABC's NPV of leasing and its maximum lease payment. (b) XYZ has many machines in the asset class with positive UCC. Its cost of debt and tax rate are 6% and 30% respectively. Calculate XYZ's minimum lease payment